Strengthening Dollar Leads to Sell Off in Stocks, Gold and Cryptos: Markets Wrap

A strong dollar and deflationary pressures may have been this week’s downfall for commodities like gold. The US currency briefly reached a two-month high on Friday while gold slumped the lowest it has in over a month.

Blockworks exclusive art by Axel Rangel

key takeaways

- In the wake of a Fed reset, the Dow Jones Industrial Average benchmarked its worst week in six months.

- Cryptocurrencies like Bitcoin hit a five-day low after baselining for most of the week as the dollar increased in value.

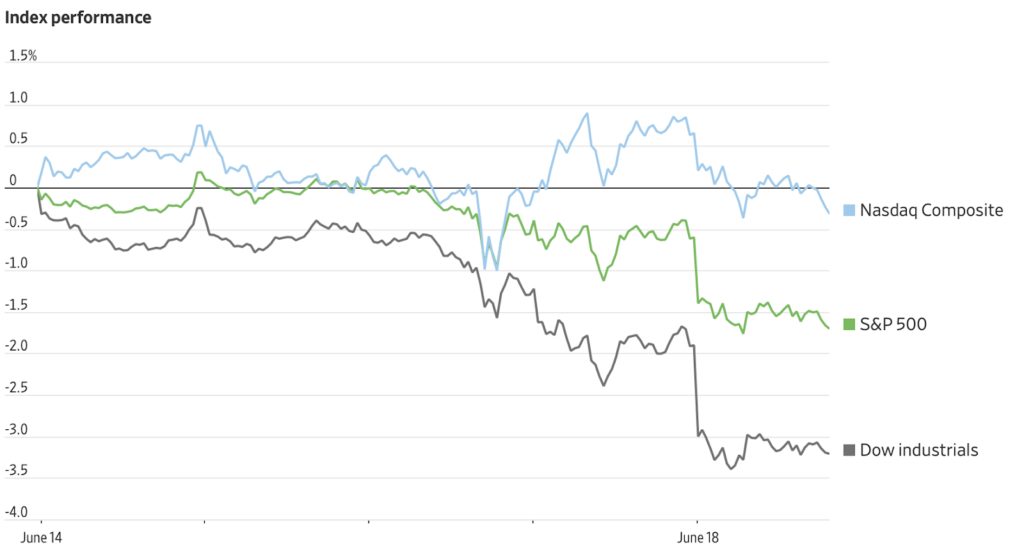

US stocks fell for a fourth day while the dollar strengthened, reaching the highest it has been in two months. Equities took a tumble after the Federal Reserve hinted at tapering and more interest-rate hikes for 2023.

In the wake of a Fed reset, the Dow Jones Industrial Average benchmarked its worst week in six months. Larger technology companies like Apple even fell, pulling the tech-heavy Nasdaq 100 down with it.

Essentially, inflation-sensitive sectors of the market declined, but short-term treasury notes ebbed slightly higher Friday morning after St. Louis Fed President James Bullard predicted an interest-rate increase as soon as 2022.

Friday also coincided with the ‘quadruple witching’, the time when four types of financial contracts (like options and futures on indices and equities) reach their maturity, which some also pointed to as the catalyst for the market’s slight volatility for the day.

Source: FactSet as seen on Bloomberg

Source: FactSet as seen on Bloomberg

Equities

- The Dow fell on the news at 33,401, shedding -1.2% by 4:00 pm ET.

- The S&P 500 also took a hit of .9% to 4,180 at 4:00 pm ET.

- Nasdaq 100 landed in the red at 14,161 as well.

Insight

“We’re expecting a good year, a good reopening. But this is a bigger year than we were expecting, more inflation than we were expecting,” Bullard said in an interview with CNBC. “I think it’s natural that we’ve tilted a little bit more hawkish here to contain inflationary pressures.”

Fixed income

- The two-year note yields 0.26% with an intra-day low at 0.20% while the 30-year treasury bond slid to 2.109%.

- The long-term bond took an intraday plunge to 2.049% on Thursday, the hardest it has fallen since February.

Commodities

A strong dollar and deflationary pressures may have been this week’s downfall for commodities like gold. The US currency briefly reached a two-month high on Friday.

- Gold has continued its two-day downward trend and slumped the lowest it has in over a month earlier this week. The precious metal sat at $1770.60, falling -0.25%, according to Bloomberg.

- Copper also scaled back, weathering to $4.14, respectively.

- Crude oil opened at $71.02 per barrel and increased to $71.71.

Insight

“Now, many people will think investors these days are short-term focussed and would not be too concerned about the possibility of rates rising two years down the line,” David Jones, Chief Market Strategist at Capital.com, wrote in an email to Blockworks. “But this signal from the Fed resulted in more market volatility than has been seen for many months.”

Crypto

Cryptocurrencies like bitcoin hit a five-day low after baselining for most of the week as the dollar increased in value, a similar story to US stocks and certain commodities.

- Bitcoin is trading at $35,486 as of 4:00 pm ET, down -6.03% over the past 24 hours

- Ether is trading at $2,165 as of 4:00 pm ET, falling around -7.61% over the past 24 hours

- ETH:BTC is at 0.06 as of 4:00 pm ET

- VIX is up 10.25% to 19.53 at 4:00 pm ET

In other news

Goldman Sachs has begun trading bitcoin with Galaxy Digital, announcing a new partnership with the crypto investment firm, founded by Mike Novogratz.

“If the phone rings enough times and clients are trying to get exposure, you eventually figure out how to do it for them safely, understanding that your role in the world is to intermediate exposure safely, not to act as a fiduciary,” the former senior Goldman trading executive said of the cryptocurrency in an interview with CNBC.

That’s it for today’s markets wrap. I’ll see you back here on Monday afternoon. Have great weekends, all.