Deutsche Börse partners with Circle on stablecoin rollout in Europe

Partnership will bring EURC and USDC to regulated trading, settlement and custody infrastructure under MiCAR rules

Circle CEO Jeremy Allaire | World Economic Forum / Faruk Pinjo/"Cracking the Crypto Code: How to Manage Crypto Assets?" (CC license)

Deutsche Börse Group has signed a memorandum of understanding with Circle Internet Financial to deploy Circle’s EURC and USDC stablecoins across its regulated market infrastructure. This marks the first such collaboration between a European exchange operator and a global stablecoin issuer.

The move, announced Tuesday, is designed to align token-based payment systems with established financial market structures, with an initial focus on trading via Deutsche Börse’s 360T subsidiary, its digital exchange 3DX, and custody services through Clearstream.

The partnership comes as Europe implements the Markets in Crypto Assets Regulation (MiCAR), the first comprehensive legal framework for digital assets globally. Circle was among the first issuers to secure MiCAR compliance, underscoring its strategic focus on the European market.

Deutsche Börse executives emphasized that the integration of stablecoins into its post-trade and trading infrastructure could lower settlement risks, streamline operations, and improve efficiency for institutional investors. Circle’s chief executive Jeremy Allaire said the deal positions stablecoins within trusted venues, enabling new financial products and workflows.

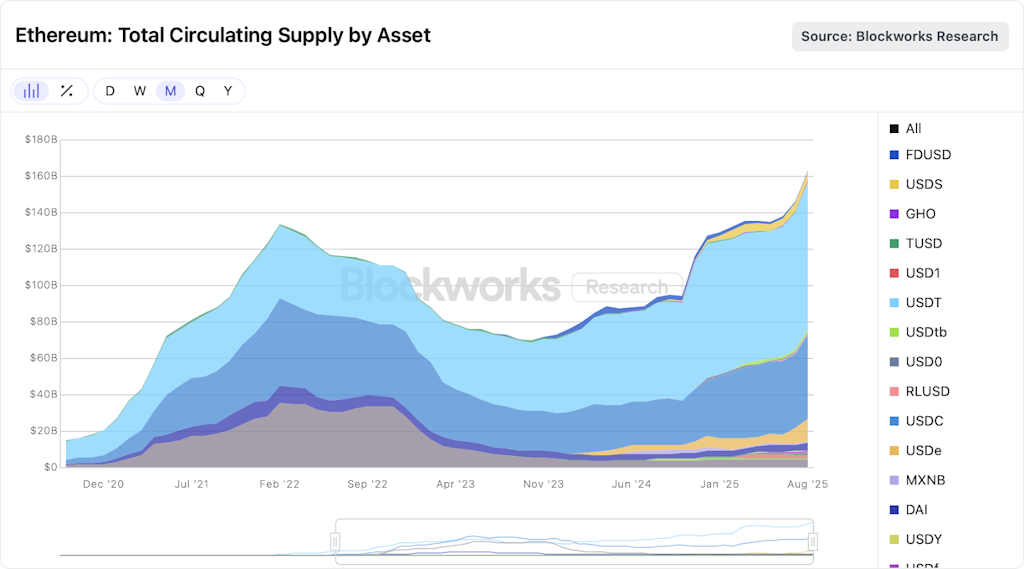

According to Blockworks Research data, USDC supply on Ethereum has returned to growth through 2025 after contractions in 2023. The recovery signals renewed demand for regulated stablecoins, particularly from institutional participants seeking transparency and compliance.

Total Circulating Stablecoin Supply by Asset | Blockworks Research

Total Circulating Stablecoin Supply by Asset | Blockworks Research

With Ethereum’s broader stablecoin market now exceeding $170 billion, Circle’s strategy to embed USDC and EURC into Europe’s regulated market infrastructure positions its tokens as core instruments for settlement and custody.

Updated at 4:45 p.m. ET to include further data from Blockworks Research.

This article was generated with the assistance of AI and reviewed by editor Jeffrey Albus before publication.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.