What to Expect for BTC Ahead of Tomorrow’s CPI Print: Markets Wrap

BTC bounces on Powell’s testimony; higher CPI levels have not been bullish for bitcoin over past few months

Source: Shutterstock

- The price of bitcoin went above $43,000 briefly on Tuesday as the rally coincided with testimony by Fed Chairman Jerome Powell’s

- The Consumer Price Index (CPI) levels for December is set to be released Wednesday morning

Jerome Powell testifies before the Senate Banking Committee as part of his confirmation process.

Surprises to the upside for Consumer Price Index (CPI) prints have been bearish for BTC over the past few months.

Higher inflation puts pressure on the Fed to normalize monetary policy.

Latest in Macro:

- S&P 500: 4,713, +0.92%

- NASDAQ: 15,153, +1.41%

- Gold: $1,822, +1.19%

- WTI Crude Oil: $81.49, +4.17%

- 10-Year Treasury: 1.746%, -0.034%

Latest in Crypto:

- BTC: $42,815, +2.20%

- ETH: $3,238, +4.70%

- ETH/BTC: 0.0756, +2.61%

- BTC.D: 40.47%, -1.09%

BTC bounces on Powell’s remarks

Federal Reserve Chairman Jerome Powell testified before the Senate Banking Committee earlier today as part of the process to head the central bank for a second term.

Bitcoin market participants appeared to take his remarks positively, pushing the price from roughly $41,000 to above $43,000 for a brief period of time, according to data from Coingecko.

“We are going to have to be humble but a bit nimble,” Powell said about raising interest rates and changing the Fed’s balance sheet.

He noted that no decision had been made about normalizing policy, but that it was likely the Fed would decide to let the balance sheet shrink “sooner and faster” than it did following the recession from 2007 to 2009, according to a Reuters article.

Luke Gromen, founder of Forest For The Trees, believes that BTC may be sending strong market signals prior to many other financial instruments.

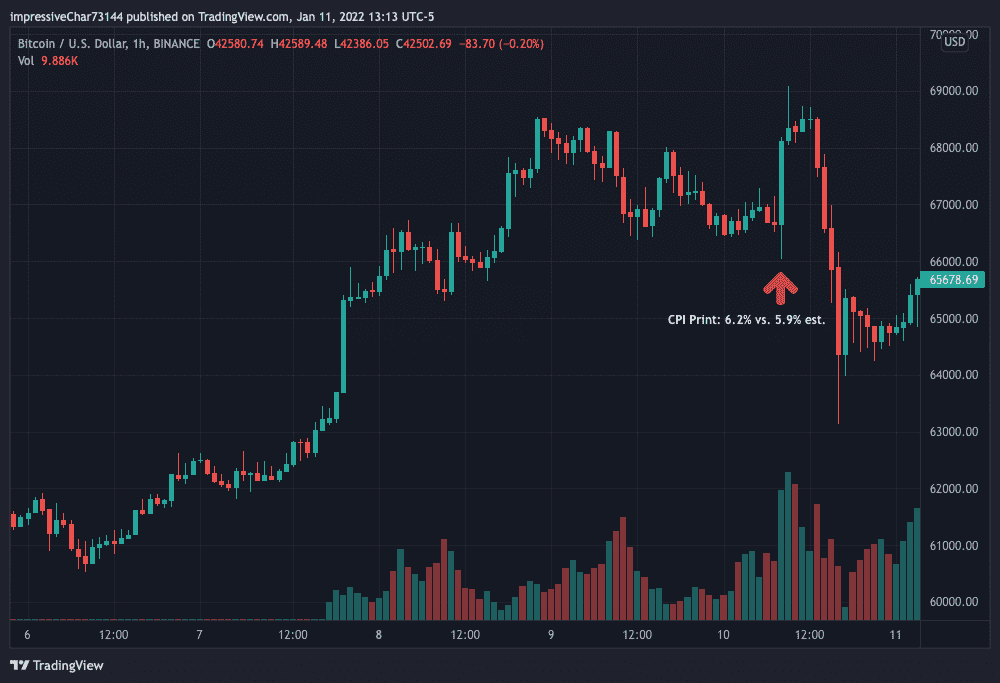

Previous CPI Prints & BTC price action

On Nov. 10 at 8:30am ET, the Consumer Price Index (CPI) came in at 6.2% for the month of October — higher than the 5.9% expected by economists polled by Dow Jones.

This was enough to push BTC past its all-time high and hover near $69,000 for about four hours before dropping and never reaching such levels again.

Source: Trading View

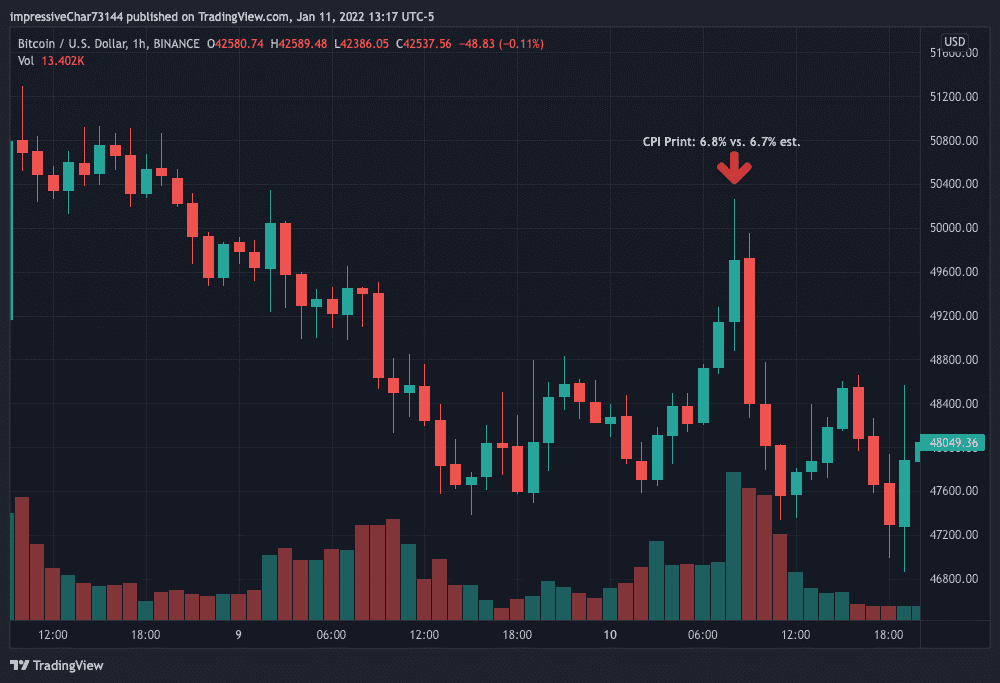

Source: Trading ViewOn Dec. 10 at 8:30am ET, the CPI for November was 6.8%, compared to the 6.7% expectation.

The market reacted similarly to the previous month, with BTC rallying from less than $49,000 to more than $50,000. The more recent price rally lasted about an hour, according to data from Trading View.

Source: coinglass.com

Source: coinglass.com

What to expect tomorrow

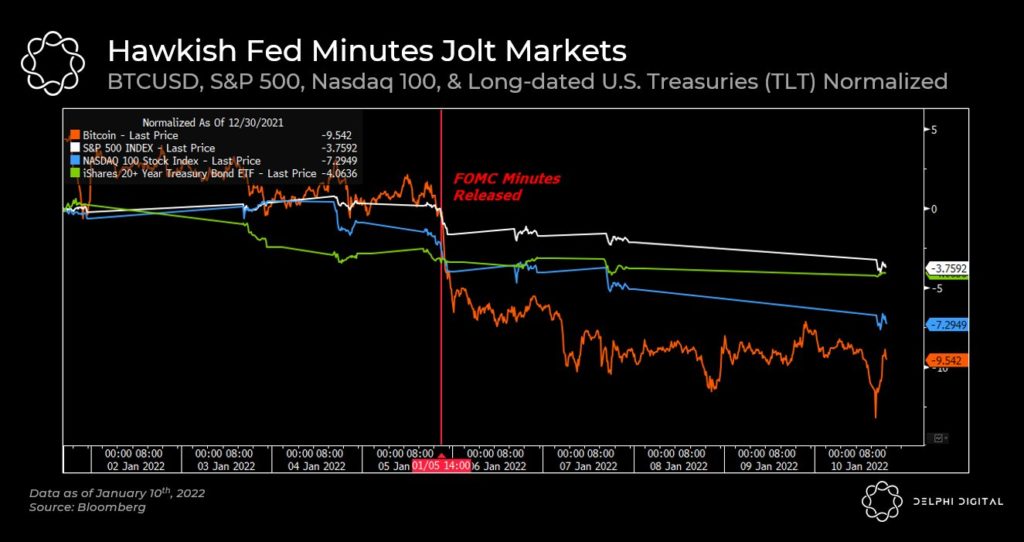

It seems counterintuitive that BTC, considered by many to be an inflation hedge, would respond poorly to high inflation becoming a reality. However, higher CPI prints put pressure on the Fed to tighten more quickly. BTC market participants appear to be figuring this out when looking at the muted rally seen in December when compared to November’s rally to an all-time high.

“We are phasing out our purchases more rapidly because with elevated inflation pressures and a rapidly strengthening labor market, the economy no longer needs increasing amounts of policy support,” Powell said in December after the conclusion of the two-day FOMC meeting.

As seen in the following graph, the hawkish tone led to a bitcoin price drop.

Source: Delphi Digital

Source: Delphi Digital

“December CPI comes out tomorrow and has a decent shot at reaching 7%+ year-over-year,” Lyn Alden, founder of Lyn Alden Investment Strategy, wrote in a Twitter post on Tuesday. “But then unless monthly inflation accelerates from here, the year-over-year figure will likely peak within Q1 2022.”

While it is impossible to guess the CPI, slated to be published tomorrow at 8:30am ET, a surprise to the upside may not be bullish for bitcoin despite logic telling investors otherwise.

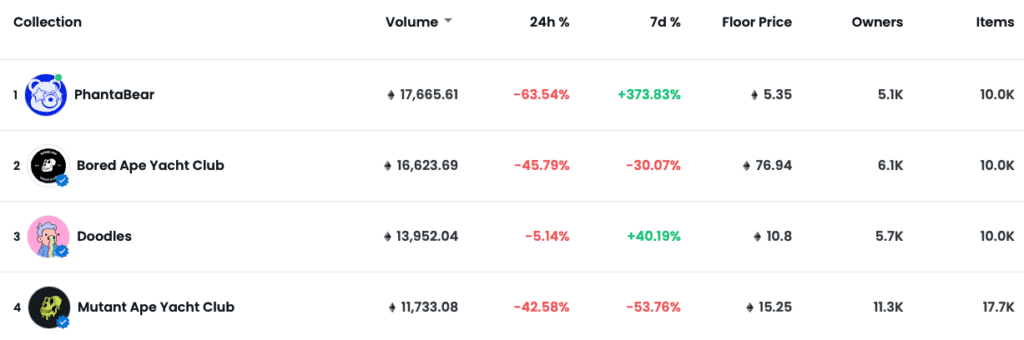

NFTs

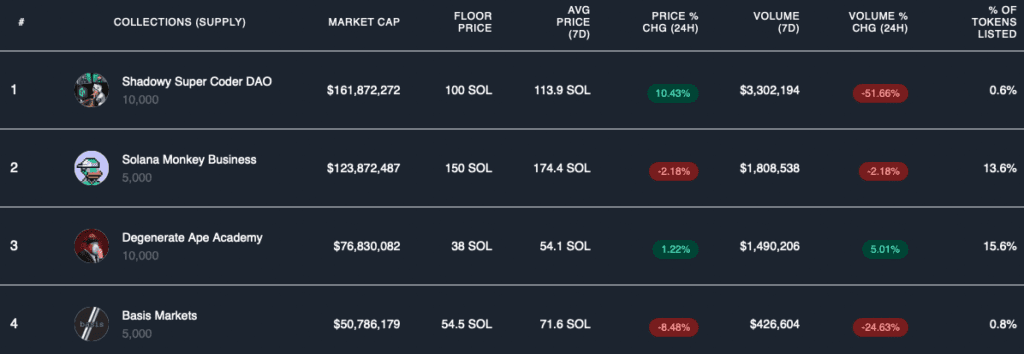

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.