Gold Sinks as Dollar Strengthens on Last Day of Q2: Markets Wrap

“Precious metal markets simply can’t find a gear with the stronger dollar and strong economic data weighing on the market,” Ole Hansen at Saxo Bank A/S told Bloomberg.

- Pending home sales have hiked 8% since April, according to data from The National Association of Realtors.

- NYDIG and NCR are partnering to allow 650 US banks and credit unions to offer crypto trading to their customers through mobile apps.

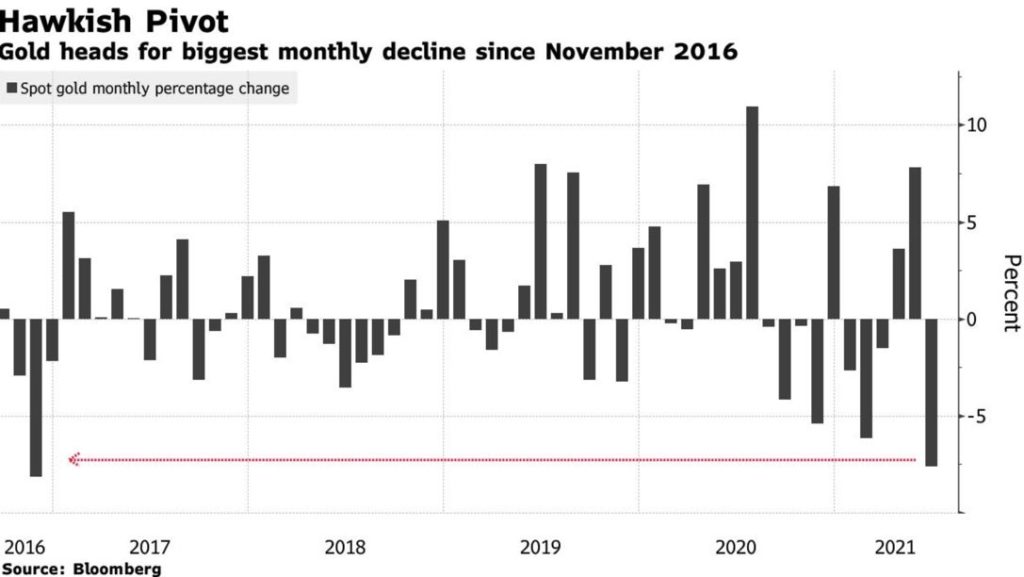

Labor, housing and consumer confidence data all landed at noteworthy highs in the last week of the quarter. Meanwhile, commodities like gold didn’t quite follow suit. The precious metal was on pace for its most drastic monthly drop since 2017. Palladium and platinum fell as well, -0.6% and -0.7% respectively intraday on Wednesday.

In a slew of optimistic news, ADP Research Institute data showed signs of further labor market recovery, indicating service-provider employment increased 624,000. The healthcare industry made gains of around 93,000 this month as well.

In the housing market, pending home sales have hiked 8% since April, according to The National Association of Realtors. Sales were at 114.7, a four-month high for the index, data released Wednesday revealed.

Finally, consumer confidence soared 127.3 points in June, the highest it has been since February of last year, according to a Tuesday report by The Conference Board.

Commodities

- Gold is down -7.35% over the month of June.

- Crude oil sits at $73.54 per barrel, inching up 0.77%.

Insight

“Precious metal markets simply can’t find a gear with the stronger dollar and strong economic data weighing on the market,” Ole Hansen, head of commodity strategy at Saxo Bank A/S said in an interview with Bloomberg. “Gold once again has its back against the wall. However, judging from previous lows, that is what gold needs in order to stabilize, reverse and eventually squeeze the shorts back out of the market.”

Currencies

- The US dollar strengthened 0.33%, according to the Bloomberg Dollar Spot Index.

Insight

“This market is an environment that looks very attractive because we have all this pent-up demand,” said Kristina Hooper, chief global market strategist at Invesco in an interview with the Wall Street Journal. “This all suggests that the economic rebound will be powerful in the back half of this year.”

Equities

Despite sentiments of economic optimism, stocks traded mostly sideways on Wednesday.

- The Dow was up 0.6%, to 34,502.

- S&P 500 inched up 0.13% to 4,297.

- Nasdaq was down -0.17% to 14,503.

Crypto

- Bitcoin is trading around $34,904.15, falling -3.65% in 24 hours at 4:00 pm ET.

- Ether is trading around $2,263.39, up 2.22% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.065, up 7.58% at 4:00 pm ET.

- VIX is down to 15.83, shedding -1.19% at 4:00 pm ET.

Fixed Income

- The US 10-year yields 1.465% as of 4:00 pm ET

In other news…

NYDIG, a major digital asset management firm, will partner with The National Cash Register to help banks offer bitcoin to clients in the US, Blockworks reported on Wednesday. The partnership will allow 650 banks and credit unions to offer cryptocurrency trading to roughly 24 million customers through mobile apps in the coming months.

Insight

“A lot of these banks have seen that one of the biggest outflows from their depositors is moving money from the bank to exchanges like Coinbase,” NYDIG President Yan Zhao said in an interview with Forbes. “And so that’s part of why banks are so excited to have this capability for themselves and for their consumers.”

We’re watching out for …

- OPEC’s meeting will be on Thursday.

- US jobs report will be released on Friday.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.