ETH outperforms BTC; DOT Hits All-Time High: Markets Wrap

ETH has outperformed BTC by 20% since the latter half of October, DOT enters price discovery, a CryptoPunk sells for pennies on the dollar.

Source: Shutterstock

- Ethereum has outperformed BTC since the latter half of October

- DOT enters price discovery

Ethereum has outperformed BTC by 20% since the latter half of October.

ETH issuance was net negative over the last seven days, giving Ethereum enthusiasts a snapshot of what ‘ultra-sound money’ could look like post merge.

The BTC market has seen a drastic decline in the amount of leverage in the system, which makes further downside due to liquidations less likely.

Polkadot (DOT) enters price discovery, last trading at $50.20.

A user mistakenly sold a CryptoPunk, the most infamous Ethereum NFT project, for 4.444 ETH instead of 4,444 ETH.

Latest in Macro:

- S&P 500: 4,613, +.18%

- NASDAQ: 15,595, +.63%

- Gold: $1,793, +.51%

- WTI Crude Oil: $83.94, +.44%

- 10-Year Treasury: 1.559%, +.003%

Latest in Crypto:

- BTC: $60,916, -.90%

- ETH: $4,315, +.24%

- ETH/BTC: .0708, +1.21%

- BTC.D: 43.73%, -.87%

ETH outperforms BTC

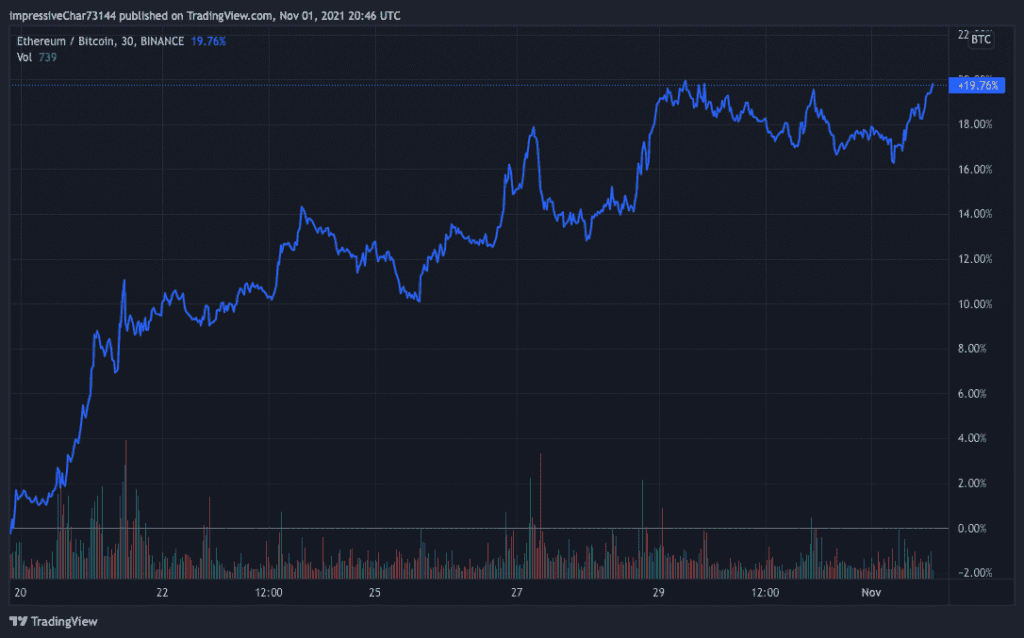

ETH has outperformed BTC by nearly 20% since the last half of October. After surpassing all-time highs last week, ETH retested the highs made in April of 2021 as support.

The put-call ratio sits at 0.913 and funding rates are creeping higher, according to data from Laevitas.ch. These two metrics indicate that traders are betting on further upside.

Source: Trading View

Source: Trading View

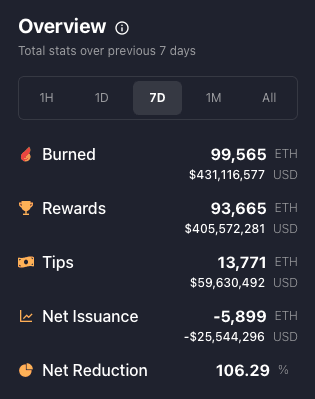

ETH issuance was net negative over the last seven days and will likely become more deflationary when the merge goes live in Q1/Q2 of 2022. This is possible due to the EIP-1559 upgrade that went live on the mainnet in August, causing the base fee that users pay to transact on the network to be burned. When the number of transaction fees that are burned outpace the block subsidy paid out to miners, the total supply decreases.

Source: watchtheburn.com

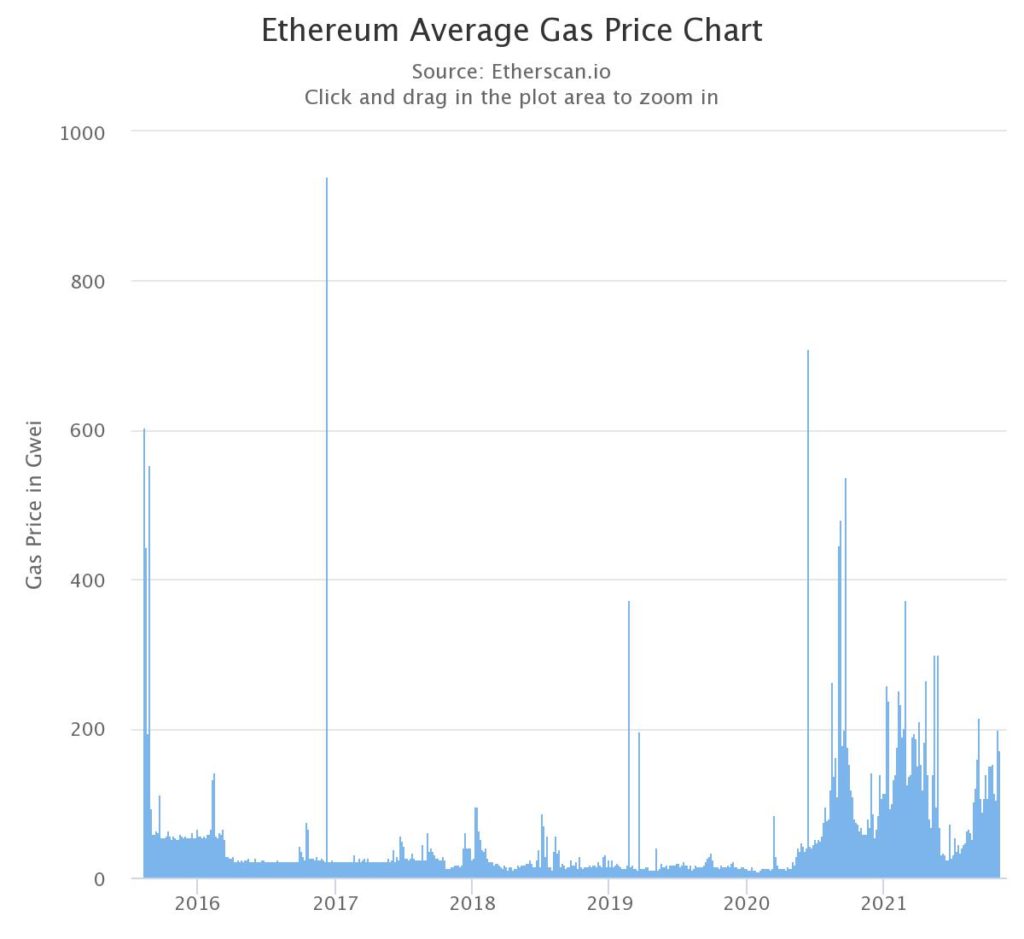

Source: watchtheburn.comAverage gas prices, or the cost to transact on the base layer of Ethereum, has been trending upward over the past week. Users can check estimated gas fees on etherscan.io to avoid transacting during periods of elevated activity.

Source: etherscan.io

Source: etherscan.io

Bitcoin

BTC fundamentals look good:

- The balance of BTC on exchanges remains at three-year lows.

- The CME is becoming one of the leading futures exchanges in terms of open interest, implying that there is increased institutional adoption.

- The realized price, or cost basis of holders, of BTC is at all-time highs.

- Miners are the most profitable they have been in over two years.

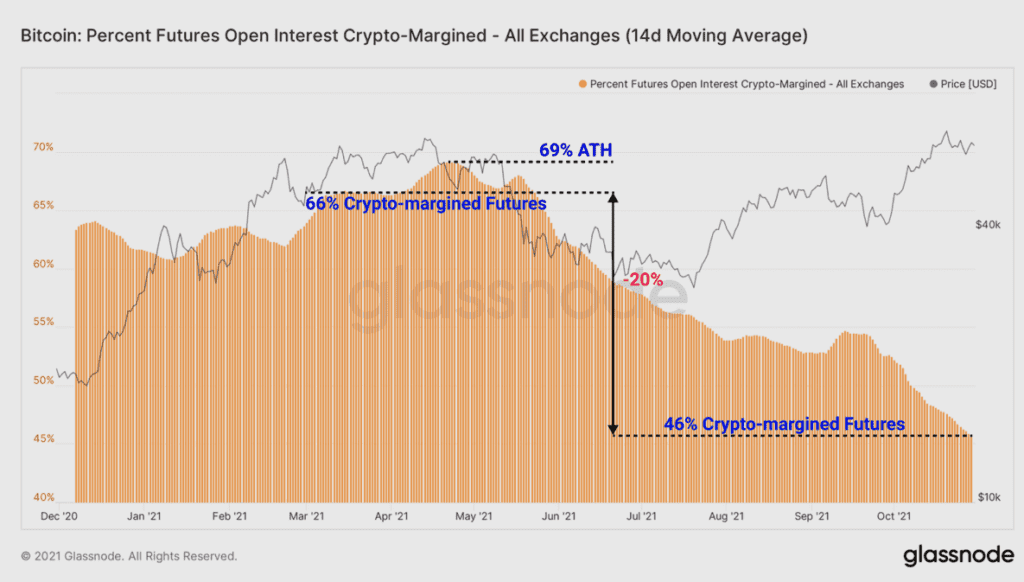

- The percentage of futures open interest that is crypto-margined has dropped to 46% versus reaching as high as 69% during the April, 2021 peak. The less leverage behind longs, the smaller the chance of a liquidation event spurring further downside.

Source: Glassnode

Source: GlassnodePolkadot enters price discovery

Polkadot (DOT) is a platform that allows diverse blockchains to transfer messages, including value, in a trust-free fashion; sharing their unique features while pooling their security. In brief, Polkadot is a scalable heterogeneous multi-chain technology.

Polkadot is heterogeneous because it is entirely flexible and makes no assumption about the nature or structure of the chains in the network. Even non-blockchain systems or data structures can become parachains if they fulfill a set of criteria.

Polkadot may be considered equivalent to a set of independent chains such as Ethereum, except with important additions: pooled security and trust-free interchain transact-ability, according to CoinGecko.

“DOT will serve three key functions in Polkadot, namely (i) providing governance for the network, (ii) operating the network, and (iii) creating parachains by bonding DOT,” as stated on Polkadot’s official website.

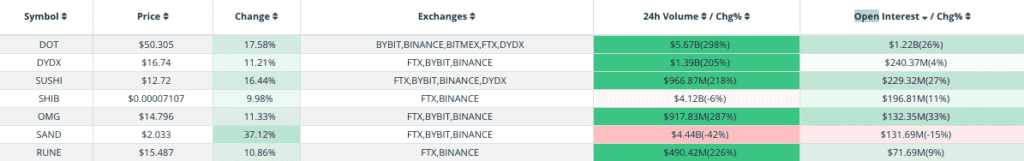

DOT was the best performing altcoin of the day when sorting by the largest amount of open interest. DOT was last trading at $50.30, up 17.58% over the last 24 hours. DOT is now in price discovery after passing its May highs of $47.33.

Source: Laevitas.ch

Source: Laevitas.ch

Non-Fungible Tokens (NFTs)

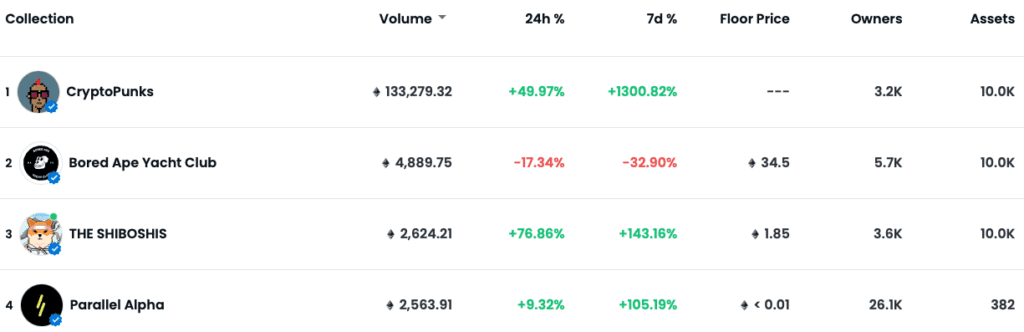

A user mistakenly sold a CryptoPunk, the most infamous Ethereum NFT project, for 4.444 ETH instead of 4,444 ETH, according to data from Larva Labs. This cost the seller millions of dollars in potential profit.

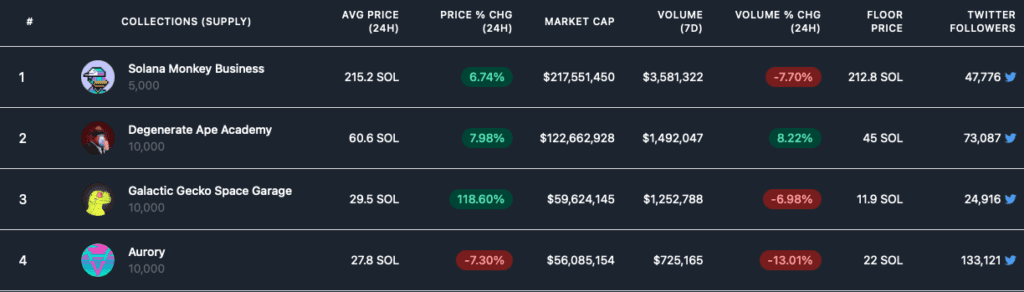

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.