Terraform Employee’s Arrest is Unwarranted, Judge Says

South Korean judge reportedly said arresting Terraform’s head of business operations isn’t necessary

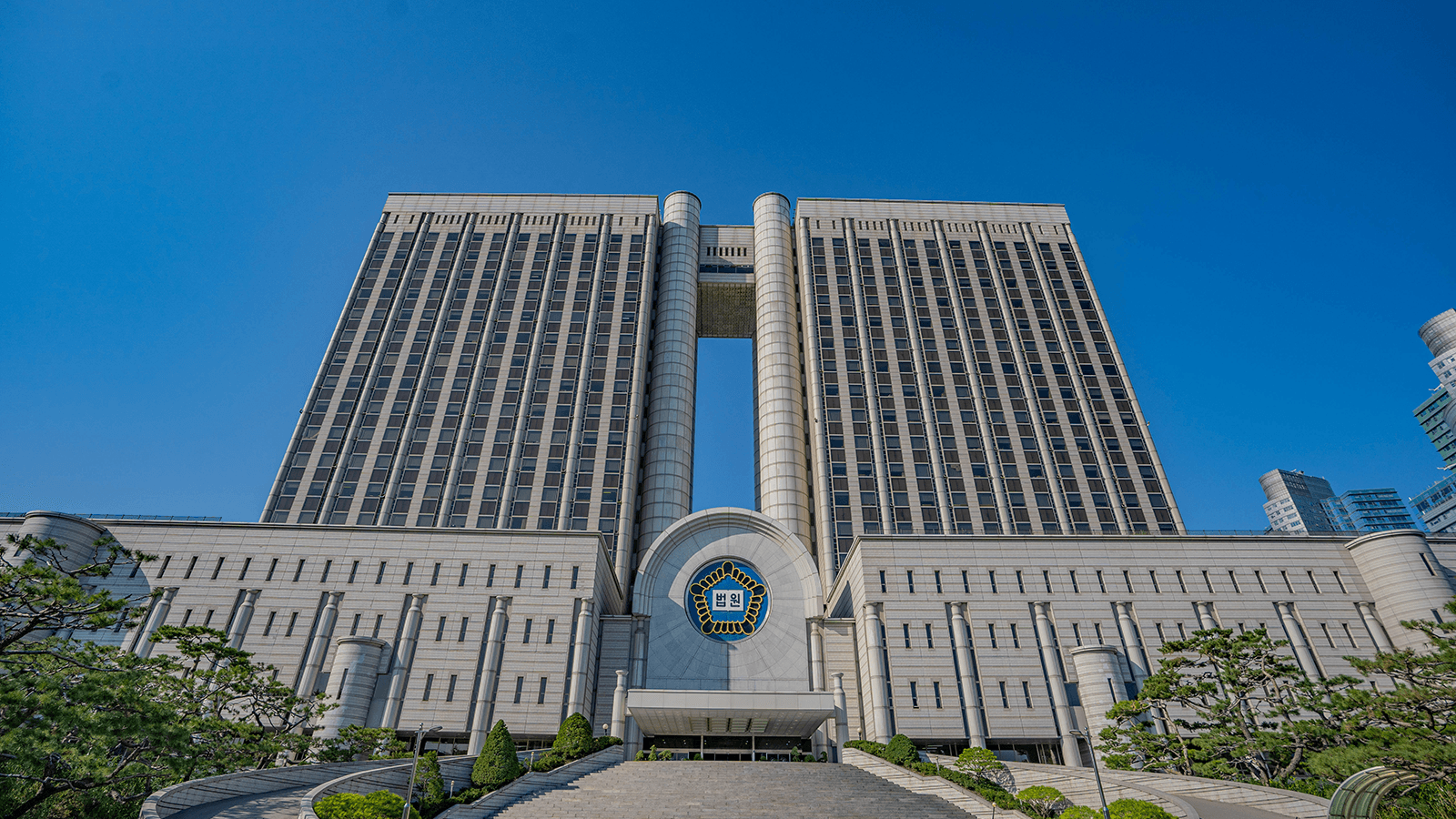

Seoul Central District Court Building; Source: Shutterstock

- Yoo Mo, a key Terraform employee, was accused of using a manipulative bot program

- His return to South Korea and cooperation with prosecutors aided the judge’s decision

A key Terraform staff member was released from interrogation after a South Korean court judge determined there’s little reason he should be held.

Local outlets Yonhap and SBS reported on Friday that the court dismissed an earlier-issued arrest warrant for the employee Yoo Mo. Judge Hong Jin-pyo of the Seoul Southern District Court reportedly considers detainment as unnecessary.

Yoo Mo, Terra’s head of general affairs, allegedly used bot programs to manipulate the firm’s stablecoin UST, prior to its depeg from the dollar and lead to the Terra ecosystem’s collapse. Subsequently, Terra’s collapse took down multiple centralized companies like Celsius, Voyager and Three Arrows Capital.

He was the first Terraform Labs’ employee to be arrested in connection with the incident.

Despite the accusations, Yoo is currently not a wanted individual. The fact that he didn’t deny operating and running the bot program in dispute was a critical factor in Judge Hong’s decision.

Other key considerations that the judge took into account were whether Luna was an “investment contract” under the capital markets law, the extent of Yoo’s complicity in the matter and that he voluntarily returned to South Korea after a warrant for his arrest was issued.

The report didn’t state where Yoo returned from, but it is believed the warrants were issued for Terraform employees who were and still may be in Singapore.

Still, the Judge declared that the crime of causing massive customer losses was serious and that some charges have been clarified.

A Terraform Labs spokesperson said recent developments reaffirm that the company and its stakeholders “remain subjected to a highly politicized and erratic legal environment in South Korea.”

“Terraform Labs has been — and will continue to be — in contact with all government agencies that have asked to communicate. The facts are on our side, and we look forward to the truth coming to light in the coming months,” the spokesperson added in an email to Blockworks.

South Korean prosecutors are reportedly now considering whether to reapply for an arrest warrant for Yoo. They’re also hastening moves to chase Terraform CEO Do Kwon, who claims he isn’t on the run.

On Wednesday, the Ministry of Foreign Affairs ordered Do Kwon to hand over his passport within 14 days. The document would be automatically invalidated if he doesn’t comply.

The Seoul prosecutor’s office didn’t return Blockworks’ request for comment by press time.

This article was updated with Terraform’s comment on Oct. 8 at 2:33 am ET.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.