Paxful Dumps ETH as CEO Voices Concerns Over Scams

Paxful’s CEO blasted ether, calling it a hotbed for crypto scams and a digital form of fiat

Vector-3D/Shutterstock.co modified by Blockworks

Peer-to-peer marketplace Paxful has decided to remove the world’s second-largest crypto from its platform.

CEO Ray Youssef, in a tweet on Wednesday, pointed to several reasons for ether’s removal, including the blockchain’s recent switch from a proof-of-work consensus model to proof-of-stake (PoS).

“[PoS] has rendered ETH essentially a digital form of fiat,” Youssef tweeted. “Proof-of-work (PoW) is the innovation that makes bitcoin the only honest money there is.”

Ethereum flipped its consensus model in September, following years of back-and-forth between its developer community and stakeholders. Youssef has long advocated for bitcoin’s use in payments, e-commerce and wealth preservation, which sits at odds with the crypto’s depreciating value this year.

PoS achieves consensus through the staking of crypto behind each newly created block. PoW, meanwhile, requires miners to expend energy on computational power to search for a cryptographic needle in a haystack that gives them the right to produce a block.

Ethereum’s move this year was viewed by many in the industry as a positive step toward grappling with its long-standing issue over the network’s energy consumption — a criticism often levied at bitcoin. Since the Merge, Ethereum uses 99.95% less energy than it did under proof-of-work consensus.

Proponents of bitcoin to the exclusion of all other cryptoassets — dubbed maximalists — continuously point to bitcoin’s model as being the most secure based on its proven design to add new blocks to an existing chain.

Youssef also pointed to a rise in crypto scams resulting from the easy token creation Ethereum enabled, which he said has “robbed people of billions” and cost the industry’s mission to liberate those held back by an oppressive “evil system” of “economic apartheid.”

“Our industry is under attack right now — which means our responsibility to protect our users is greater than ever before,” the CEO said in his tweet.

Decentralization also remains a primary issue for Paxful and its head, who said, without providing evidence, that Ethereum is controlled by a select few that would later require permission to use it.

Analysis by Macauley Peterson

Very little has changed regarding Ethereum’s decentralization metrics as a result of the Merge.

Ethereum’s software upgrades or forks require the agreement from operators of its decentralized network of nodes, much like bitcoin. The number of nodes has fluctuated in recent years from a low of about 2,600 to a high of about 12,000, according to data from ethernodes.

Available bitcoin nodes in a similar timeframe have been more stable, oscillating between about 8,200 and 10,200, per bitnodes data. (Bitcoin core developer LukeDashJr estimates the number of “updated nodes” — another metric — is actually higher at around 32,000.) That includes miners which necessarily operate full bitcoin nodes, but also the many node operators around the world who are not miners.

The independent decisions of node operators in both cases is the ultimate arbiter of how the networks develop. The open-source software running each network gradually evolves through a consensus building process among a much smaller group of software engineers.

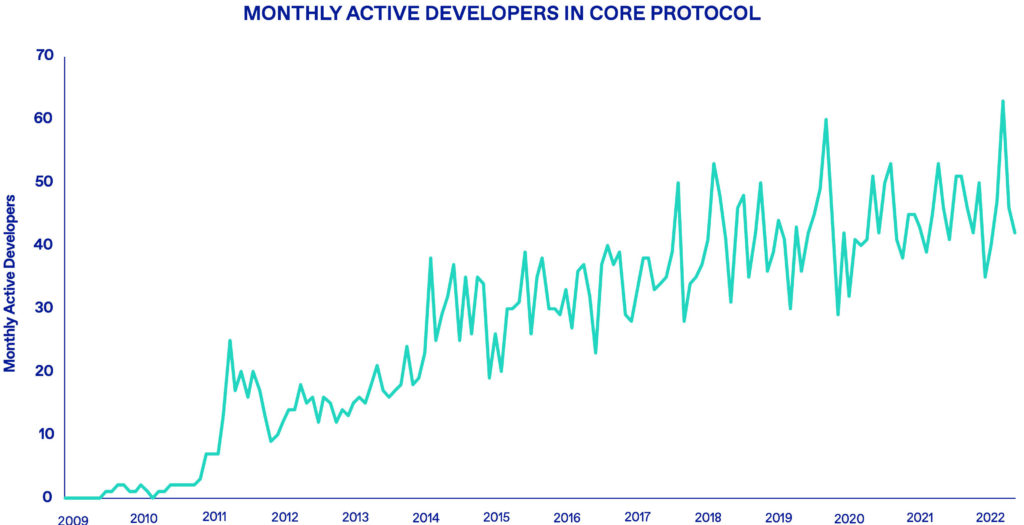

According to a September report from NYDIG, which tracked the growth of Bitcoin Core developers over time using data from GitHub, there have been between 30 and 60 monthly active developers over the past three years.

Source: NYDIG / GitHub

Source: NYDIG / GitHub

A much smaller group of 13 developers have had the responsibility for cryptographically signing each Bitcoin Core software release since Sep. 2021, which allows users to verify its authenticity.

Ethereum currently has 76 contributors listed on its project management repository on GitHub, a subset of which attend its periodic All Core Developer consensus calls.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.