DeFi Star Developer Andre Cronje Calls it Quits

The influential developer of projects such as Fantom and Yearn Finance is leaving DeFi for good, according to former Fantom Foundation colleague Anton Nell

Logo of Fantom, on which Andre Cronje recently deployed projects; Source: Shutterstock

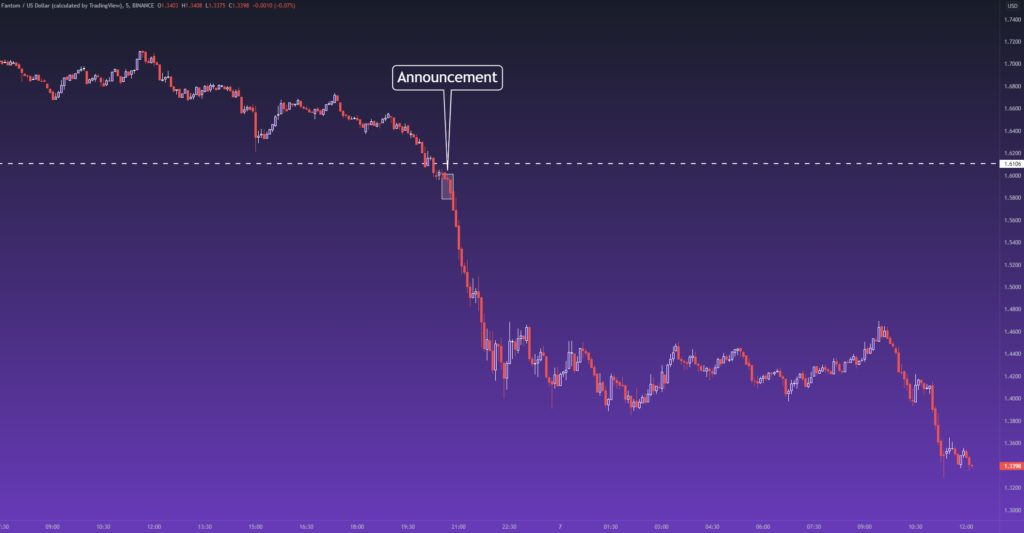

- Shortly following an announcement by former colleague and developer Anton Nell, crypto prices on project associated with Cronje fell sharply

- No reason for the pair’s apparent departure from the DeFi sector was given.

Multiple tokens associated with crypto developer Andre Cronje representing governance in projects and apps in DeFi fell sharply over the weekend following an announcement the South African plans to quit the space for good.

According to a tweet on Saturday by Cronje’s colleague and former senior solutions architect for the Fantom Foundation, Anton Nell — speaking on Cronje’s behalf — the pair have decided to stop contributing to the “defi/crypto space” and related projects.

No reason for their apparent departure from the DeFi (decentralized finance) sector was given. It is unclear if the pair intend to continue contributing to projects outside DeFi. Cronje deleted his Twitter account last week and updated his LinkedIn to reflect he was no longer working at Fantom.

Of the 25 projects, Nell said the most notable ones are related to Yearn Finance, Keep3r Network, Multichain.xyz, smart contract protocol exchange Solidly, Chainlist and Bribe Crv Finance. Some projects will apparently be carried on by other people, Nell added.

Front-end services for most of the projects are expected to end by April 3 while their open source code and smart contracts will allow others to fill the void left by Cronje, according to a new message on multiple websites affiliated with the prolific developer, such as Yearn.fi.

Yearn.Finance, for instance — the protocol’s main entry point — continues unabated. A leading pseudonymous developer for Yearn who goes by the name Banteg was quick to note on Twitter that Cronje has not contributed to the project for “over a year.”

Toxic DeFi culture?

In 2020, Cronje told Decrypt he was on the edge of quitting crypto, citing a “toxic” DeFi community as his primary reason. Those comments came five months after Cronje’s departure from Yearn, known as iEarn Finance at the time.

While the announcement is reminiscent of those made by Cronje in the past, Nell said this time was markedly different and definite.

“Unlike previous ‘building in defi sucks’ rage-quits, this is not a knee-jerk reaction to the hate received from releasing a project, but a decision that has been coming for a while now,” Nell said in a follow-up tweet.

Immediately following the announcement on Twitter, dozens of native tokens linked to projects and apps associated with or founded by Nell and Cronje began to fall. Fantom’s token (FTM), to which Cronje held a technical adivsory role at for three years, has fallen 17.5%.

FTM begins to fall immediately following announcement from Nell

FTM begins to fall immediately following announcement from Nell

The Fantom Foundation pointed to its large team to minimize the impact of Cronje’s move.

Keeper Network’s token (Keep3r) suffered greater losses and has fallen 35% while Yearn Finance’s token (YFI) fell 12.6% before recovering slightly — down 8.6%. All other tokens mentioned in the tweet have followed a similar pattern.

Leading by example

Cronje has had a prolific career in crypto. According to his LinkedIn page, Cronje has held numerous positions within the community including technology head at the Fusion Foundation, tech analyst at Lemniscap and code reviewer at news outlet Crypto Briefing. He has also developed and contributed to numerous DeFi projects including Yearn Finance, Curve Finance and Fantom.

One source speaking under condition of anonymity and a former colleague of Cronje told Blockworks on Sunday he was impressed by the developer’s “inspiring work” who led by example.

“Andre is an impressive deep thinker with big questions,” the source said. “He is an important and positive influence…his departure will have an impact.”

Blockworks’ source also added that the crypto market, in general, tends to overreact to events such as these and that the projects outlined in Nell’s tweet still have “exceptional” people working there.

“They’ll still kick massive goals,” the source said.

Blockworks attempted to contact Cronje but did not receive a reply by press time.

Macauley Peterson contributed reporting for this story.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.