Why Investors are Paying Millions for Virtual Land in the Metaverse

One buyer, who purchased a plot of virtual land for $1.5 million, described their investment as “the Hamptons of digital real estate.”

Source: Axie Infinity

- The metaverse could generate a $1 trillion annual revenue opportunity, according to a recent report from Grayscale

- Virtual property is a kind of NFT that represents ownership of a piece of land in the metaverse

A plot of land in the popular play-to-earn video game, Axie Infinity, recently sold for $2.3 million. The following week, virtual real estate developer, Republic Realm, said it had purchased a piece of property in The Sandbox for $4.3 million.

Digital property sales are notching never-before-seen highs as investors pile millions of dollars into real estate in the metaverse.

Axie Infinity co-founder Jeffrey Zirlin told Blockworks in an email that the recent sale of the plot of land, which was worth 550 ETH, makes perfect sense as people’s “digital lives are starting to take more importance in relation to [their] physical lives.”

“In the future the majority of people will be found mingling in virtual environments which will still need to mirror the physical world in some aspects,” Zirlin said.

For the uninitiated, Axie Infinity is a blockchain-based world where users can earn crypto rewards that can later be sold on exchanges. But the Axie homeland, called Lunacia, is divided into tokenized plots of land which act as homes or bases of operation for players, according to Zirlin. Therefore, virtual property can represent a non-fungible token (NFT) that represents ownership of a certain piece of land in the metaverse.

One buyer, who previously purchased a plot of land for $1.5 million, described their investment as “the Hamptons of digital real estate.”

“The transition and blend from real life to digital events has increasingly accelerated, leading to the formation of digitally native nations. I believe having ownership in such nations has an addressable market that is far greater than the real world,” the virtual landowner, who goes by “Flying Falcon” online, told Blockworks.

High-risk investment

In a rapidly evolving, growing — and at times volatile — space, virtual land could also be considered a high-risk investment choice, Zach Aarons, a general partner at real-estate tech VC firm MetaProp, told the Wall Street Journal.

“If I buy a building for 40 ETH, and then ethereum goes from $4,000 to $100, that’s a fundamental risk that I’m not really taking when I’m buying a piece of physical real estate,” he said to the Journal, who first reported Republic Realm’s $4.3 million investment.

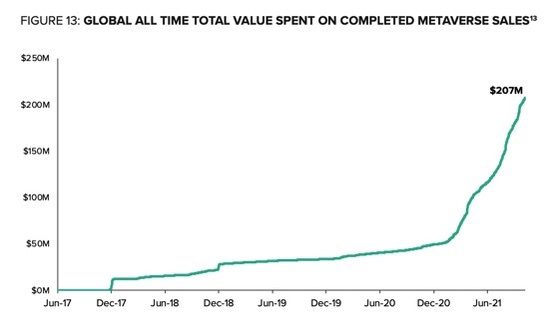

But the metaverse could still generate a $1 trillion annual revenue opportunity, according to a report from crypto asset management firm Grayscale in November.

Source: Grayscale

Source: GrayscaleThere’s even a “Zillow for the metaverse” now, a New York-based startup called Parcel. The niche marketplace allows users to connect their digital wallet such as MetaMask and bid on properties in virtual worlds like Decentraland, Cryptovoxels and others.

“Blockchain is the first time where it’s a fully global market,” co-founder Noah Gaynor told Blockworks in an interview. “I actually think things in the metaverse and crypto in general have this premium because you have liquidity from all over the world.”

“Not every single person in the world can buy Apple stock, but practically everyone with an internet connection can buy a piece of virtual land. There’s a lot more players chasing the same assets,” he said.

Gaynor added that the future of real estate investment has a huge growth opportunity in the metaverse, citing the potential for digital landowners to put up billboards on their property to make passive income.

“We believe these virtual worlds will have thriving economies just like the physical world,” he said.

When asked how to respond to skeptics who question how a virtual piece of property could be worth millions, Gaynor responded: “At the end of the day, it’s just supply and demand, right? Someone’s willing to pay that much for it, then that’s what it’s worth. [It’s the] same as bitcoin or any other asset.”

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.