Fed Keeps Interest Rates, Bond Buying the Same, Again

The central bank said that it will maintain its current bond buying pace, $120 billion a month, until “substantial further progress has been made.”

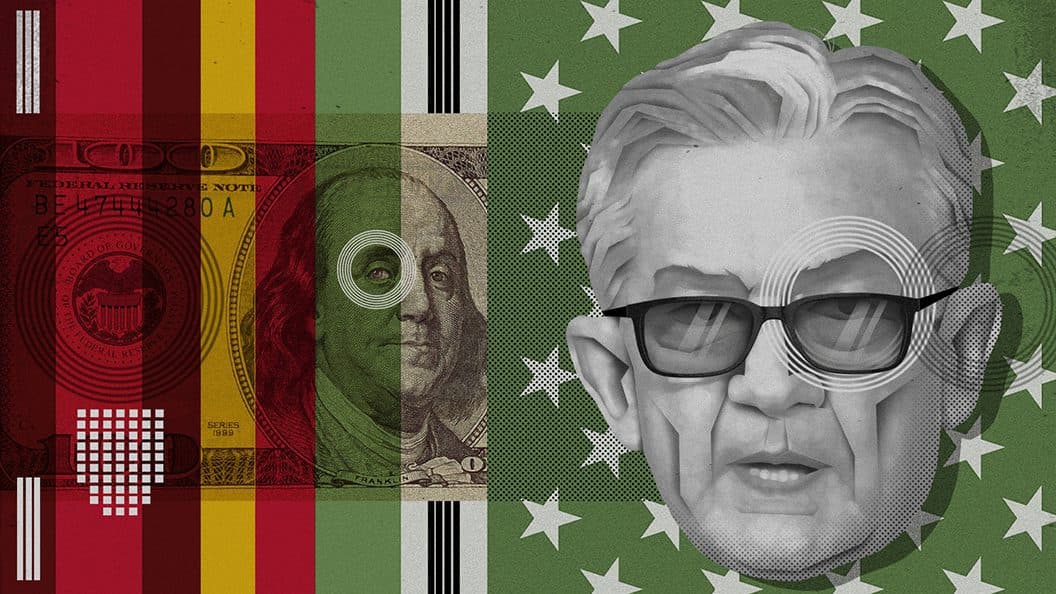

Jerome Powell, chairman, Federal Reserve; blockworks exclusive art by Axel Rangel

- The Fed has hinted that inflation may not be as transitory as officials previously anticipated

- Wednesday’s statement did not include the language claiming that the pandemic is weighing on the economy

In an unsurprising move, the Federal Reserve left interest rates near-zero and maintained asset purchases, but officials expect two interest rate hikes by the end of 2023.

“Progress on vaccinations has reduced the spread of Covid-19 in the United States,” the Federal Open Market Committee (FOMC) said in a statement released Wednesday at the end of its two-day policy meeting. “Amid this progress and strong policy support, indicators of economic activity and employment have strengthened.”

Regardless of these stronger economic indicators, officials elected to keep the target range for its benchmark policy rate where it has been since March 2020, at zero to 0.25%. The central bank said that it will maintain its current bond buying pace, $120 billion a month, until “substantial further progress has been made.”

The Fed’s ‘dot plot’ showed that 13 of 18 officials favored at least one rate increase by the end of 2023, versus seven following the FOMC’s March meeting. Eleven officials predict at least two increases by the end of 2023. Seven officials saw a change in interest rates as early as 2022, up from four in March.

“The dots are not a great forecaster of future rate moves just because it’s so highly uncertain,” said Chairman Jerome Powell. “There is no great forecaster.”

The dots also revealed that officials changed economic estimates. They now see inflation averaging 3.4% in the fourth quarter of 2021, before volatile food and fuel are excluded. Central bankers then expect headline inflation gauge to retreat, falling to 2.1% next year and 2.2% in 2023.

“Our expectation is that these high inflation readings we are seeing right now will start to abate,” said Powell. “There is no reason to think that prices will keep going up a lot.”

This is the first time that the Fed has hinted that inflation may not be as transitory as officials previously anticipated, but Powell maintained his stance that higher prices are due to economic reopening.

“What we are seeing in the near term is principally associated with the reopening of the economy,” said Powell. “I have more confidence that we could see inflation above 2%, and that it may not be as hard to do that as we thought.”

Wednesday’s statement did not include the language claiming that the pandemic is weighing on the economy, something previous meetings’ statements have noted. Powell was careful to emphasize that while progress is being made in terms of vaccinations, hospitalizations and inflection rates, we are not yet on the other side.

“We are not out of the woods and it would be premature to declare victory,” said Powell. “We’re a ways away from substantial further progress, we think, but we’re making progress.”

Stocks pared earlier losses following Powell’s statement. The dollar rose and yields on benchmark 10-year Treasury notes rose from a nearly-three month low.