DeFi Products Are Exploding, But Maturity and Security Concerns Remain

As bitcoin extends its historic rally and tops $38,000 for the third time this week, investors looking to gain cryptocurrency exposure are turning to decentralized finance solutions. Decentralized exchange trading volumes reached a record high of $55 billion last month. Uniswap, […]

- Uniswap is up about 300 percent year-to-date, making up 45 percent of total volumes on decentralized exchanges

- DeFi tech is still very new, so some worry about security

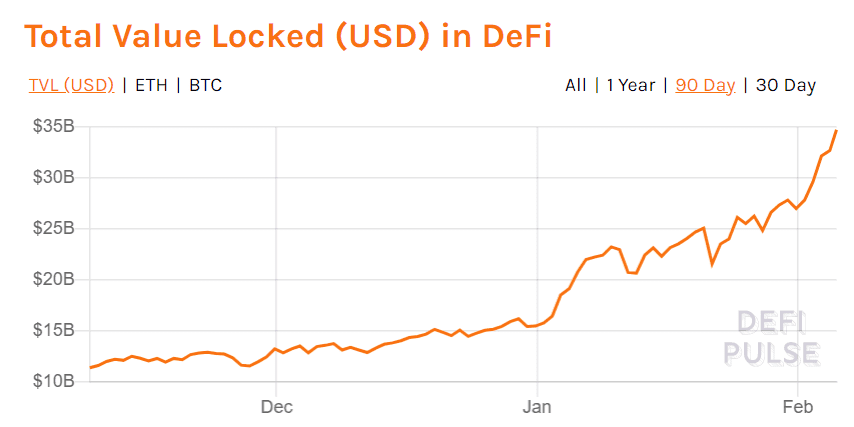

As bitcoin extends its historic rally and tops $38,000 for the third time this week, investors looking to gain cryptocurrency exposure are turning to decentralized finance solutions.

Decentralized exchange trading volumes reached a record high of $55 billion last month.

Uniswap, the fourth-largest DeFi platform, was the frontrunner, making up 45 percent of total volume traded with nearly $30 billion last month. Uniswap is up about 300 percent year-to-date.

Source: CryptoRank

DeFi platforms Maker and Aave are also seeing record returns in 2021. Maker is up more than 400 percent and Aave is seeing returns just shy of 500 percent.

“There’s a lot of enthusiasm in the market,” said Ken Deeter, partner at Electric Capital. “You can also expect to see growth with earlier stage startups, which in the traditional market would also command higher multiples because people are expecting growth in the product.”

The DeFi industry is currently in what is known as the “first wave.” Most platforms have only been around for two years, and while investors praise DeFi for its convenience, Deeter acknowledged that there are privacy and security concerns, given the nascent and unregulated nature of the industry.

“People are deploying these new systems at breakneck speed right now,” said Deeter. “It makes me a little bit nervous about how safe this stuff really is.”

The purpose of DeFi is to eliminate the intermediaries associated with traditional finance. These products are, in theory, supposed to be fee-free, although this isn’t always the case. Unipswap users pay a flat fee of 0.3 percent for all trades, which is sent to a liquidity reserve.

Deeter pointed out that the overall newness of digital currencies is bound to lead to some growing pains.

“It’s cool to see people enthused, but a lot of the enthusiasm right now is probably a little bit misplaced,” said Deeter. “There’s not enough sophistication in the market around crypto in general.”