Crypto could see the ‘dawning of a new age’ in 2025

Stablecoins could help push crypto into the mainstream, Hashdex’s Bruno Caratori said

ddRender/Shutterstock modified by Blockworks

“Next year is gonna really show everyday people what crypto is for,” Hashdex co-founder Bruno Caratori confidently told me last week.

And, no, he didn’t just mean bitcoin. He added that this next year could be the “dawning of the age … of a crypto beyond bitcoin.”

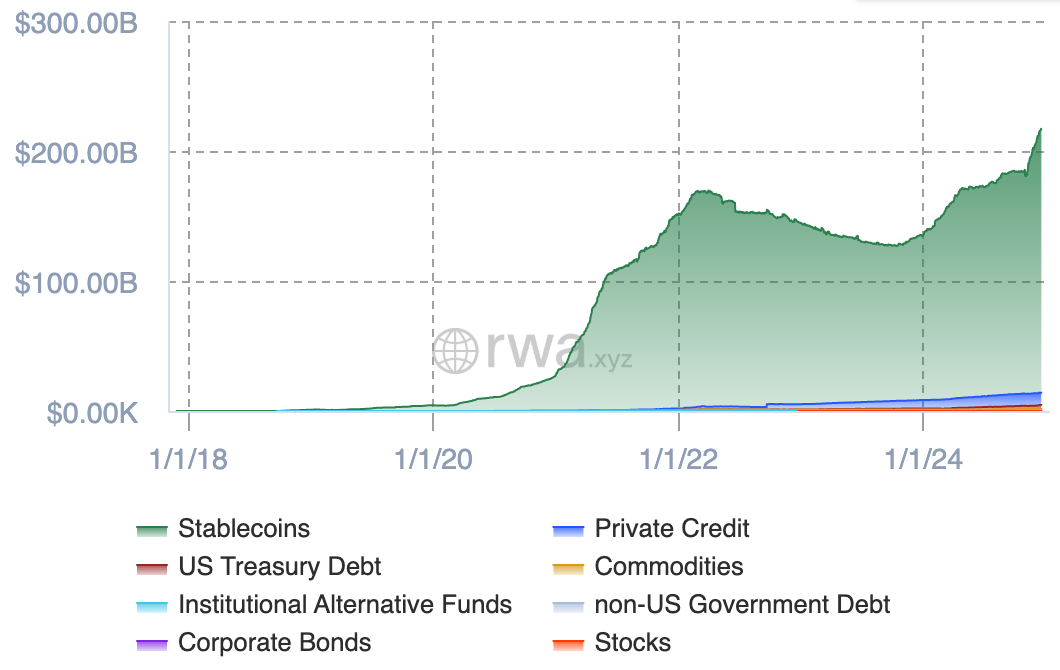

A lot of Caratori’s thinking comes from the fact that stablecoins have seen such a breakthrough to mainstream attention, as has a lot of the real-world asset offerings (if you include stablecoins in that mix, though I’m not so sure David would).

RWA onchain totals out at nearly $14 billion, with stablecoin value topping $200 billion

Here’s a look at total RWA value with stablecoins

Here’s a look at total RWA value with stablecoins

Caratori noted that stablecoins get an upper hand because they’re “easy enough” to understand.

If you were to ask Caratori for some predictions — and, dear reader, you best bet I did — he’d tell you that he thinks we could see “everyday transactions” in the US using stablecoins starting next year.

Part of this is due to the potential for Circle to enter the public markets in 2025. If you remember, we recently talked about what a Circle IPO could look like.

If we see them enter the public stage, it’ll be the “most significant IPO in crypto since Coinbase.”

“This is a player that’s going to get a lot of notoriety. First of all, it’s going to get resources to invest in the ecosystem. And even what they’ve been doing so far, initiatives such as integrating into Stripe may be the major gateway for online commerce. [With] initiatives like these, they’ll just be better resourced with not just money, but the credibility that comes with establishing the relationships,” he explained.

If we see adoption across crypto, then Caratori thinks we could see the end of the boom-bust cycle. Controversial, I know.

“There’s this widespread consensus in crypto that it behaves in this four-year cycle, and that it’s been like this forever, and it’s going to continue to be like this. And that 2025 will be the year of exuberance, and that will inevitably be followed by a big 70-80% drawdown. I see how this was true before [but] I think that real adoption by governments, by big players — such as the BlackRocks of the world — [stabilize crypto].”

“So I don’t expect this to be a big exuberance and then a bust cycle after and again. The first applications are really going to become real for the public,” Caratori said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.