Kraken and Legion ready Yield Basis for ‘Launch’

Kraken teams with Legion’s reputation-based platform to debut with public sale of Yield Basis (YB), Michael Egorov’s new BTC-yield protocol

KOYPIC/Shutterstock and Adobe modified by Blockworks

Kraken is set to christen its new public-offering venue, Kraken Launch, with Yield Basis (YB), the protocol from Curve founder Michael Egorov that targets BTC-native, fee-driven yield while neutralizing AMM curvature risk.

The sale will run in partnership with Legion, whose reputation-based access system has been used for prior token launches.

The offering is slated to roll out in two phases: Phase 1 allocates up to 20% of the sale to users with a Legion Score on legion.cc; Phase 2 opens remaining tokens simultaneously on Kraken and Legion on a first-come, first-served basis.

Legion says allocations are informed by verified activity (on-chain, social, GitHub) to skew toward builders and power users, while Kraken provides global distribution and compliance rails (e.g., MiCA in Europe). YB is expected to list on Kraken shortly after the sale, offering immediate secondary liquidity.

Yield Basis builds on Curve’s liquidity pool architecture with an automated re-leverage mechanism that keeps LP exposure aligned with the underlying asset (namely BTC on Ethereum) while harvesting trading fees.

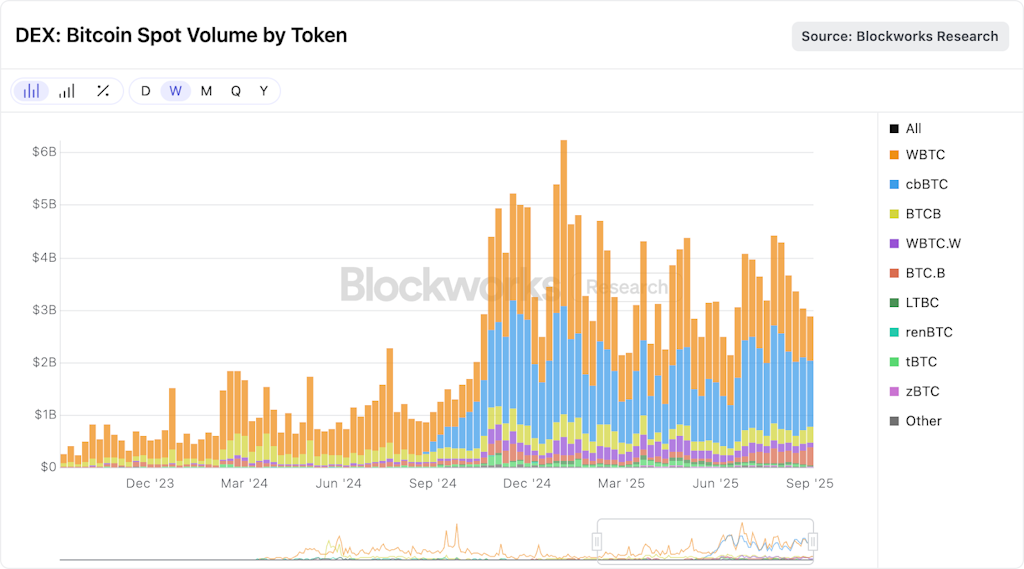

Source: Blockworks Research

Source: Blockworks Research

Economically, LPs must choose one of two paths: either take real BTC-denominated fees or forgo those fees to receive YB emissions — but not both. Locked veYB governs emissions and receives a share of protocol fees via a dynamic admin fee that adjusts with the share of LPs opting into emissions (described as ~10% minimum up to 100% in the extreme case where everyone chooses emissions).

Tokenomics, as disclosed to Curve DAO shows, 30% to liquidity incentives (inflation), 25% team, 15% ecosystem reserve, 12.1% investors, 7.5% for “Curve licensing”, 7.4% protocol development reserve and 3% liquidity incentives & Curve voting reserve. Detailed emission pacing, vesting schedules, and sale pricing were not included and have not yet been publicly disclosed.

Yield Basis has requested a crvUSD credit line from Curve DAO to seed BTC pools. The related on-chain proposal has reached quorum with a large “Yes” margin, signaling strong community support. The proposal text links the 7.5% allocation to future crvUSD liquidity incentives (ultimately directed by veCRV governance), aligning YB’s growth with Curve’s stablecoin flywheel.

The Kraken–Legion collaboration gives YB strong initial distribution while trialing a merit-based retail allocation at scale. For Curve’s ecosystem, the vote outcome and the dedicated licensing slice suggest tighter economic linkage between crvUSD routing and YB’s fee-and-emissions engine — just as BTC volatility and on-chain liquidity heat up this cycle.

This article was updated on 9/22/2025 at 11:50 a.m. to include links to key topics.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.