Luke Gromen: Fed Has Limited Tools to Prevent Debt Default

A lack of foreign government debt-buyers means the Fed may have to step up to finance US debt.

Source: Shutterstock

- The Fed is limited in its ability to prevent a sovereign debt default

- The extent to which the US government is supporting GDP is not sustainable

The United States government is playing a bigger role in economic growth today than ever before, and it is posing a threat to US solvency, according to one macro analyst.

“The economy is not recovering in a endemic way and in a self-sustaining way, which was seeming like the case prior to the delta variant and post-delta is increasing looking like the case,” said Luke Gromen, founder and president of Forest for the Trees LLC, during a recent Real Vision interview.

With the US in the midst of its largest peacetime budget stimulus ever, amounting to more than 12% of total GDP, the apparent economic recovery may not be as strong as some think.

“If you look back in the last year, about 35% of US disposable personal income is coming from government transfer payments, which, in plain language, there really hasn’t been a consumer recovery. There’s been a US government-deficit-debt-fueled-Fed-monetized spending binge as they handed cash to consumers,” said Gromen.

Consumer spending, measured as personal consumption expenditures (PCE), increased 11.8% during the second quarter of 2021. Americans are spending an average of $675 more a month compared to last year, according to the MassMutual Consumer Spending and Saving Index.

Even as spending increases, which Gromen claims is mostly bolstered by pandemic-related monetary policy and higher unemployment benefits, wages have not kept up with inflation.

Real, meaning after inflation, hourly wages have fallen every month for the past seven months, totalling about 2%, according to data from the Bureau of Labor Statistics. In the past year, real wages have fallen a total of 1.3%. This is in contrast to pre-pandemic real wages, which increased 1.4% over the year between August 2018 and July 2019.

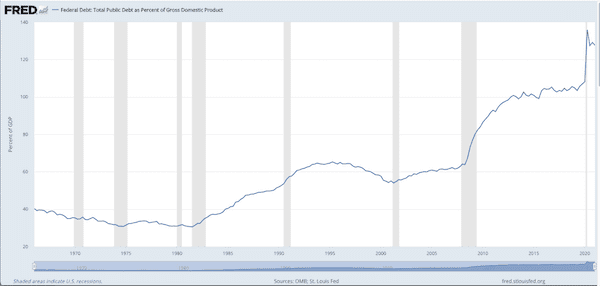

Federal Debt: Total Public Debt as Percent of Gross Domestic Product

Federal Debt: Total Public Debt as Percent of Gross Domestic ProductFederal debt-to-GDP is about 128%, down from its peak of about 135% during the second quarter of 2020, but still higher than it has ever been pre-pandemic.

“When you have debt-to-GDP of 130%, falling GDP is simply not a policy option,” said Gromen.

The fate of the dollar

The fate of the dollar, Gromen explains, is in the hands of the Federal Reserve and the US Treasury.

“The US federal government is now 22% of GDP, it’s the biggest single actor in the US economy by far,” he said. “And we saw them ramp up their spending significantly, which counter-cyclically is what you’re supposed to be doing in a downturn like we have here.”

But there has been little to no demand from foreign central banks to purchase US treasury bonds, which the US government needs to finance debts. Either bond buyers must be found, or the Fed will have to monetize all the debt.

“There’s not any private sector balance sheet big enough to finance US government deficits in a non-deflationary manner,” said Gromen.

If the Treasury spends enough in stimulus and the Fed monetizes enough of it, then it will likely be negative for the dollar, Gromen said. In the event the Fed does not monetize enough of Treasury spending, the dollar will rise, Gromen said.

“The challenge is if the dollar gets too positive for too long, it quickly begins to put, to be blunt, the US government’s solvency at risk,” said Gromen. “In other words, if they let the dollar get too strong, it leads to a cascading sell-off in global risk markets after not too long a period of time.”

US solvency, Gromen explains, depends on a significant increase in productivity in a short period of time. A continuation of fiscal spending and Fed monetization will increasingly put the US in a position where debt default becomes more likely.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.