Hackers Steal Over $600M; Biggest in DeFi History

Interoperability protocol Poly Network has been hacked with more than $600 million stolen in the largest decentralized finance security breach in history. The market remains stable, despite the news.

Source: Shutterstock

- Hackers exploited Poly Network on DeFi exchanges Polygon, Ethereum and Binance Smart Chain

- The team behind the protocol has promised legal action and requested that hackers return stolen assets

Hackers stole more than $600 million from interoperability protocol Poly Network in the largest decentralized finance security breach in history.

The hackers exploited Poly Network on DeFi exchanges Polygon, Ethereum and Binance Smart Chain. Assets stolen include $253 million in tokens on Binance Smart Chain, $266 million in Ethereum tokens, and $85 million in USDC on the Polygon network, at time of publication.

Poly Network is a cross-chain protocol for swapping tokens across various blockchains. The founder of Chinese blockchain project Neo launched Poly Network in partnership with Ontology and Switcheo.

Poly Network has asked digital asset exchanges and miners to block any tokens coming from the above addresses. The team behind the protocol also promised legal action and requested that hackers return stolen assets.

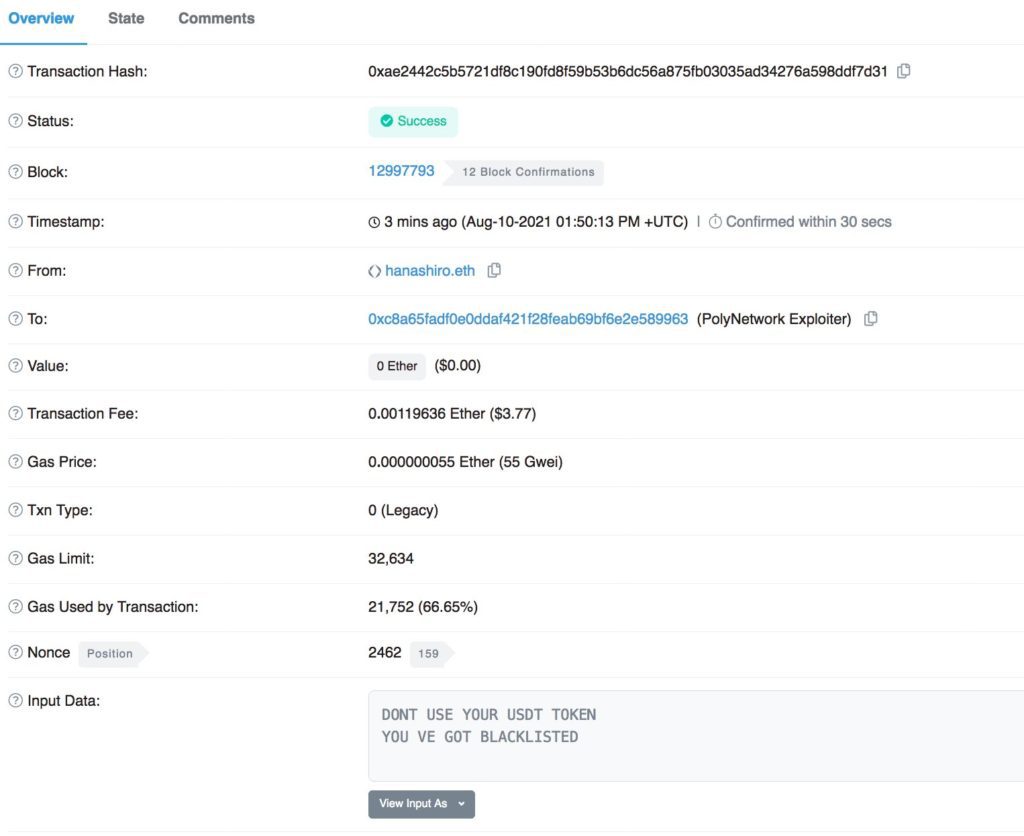

Tether froze more than $30 million in response to the hack, Tether Chief Technology Officer Paul Adroino tweeted.

About an hour following Poly Network’s announcement of the hack, the perpetrator attempted to move stolen assets through the Ethereum address into Curve.fi, but the transaction was blocked. The hackers continued trying for about 20-30 minutes before an anonymous user sent the hackers a message on the blockchain that USD Tether had been blocked.

The user told the hackers to try depositing the stolen tokens without Tether, which the hackers did successfully and they deposited all the addresses into Curve. The hackers then sent the anonymous user about $45,000 worth of ethereum for their help.

Neo Smart Economy also announced via Twitter that “migration from Neo Legacy to N3 has been temporarily paused,” and assets were secure.

The market has not been impacted significantly. Ethereum was down 1.57% and bitcoin lost 1.9% at time of publication.

“Surprisingly, the market has not been affected much, despite $600 million being exploited, which is pretty significant.” said Michael Tant, business analyst at Inside. “I think that is telling of the market that we are in. DeFi has survived so many individual hacks and exploits that people are less scared of their assets going to zero as a result.”

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.