One Year In, El Salvador’s Bitcoin Bonds Could Be Right Around the Corner

Pro-bitcoiners say the digital currency helped the Central American nation bring back its tourism industry

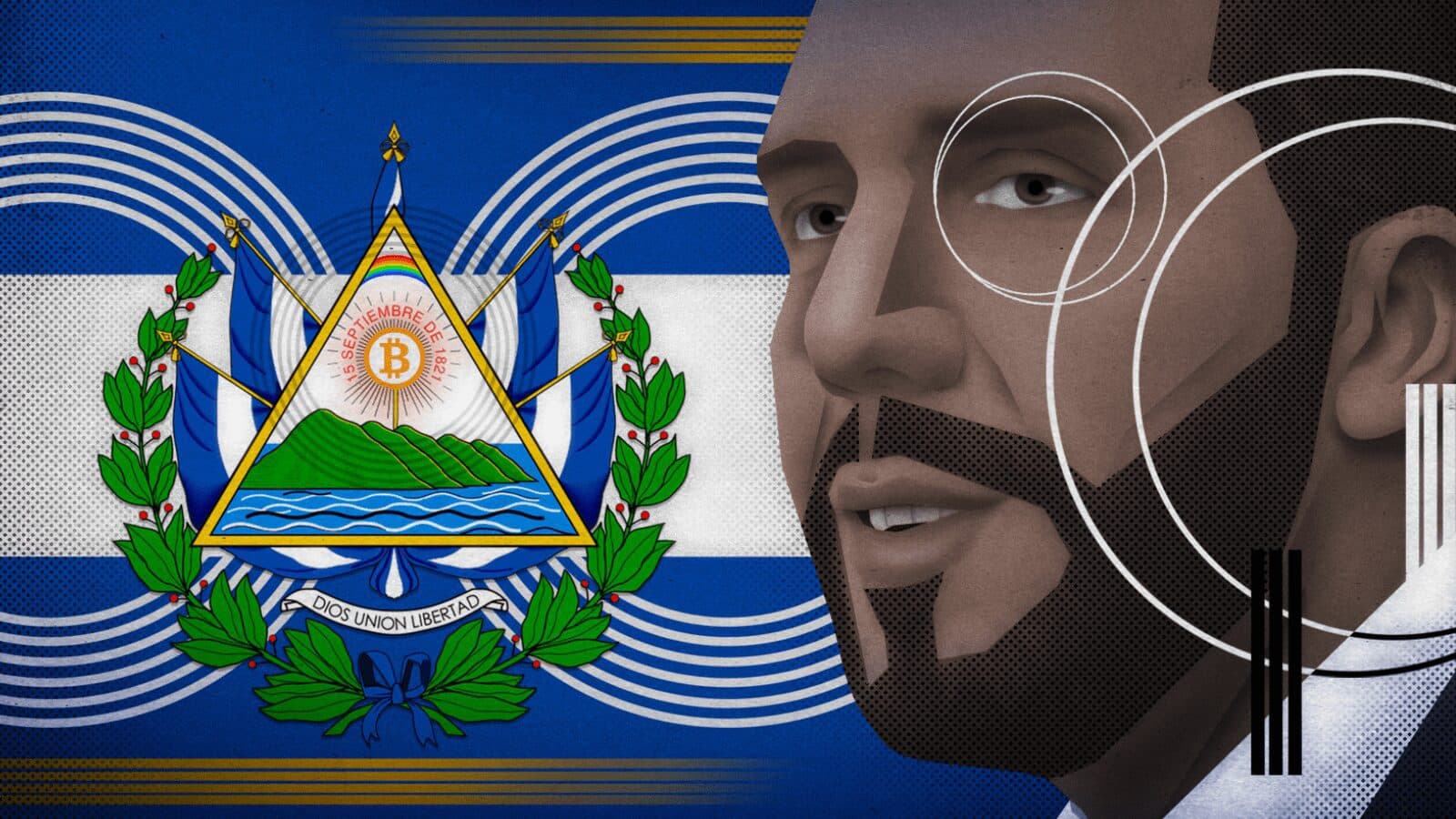

El Salvadorian President Nayib Bukele | Blockworks exclusive art by axel rangel

- El Salvador became the first country in the world to establish bitcoin as legal tender one year ago

- Officials have not broken ground on President Nayib Bukele’s promised “Bitcoin City,” a bitcoin bond-funded hub to be run on volcanic power

One year after becoming the first country to render bitcoin legal tender, many of El Salvador’s more ambitious plans have yet to materialize, but private partners are holding out hope.

Officials have not broken ground on President Nayib Bukele’s promised “Bitcoin City,” a bitcoin bond-funded hub to be run on volcanic power.

The elusive ‘volcano bonds,’ as President Bukele calls them, once advertised as sovereign, are now securitized corporate blockchain bonds. If they get off the ground, it will be the first such offering.

The bonds, which require a minimum investment of $100, were originally slated to launch in March 2022. Rollout was delayed, first until May 2022, and then indefinitely put on hold. Officials cited several reasons for the holdup: first, the war in Ukraine and dwindling risk appetite, then faltering bitcoin prices and finally legislative deferrals.

Now, sources claim that approval and launch may still come before 2023. Once the digital securities bill, which Bukele originally expected to pass in May, makes it through El Salvador’s congress, plans for the tokenized bonds can move forward.

“We’ve had confirmation from senior government officials that the current draft of the law is final,” Paolo Ardoino, chief technology officer at Bitfinex Securities, which will be the technology provider for the Volcano Token, the digitized form of the debt offering which Bitfinex is refraining from calling a ‘bond.’

“We are confident that the law will obtain approval from Congress in the coming weeks, assuming that the country has the necessary stability for such legislation to pass,” Ardoino added.

If the bill is indeed passed, Bitfinex will apply for a digital securities license to operate in the Central American country, Ardoino said.

Anyone with access to Bitfinex, which is prohibited in countries including the United States, United Kingdom and Canada, will be able to purchase Volcano Tokens. The exchange is anticipating a largely retail audience, as larger institutions may have internal policies prohibiting participation, a spokesperson from Bitfinex said.

Even as El Salvador struggles to get its latest bitcoin ventures off the ground, crypto proponents claim the digital currency has helped the Central American country build back its tourism industry. El Salvador attracted 1.2 million tourists in 2021 and 1.1 million in the first half of 2022, according to data from the Ministry of Tourism.

“Thank you Bukele, we appreciate the opportunity to give this a go and we just see adoption and growth happening,” one Twitter user shared Wednesday.

The country’s expanding tourism industry aside, economists are uncertain about El Salvador’s economic future.

The International Monetary Fund (IMF) expects El Salvador’s fiscal deficit to reach 5% of gross domestic product (GDP) in 2022. Public debt is also anticipated to rise to about 96% of GDP in 2026. Given the circumstances, the IMF estimates El Salvador is on an “unsustainable path.”

“The IMF forecasts a primary balance for 2022, yet says the debt is unsustainable under current policies,” Nathalie Marshik, head of emerging markets sovereign research at Stifel Financial, said. “El Salvador needs a 3% of GDP adjustment to get the debt to a sustainable level.”Persistent fiscal deficits and high debt service are leading to large and increasing financing needs, a recent IMF report said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.