Oregon Weighing Crypto Miner Carbon Crackdown

Oregon was once a hotbed for crypto miners. A new bill is the latest blow against them.

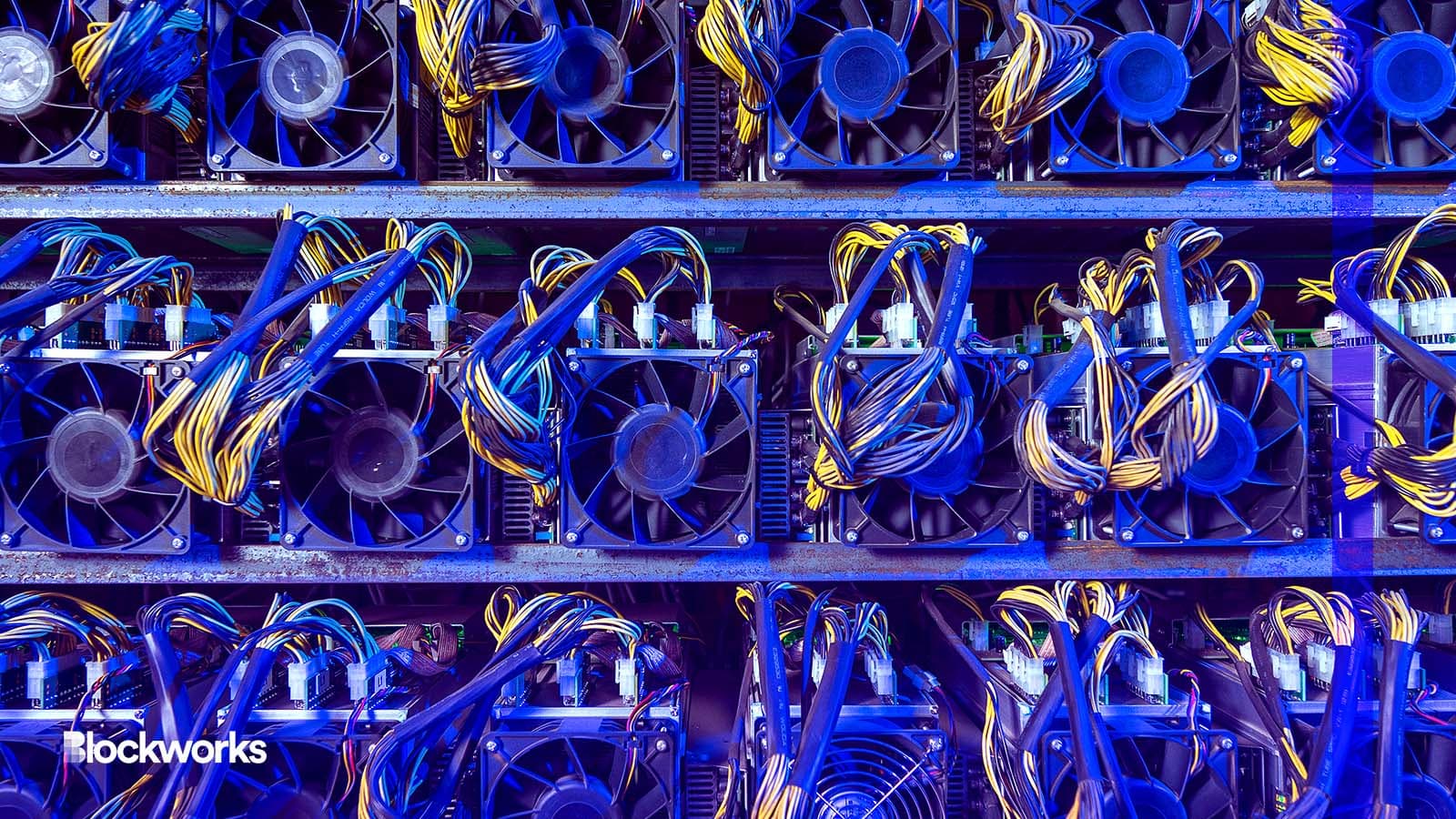

Mark Agnor/Shutterstock.com modified by Blockworks

Cryptocurrency miners and related entities could soon be required to adhere to an uncommonly stringent set of restrictions around their energy usage.

The measures — largely an outlier in the US — stem from a bill submitted to Oregon’s legislature on Wednesday. New York has been one of a handful of other states to impose strict standards on miners of bitcoin and other proof-of-work cryptoassets.

Sponsored by Rep. Pam Marsh, Sen. Michael Dembrow and Rep. Mark Gamba, House Bill 2816 aims to curb the carbon output of such “high energy use” facilities — with the goal of tamping down emissions by 60% below their baseline current levels by 2027.

The proposed new baseline is set at 0.428 metric tons of carbon dioxide equivalent per megawatt-hour. It would mandate those crypto companies to cut their emissions according to the following timeline: 80% by 2030; 90% by 2035; and 100% five years after that.

Failure to comply, each step of the way, would result in civil penalties of some $12,000 per megawatt-hour for each successive day not in compliance.

House Bill 2816 is meant to work in conjunction with another bill passed two years ago in Oregeon’s legislature, House Bill 2021. That bill also establishes clean energy targets toward 100% renewable energy by 2040, while bolstering existing guidelines.

“This is a bill that aims to bring the very largest of our energy and consumptive operations including crypto miners and data centers in line with the Senate and House Bill 2021,” Marsh told Blockworks.

The legislation currently applies to the state’s two largest electricity providers, together covering roughly three-quarters of the northwestern state. Even so, there’s still a significant portion of Oregon that was not covered under the previous legislation, according to Marsh.

Oregon was once viewed as a crypto mining haven. That standing was in part due to its hydropower capabilities powered by the Columbia River — back then, that renewable energy production cost 3 to 4 cents per kilowatt-hour, significantly less than other states.

Rising energy costs and a shift in overall sentiment in the sector, as well as major projects moving away from heavy energy-intensive proof-of-work consensus mechanisms, have resulted in less demand.

Both miners and data centers have come under fire in recent years over their excessive energy draw and subsequent high levels of greenhouse gas emissions.

An executive order on cryptocurrencies issued by the Biden administration last year emphasized that their underlying blockchain technology has contributed in no small measure to rising greenhouse gas emissions.

The bill, which has just hit the legislature’s table, is yet to be assigned to a committee and has not yet faced a hearing. That process, according to Marsh, could take two to three weeks.

Casey Wagner contributed reporting.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.