ETF inflows, ‘debasement trade’ fuel bitcoin’s climb above $123K

US bitcoin ETFs that seen more than $2.2 billion of net inflows over the last four trading days

Shatsko Yauhen/Shutterstock and Adobe modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

The weekend is just about here, and bitcoin is flirting with its all-time high.

With the government shutdown delaying new potential crypto ETF launches, we can focus today on the US bitcoin funds that have seen ~$2.2 billion of inflows over the last four trading days.

(This is part of a broader “debasement trade” that analysts at a TradFi giant are only now starting to talk about. You’ll have to forgive them for not hearing about this when you did.)

When I wrote about the crypto market outlook for October, bitcoin was in the $117,500 range. It has since surged above $123,000 — sitting 1% off its all-time high at midday.

As many have turned attention to the expected launches of crypto ETFs holding SOL, LTC, XRP, etc., the government shutdown (and therefore SEC pause) gives us a chance to check back on the classics.

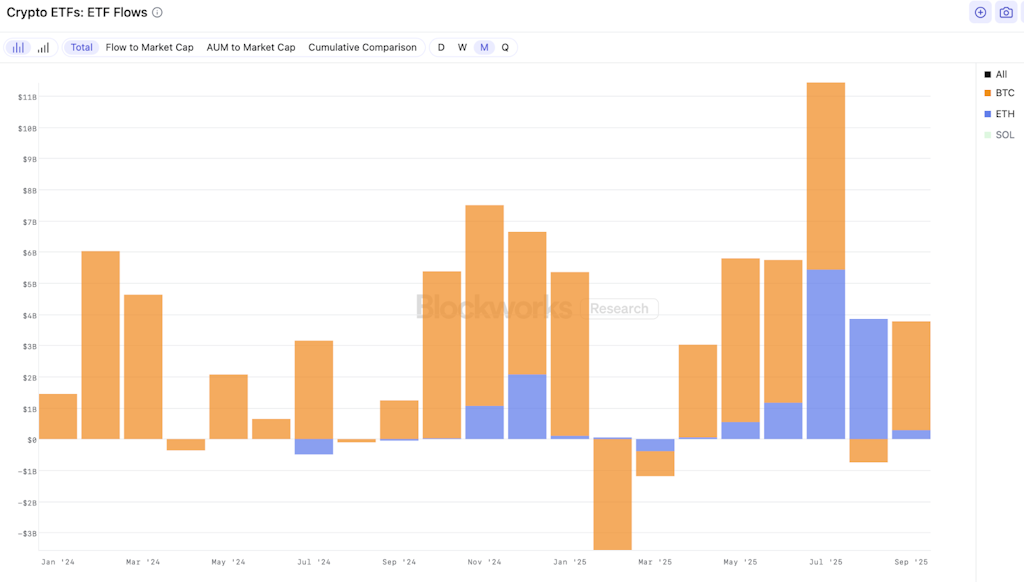

Spot bitcoin ETF inflows rebounded in September after the products bled $750 million in August. Though ether ETFs had stolen the show in August, capital flowing to those funds slowed mightily last month.

The above chart doesn’t include Wednesday and Thursday, during which bitcoin ETFs reeled in another $676 million and $627 million, respectively — their highest inflow levels in three weeks.

On the odds of another “Uptober” playing out for BTC, 21Shares’ Matt Mena had noted the expected Fed rate cut later this month as a major tailwind. Bitcoin can benefit as both a “digital gold” hedge in times of fiscal uncertainty and as a high-beta risk asset when liquidity returns, he explained.

Felix mentioned in yesterday’s newsletter how the ongoing government shutdown (and the delay of jobs data, for example) forces market watchers to lean on recent private payrolls data that showed labor market weakness. Essentially that means “the continuation of the rate-cutting cycle is a lock,” he explained.

Beyond the expected cut, Mena mentioned ETF flows as another reason bitcoin looks well-positioned to retest $124,000 and potentially reach between $140,000 and $150,000 before 2025 is through. The broader market could follow suit, he added.

“Total crypto market cap is poised to challenge the $5 trillion threshold — less than 25% above current levels,” Mena told me earlier this week. “That’s an achievable move considering Q4 2024 saw a 63% surge, with market cap climbing from $2.2 trillion in October to $3.6 trillion by year-end.”

JPMorgan analysts recently went on record saying bitcoin could reach $165,000 by the end of 2025 — noting the asset is undervalued relative to volatility-adjusted gold levels.

As we get set to see a widely expanding array of crypto ETFs, it’s important to remember the role bitcoin plays in a portfolio is different from that of other crypto assets. I’m not telling bitcoin maxis anything they don’t already believe.

Remember what ETF.com analyst Sumit Roy told me about potential demand for the upcoming spot crypto ETFs? They won’t necessarily see flows from the investors who put a fraction of their wealth (2%, let’s say) in BTC as a diversifier and/or hedge.

This ETF-focused Oct. 15 panel at DAS London with execs from BlackRock and 21Shares is an extra timely one.

Another possible tailwind for bitcoin ETFs would be a brokerage firm like Vanguard allowing clients to trade them. This has come up again after a recent report that the index fund giant was weighing that possibility.

While Vanguard hasn’t responded to me about this report, it’s historically made its crypto stance (or should I say anti-crypto stance) very clear. A Vanguard spokesperson has previously told me the firm “continuously evaluates” its brokerage offerings, so this report doesn’t seem too different from that language. Many believe, of course, Vanguard will ultimately cave.

I’ve rambled enough for a Friday. If you’re in a place with seasons, go enjoy this autumn weather.

— Ben Strack

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.