Strategy, Metaplanet take bitcoin treasuries to new all-time high

Bitcoin is formally in the second phase of its adoption curve

Daranee Ganesh

Daranee Ganesh

10:34 AM Mar 26

Strategy Executive Chairman Michael Saylor | DAS 2025 New York by Mike Lawrence for Blockworks, modified by Blockworks

This is a segment from the Supply Shock newsletter. To read full editions, subscribe.

Stacking sats?

Chances are you’d be buying alongside any one of the dozen or so companies that are actively accumulating right now.

An estimate of the number of bitcoins held by corporate treasuries, both private and publicly-listed, has today reached a new all-time high: 1,082,164 BTC ($110.8 billion), according to BitcoinTreasuries.

It’s equivalent to almost 5.5% of the current circulating supply. And if we don’t include Satoshi’s million or so coins, or the estimated 1.57 million BTC believed to be lost forever, corporate treasuries are actually holding 6.25%.

That’s four times more bitcoins on corporate balance sheets than three years ago, as Terra/Luna was driving a wrecking ball through crypto markets.

Most of that growth is coming from public companies, led by Strategy of course, but Metaplanet, Semler Scientific and Tether are proving to be as ravenous as Saylor’s firm was in 2020.

The Jack Mallers-led XXI is on track to do the same, starting off with 31,500 BTC ($3.2 billion) disclosed late last month.

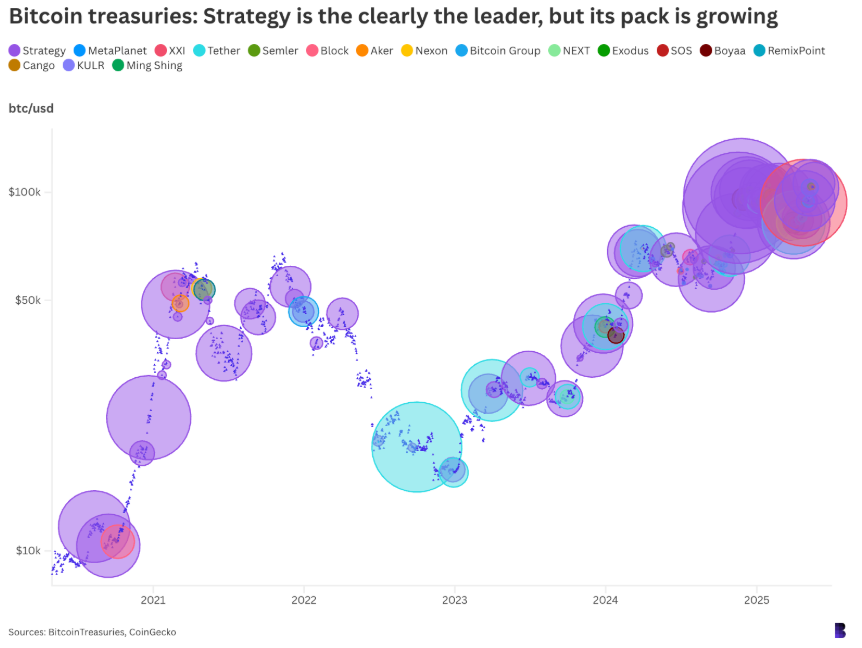

This morning, Strategy disclosed buying another 7,390 coins, bringing its running total to 576,230 BTC ($59 billion). Purple bubbles point to Strategy’s bitcoin acquisition.

This morning, Strategy disclosed buying another 7,390 coins, bringing its running total to 576,230 BTC ($59 billion). Purple bubbles point to Strategy’s bitcoin acquisition.

Tether now holds over 25% more bitcoin than it did last October: 100,521 BTC ($10.3 billion) as of its latest disclosure.

Metaplanet holds 700% more coins across the same period, today reaching 7,800 BTC ($800 million). Semler has meanwhile tripled its stack to 3,808 BTC ($390.1 million).

Some of the data on BitcoinTreasuries may be a little screwy (does Block. one really still have 164,000 BTC, worth $16.8 billion?), but that’s besides the point.

The rate at which businesses are adopting bitcoin to reinforce treasuries (and copy the Strategy acquisition playbook) has, in turn, advanced Bitcoin to its intermediate phase.

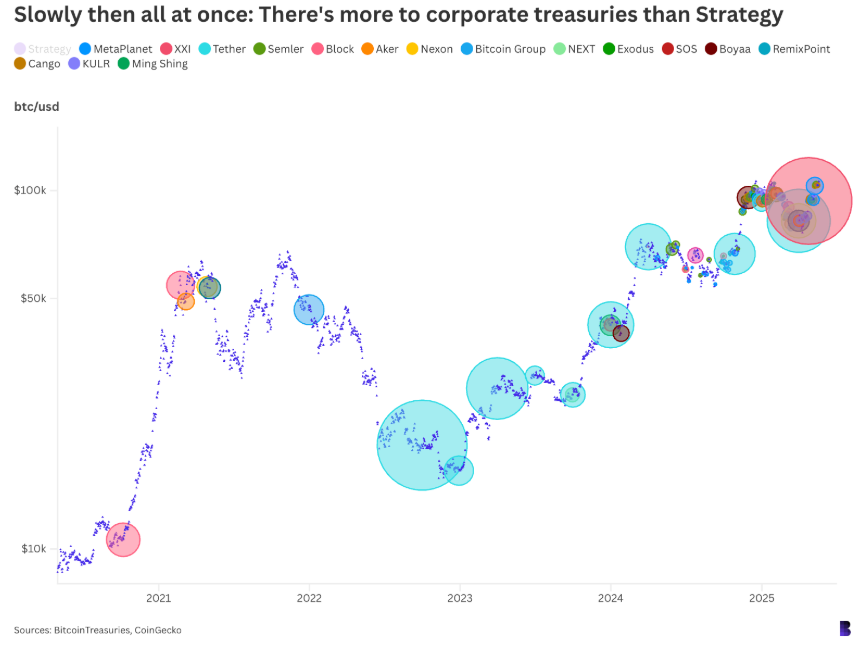

Every bubble is more bitcoin added to corporate balance sheets. Not shown: Strategy’s buys.

Every bubble is more bitcoin added to corporate balance sheets. Not shown: Strategy’s buys.

And just like the internet, mobile phones and social media, businesses were significantly slower to adopt Bitcoin than the public. It was now a decade ago, in 2015, that individuals in Venezuela and Argentina adopted bitcoin to protect their wealth from hyperinflation.

A handful of governments have clearly developed a keen understanding of the technology adoption curve and acted accordingly. We all know what comes next.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.