Gemini Joins Coinbase in Offshore Expansion, This Time in APAC

With its APAC announcement, Gemini is the second major US crypto exchange in two days to reveal plans to expand abroad

Rena Schild/Shutterstock, modified by Blockworks

Gemini plans to expand its presence across Asia-Pacific (APAC) with the appointment of a regional CEO, Pravijt Tiwana, and the establishment of an engineering center in Gurgaon, India.

The move is part of the New York-domiciled exchange’s strategy to grow its international business and capitalize on increasing demand for crypto and Web3 products, according to a company blog post.

As Gemini APAC’s CEO, Tiwana will be responsible for launching and expanding region-specific products and services, leading go-to-market strategy and managing profit and loss. He will continue to serve as the exchange’s global technology chief, per the post.

Gemini’s expansion plans include building out product and engineering teams in India and expanding its business in the country, alongside Singapore, where it will focus on growing its customer base, according to a separate post on Thursday.

The news comes as major crypto firms in the US are beginning to chafe under increased regulatory scrutiny from US agencies. Only this week, Coinbase revealed its own offshore desires in expanding to Bermuda and Abu Dhabi in preparation to launch derivatives trading.

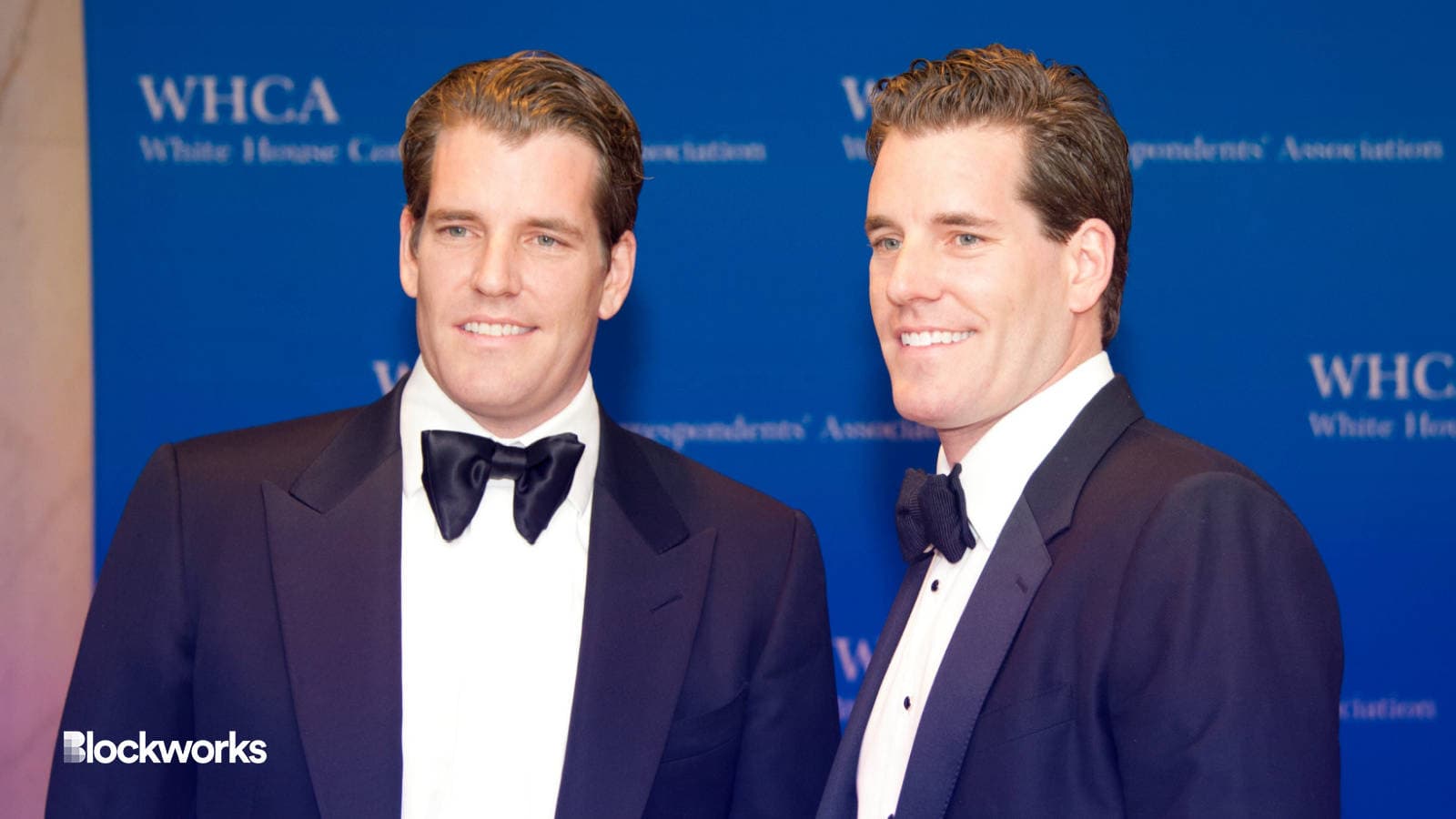

Gemini, owned by early bitcoin billionaires Cameron and Tyler Winklevoss, was charged with violating securities laws through its Lend program at the start of the year, alongside financial services firm Genesis. The SEC claims the violations involved billions of dollars of crypto “principally from US retail investors.”

Even so, Gemini’s decision is a sign that it believes in crypto’s resurgence after a painful 2022. APAC has proven to be one of the largest crypto markets in the world, according to a Chainalysis industry report.

“Gemini has big plans for international growth this year in APAC,” Gemini co-founders Cameron and Tyler Winklevoss said in the post. “We believe that crypto and Web3 products will continue to have a strong growth trajectory in APAC.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.