Jack Dorsey and Jay-Z Created ₿trust; Here’s How its Board Plans to Deploy the 500 Bitcoins

The endowment’s mission is to “make bitcoin the internet’s currency,” 22-year-old Board Member Abubakar Nur Khalil told Blockworks

Abubakar Nur Khalil, board member, ₿trust

- “We’re looking at starting with Africa initially, but then gradually expanding into other regions in the global South,” Nur Khalil said

- The board wants to further Bitcoin development efforts and grow the ecosystem at large through supporting entrepreneurs and educational initiatives, he said

Meet 22-year-old Abubakar Nur Khalil. He’s the chief technology officer and CEO of Recursive Capital, an early-stage VC fund in Africa focused on funding and building critical infrastructure for the Bitcoin network. He is also a programmer and Bitcoin core contributor, and a board member of ₿trust, a new endowment fund of 500 bitcoins for development across Africa and India.

About six months ago, his older brother suggested he apply for the role as a board member of ₿trust, which was created by Rapper Jay-Z and Jack Dorsey, current CEO of Block, formerly known as Square. “It‘ll be set up as a blind irrevocable trust, taking zero direction from us,” Dorsey said then in a tweet.

Nur Khalil applied, but never expected that out of the 7,000 applicants, he would be chosen, he told Blockworks.

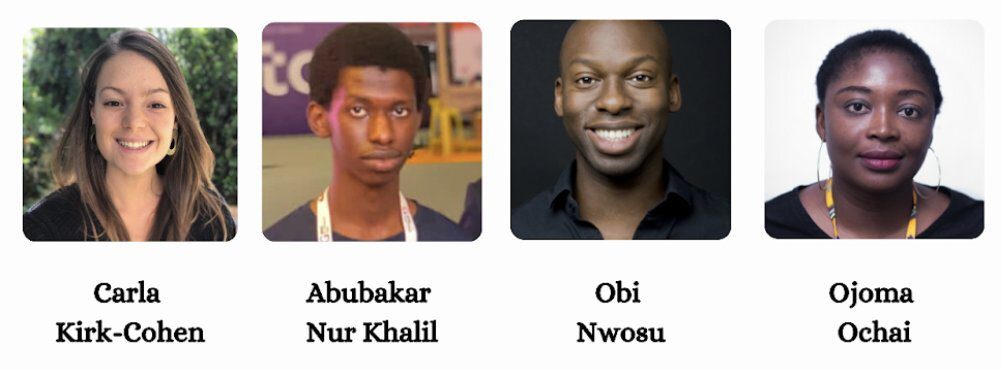

But he was picked, alongside three other candidates: Carla Kirk-Cohen, Obi Nwosu and Ojoma Ochai. All of the board members are in Nigeria, with the exception of Kirk-Cohen who is based in South Africa.

₿trust Board Members Source: Jack Dorsey’s Twitter

₿trust Board Members Source: Jack Dorsey’s Twitter

Getting down to business

Now, it’s time for the four of them to get down to business. The endowment’s mission is to “make bitcoin the internet’s currency,” Nur Khalil said the fund will also center on transparency and openness.

“It’s very, very important for us to keep it as transparent as possible,” he said. “We’ll be communicating a lot about the process, our thinking and the things we’re going to be doing going ahead primarily through Twitter,” he added. The board has a Twitter page with no tweets at the time of publication. It will post announcements there as they transpire, he said.

The 500 bitcoin is currently worth about $25.7 million, based on bitcoin’s price of $51,443 as of Dec. 27, 2021. While the board would like to deploy all its capital investments in bitcoin, it could be converted to local currencies if the organizations won’t accept the digital currency, Nur Khalil noted.

“We’re looking at starting with Africa initially, but then gradually expanding into other regions in the global South,” Nur Khalil said. “So that’s places like India as well. And then in general, with regards to the overall vision, we feel there’s so many disparities in some of these regions like Africa in terms of the actual amount of talented developers versus those of them that are actually working on Bitcoin,” he added.

However, the fund wants to change that and bring developers into the space. Nur Khalil said the board members want to further Bitcoin development efforts and grow the ecosystem at large through supporting entrepreneurs and educational initiatives.

“There still needs to be focus on other projects that are kind of on the periphery, on the heel of the ecosystem,” like crypto wallets or exchanges, he said.

“What we’re trying to optimize for is trying to do things gradually because there’s a lot and we won’t just look at the ecosystem and just throw a bunch of money on it. We still have to be meticulous on what the impact is, what the outcome we’re looking for and then look at ways that make it easy for us to address those things going forward.”

There isn’t a fixed timeline or specific date that the capital will be deployed, but it will begin during 2022, Nur Khalil said.

“There’s a really large talent pool [of developers] in Africa and a lot of it is translated into the wider ecosystem around it,” Nur Khalil said. “Shifting focus into building products that are geared towards more Bitcoin-related things, I think will have a huge net positive, or net benefit, or net gain both locally and globally,” he said.

A pivotal role

Even though the fund is new, crypto businesses and entrepreneurs shared an interest to donate or contribute to the fund. When the fund was first announced, Justin Sun, founder of cryptocurrency platform TRON tweeted, “I am happy to support and donate to ₿trust to fund #Bitcoin development. Africa & India is my top priority!” The CEO of Binance Changpeng Zhao also tweeted that he would be “happy to make a donation.”

Although the fund isn’t partnering with companies right now, that could be up for discussion later on as ₿trust will have to engage with a lot of stakeholders, from local groups or projects in Africa to global crypto corporations, Nur Khalil said.

“Eventually this will probably run out obviously since it’s 500 bitcoin and there’s a lot to do given the scope is to gradually expand it into other global South regions like India,” he said. “So we would likely be finding ways to replenish that supply,” he added.

As the new year is around the corner, Nur Khalil believes Africa will play a pivotal role in furthering Bitcoin development, while simultaneously launching the continent into the forefront of the monetary revolution.

“The possibilities are endless at this stage,” he said. “A lot of things are going to come on. A lot of these things will start materializing come next year.”

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.