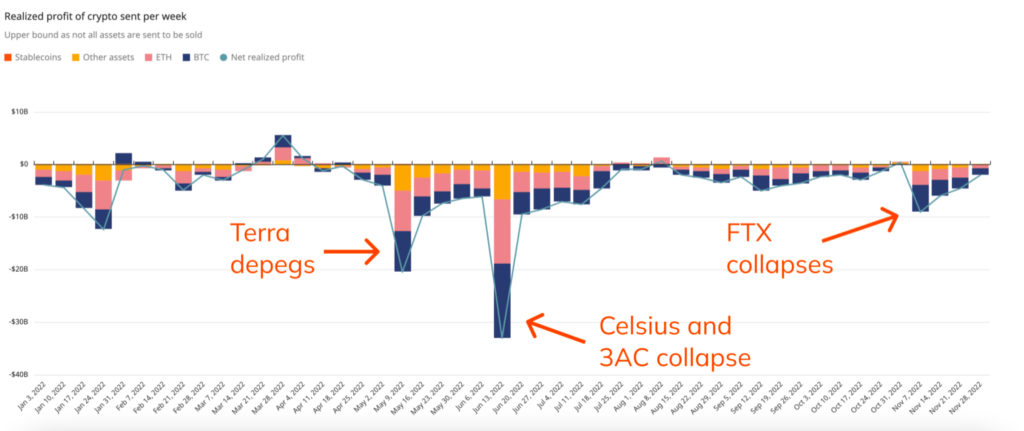

Terra, Celsius, 3AC Wiped $53.5B From Crypto Portfolios — FTX? Only $9B

Crypto has survived far worse things this year than FTX implosion, Chainalysis has found

CryptoFX/Shutterstock.com modified by Blockworks

Chainalysis has calculated that two major crypto catastrophes leading up to FTX’s sudden bankruptcy were more damaging to crypto investors: Terra’s depegging in May, followed in June by collapses at Celsius and hedge fund firm Three Arrows Capital (3AC).

The firm measured realized gains and losses for all personal crypto wallets over the year, so no crypto exchange hot or cold wallets and the like. Chainalysis’ goal in three easy steps: Find at which point all wallets lost most of their value.

- Measure the value of each wallet’s assets at the time they were deposited.

- Subtract the value of any portion of those assets sent to another wallet.

- Account for price differences at different times the assets were acquired (“e.g. a wallet holding some Bitcoin acquired at $30,000 and some acquired at $20,000”).

“We can’t assume that any cryptocurrency sent from a given wallet is necessarily going to be liquidated, so think of these numbers as an upper bound for realized gains of a given wallet,” Chainalysis said.

“This methodology can therefore give us a directional sense of when investors lock in gains and losses.”

And so, Chainalysis says Terra’s failed algorithmic stablecoin wiped $20.5 billion from personal crypto wallets. Celsius and 3AC kicking the bucket sent values tumbling $33 billion.

FTX, on the other hand, seemed to have affected markets by a much smaller degree, only $9 billion.

“These charts don’t take everything into account: For instance, people who used FTX likely lost any funds they kept on the exchange, and the likelihood of recovering them is unknown,” Chainalysis said.

“But from a market-wide point of view, the data above suggests that as of now, the heaviest hitting crypto events of 2022 were already behind investors by the time the FTX debacle took place.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.