Dreaming of the Perfect Metaverse ETF (Part 2)

The most critical companies building the metaverse will be focused on game engines, VR and digital assets

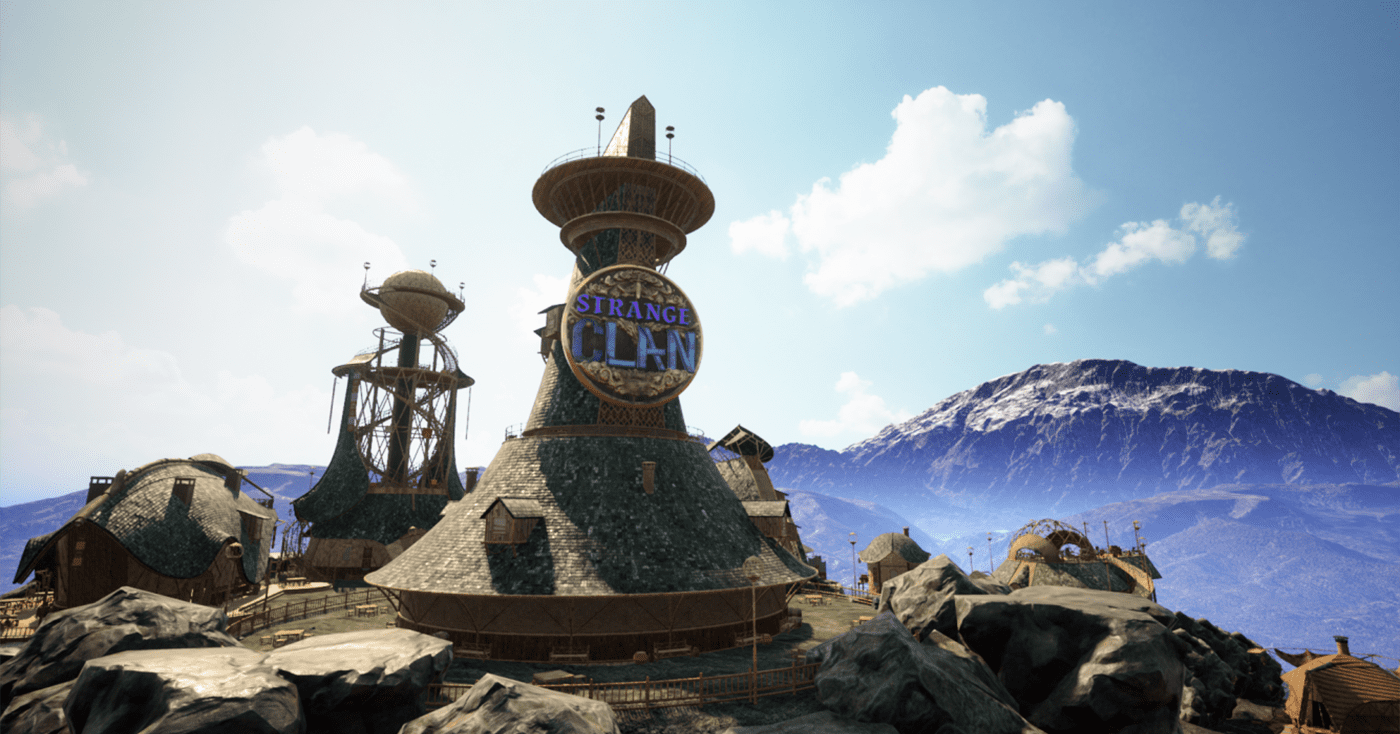

A frame from the game Strange Clan; Source: Strange Clan Discord

- For the metaverse to become truly immersive, the quality of the graphics will have to rival big-budget Hollywood movies

- A quintessential facet of Web3 is individual ownership of assets, so companies that provide or facilitate transactions of digital assets will have a role to play

So, you want to invest in the metaverse, but — as we covered in part 1 — the Solactive Global Metaverse Index includes some companies that are irrelevant or nearly so. With that in mind, what should belong in a metaverse investors portfolio?

Here’s a slate of companies and projects that are worth a closer look.

What to double-down on

Game engine developers, e.g. Epic Games and Unity

If the metaverse is going to be about exploring virtual worlds with headsets, there needs to be a precursor: good VR games.

Behind the vast majority of virtual experiences, there are one of two game engines to watch: Epic Games’ Unreal and Unity’s game engine. I say virtual experiences — not games — because in the last few years we’ve seen an evolving role for this technology that goes beyond just powering games. These two game engines have evolved to a point where they can create photo-realistic imagery that rivals pre-rendered computer animation.

In “The Mandalorian,” Disney+ animators used Unreal to create the series’ visual effects for everything from spaceships in the stars to virtual backgrounds that extended sets.

Unreal’s rival Unity completed the acquisition of Peter Jackson’s visual effects house Weta Digital in late November, demonstrating just how determined they are to develop this new vertical.

While there are other game engines out there, Unreal and Unity dominate the market share because they are open platforms and agnostic to users while other game engines are proprietary and locked behind walled gardens. For this reason, they are the platforms that interoperable virtual experiences will be built upon.

Strange Clan is an NFT game powered by Unreal Engine; Source: Strange Clan Discord

Strange Clan is an NFT game powered by Unreal Engine; Source: Strange Clan Discord

What to include

VR headset manufacturers, digital asset trusts, e.g. HTC

HTC, the company behind the Vive headset, has been notably absent from current Metaverse ETFs and indices thus far.

Perhaps because the stock trades in Taiwan, on the Taipei exchange, and its New York-listed American depositary receipt (ADR) was delisted long ago as investors lost interest with year-over-year declines in smartphone market share.

But that was a different era. HTC’s Vive virtual reality (VR) headset is a portal to the metaverse. Its main rival is Facebook’s Oculus. Sony’s PSVR headset is locked down to games on the PlayStation and there’s no indication that PlayStation games are going to be part of the metaverse anytime soon.

Despite VR being available since 2015, the current games on the market failed to impress players. For most of its life, it has been a rather niche product.

That said, demand for VR headsets is on the rise — not from the metaverse quite yet, but from games that are properly embracing the medium.

According to data from Counterpoint Research and IDC, VR and augmented reality (AR) headset shipments nearly tripled year-on-year in the first quarter of 2021 because game developers and gamers finally found a product market fit.

Investors in Taiwan seem to have taken notice. HTC stock up nearly 120% over the last six months, with the biggest gains coming since October. In a recent monthly earnings report, HTC said that its sales hit $20 million for September, up 64% from a year earlier, coinciding with the launch of the HTC Vive Pro 2 headset — and all of this comes as the company still loses money, a lot of it, as smartphones prove to be an anchor.

Grayscale’s Ethereum, Chainlink and Decentraland trusts

If the metaverse is really going to be tied together by digital assets, NFTs and the blockchain, Grayscale’s Ethereum, Chainlink and Decentraland listed trusts could be important in a metaverse ETF.

Ethereum, after all, is the tie that binds it all together, powering NFTs and digital asset trading.

Chainlink transports real-world data onto the blockchain and has quickly become the trusted oracle for the market data that powers many of the most aggressive trading venues out there. Theoretically, it would also be useful for the metaverse by allowing data to be transported between virtual worlds.

Decentraland is an obvious choice. Its MANA token provides liquidity to one of the first metaverse experiments of the NFT era.

To be sure, the metaverse is a trend to watch for 2022 but whether it has sticking power remains to be seen. Let’s not forget about Second Life, a 2003 centralized online multimedia platform that gives people a second life in a virtual world — it’s still quietly plugging along in the background of all this metaverse noise.

Not investment advice. The author has no positions in the above-mentioned equities.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.