Support for Spot Bitcoin ETF Revs Up as Agency Holds Course

SEC Chair Gary Gensler said he’s “technology-neutral” in a letter to US Rep. Tom Emmer

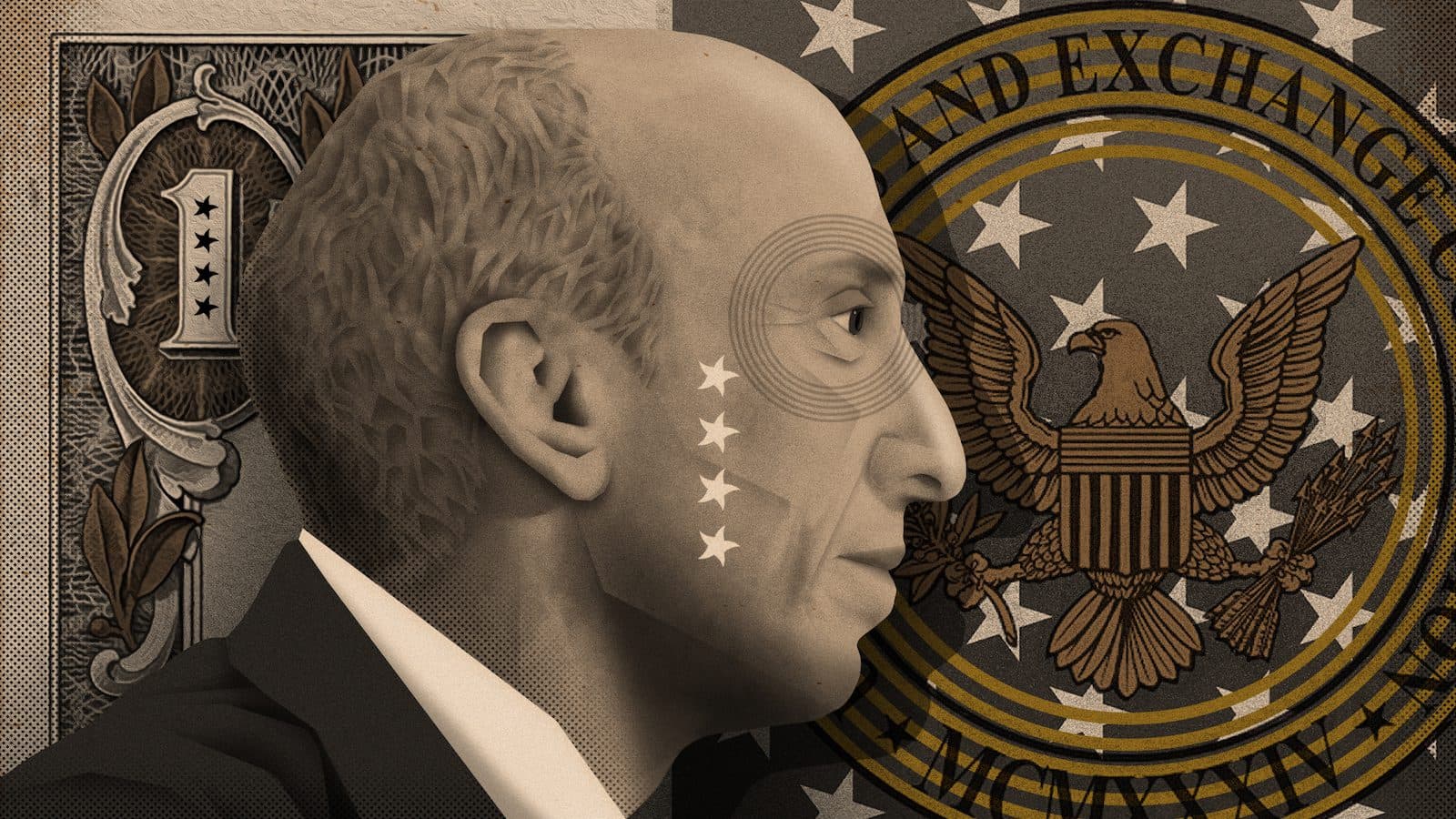

Gary Gensler, Chair, US Securities and Exchange Commission | Blockworks exclusive art by Axel Rangel

- SEC Chair Gary Gensler said his agency must consider whether a spot bitcoin ETF is designed to prevent fraudulent and manipulative acts and practices

- Nearly 100 people have so far weighed in on Grayscale Investments’ proposed conversion of its Bitcoin Trust to an ETF in public comments to the SEC

As the Securities and Exchange Commission refuses to budge on signing off on a spot bitcoin ETF, a growing number of industry participants are urging the regulator to reconsider.

The latest battleground: Grayscale Investments’ proposal to convert its bitcoin trust to an ETF (exchange-traded fund). The firm filed to morph the $28-billion Grayscale Bitcoin Trust (GBTC) to an ETF in October after the first bitcoin futures ETF began trading.

During the SEC’s 240-day review period, which expires in July, the agency is soliciting feedback from the public.

Andrew Farinelli, a private wealth advisor at Embree Financial, wrote to the SEC that the conversion would reduce costs and improve security for bitcoin investors. Chicago-based Embree, which has 85 institutional clients and 300 families, runs about $1.5 billion.

“Their accounts and investment would often be fully protected under the FDIC, it would be custodied at a trusted institution — [such as] Charles Schwab — and investment itself would be safer under the SEC’s regulation of ETFs,” Farinelli wrote. “Lastly…this allows investment professionals like myself to provide the best guidance to their clients and investors at large.”

SEC Chair Gary Gensler, meanwhile, has given bitcoin ETF hopefuls little reason for optimism. In his latest public comment, Gensler wrote a letter Tuesday to US Rep. Tom Emmer, R-Minn., saying the “different holdings” of bitcoin spot and futures products have led to “different regulatory outcomes.” Gensler is “technology-neutral” on the outcome, he wrote.

“When reviewing bitcoin spot ETPs, the commission must apply all the standards of the Exchange Act, which it has followed in connection with its orders considering previous proposals to list bitcoin spot ETPs,” Gensler wrote. “In particular, the commission must consider if the bitcoin spot ETP proposal is designed to prevent fraudulent and manipulative acts and practices.”

The letter followed a November dispatch to Gensler from Emmer and Rep. Darren Soto, D-Fla., saying the agency’s approval of a futures ETF should equate to a greenlight for a spot product.

“We do not understand the SEC’s views around the perceived material difference in risk profiles, since both the futures and spot bitcoin markets are inherently intertwined and bear the same risks regarding fraud and manipulation,” Emmer and Soto wrote.

The stakes are rising. A survey last month found that the percentage of financial professionals investing client funds in crypto rose from 9% to 15% over the past year.

Sixty percent cited regulatory concerns as preventing them from making their first or increasing their crypto allocation, while 32% noted the lack of easily accessible investment vehicles, such as ETFs.

The argument of industry powerhouses such as Coinbase is that a spot ETF would lead to an expansion of safe retail investment in bitcoin.

Paul Grewal, chief legal officer at Coinbase, also wrote a letter in support of the conversion in December.

“We believe investors should have access to GBTC in an ETP format because it offers a tried and tested way for retail investors to gain exposure to bitcoin at prices that closely reflect spot Bitcoin trading prices without holding it themselves,” Grewal wrote.

Grewal joined more than 100 people in writing, with the majority in support of the Grayscale conversion.

“This issue remains a priority for us and we will continue to oversee the SEC in its mission to maintain fair and orderly markets and facilitate capital formation,” Emmer wrote in a Thursday Twitter post.

A spokesperson for Emmer did not immediately return a request for further comment.

The recent flood of public comments comes after attorneys representing Grayscale Investments called the agency’s decision to approve a futures-based fund and not a spot ETF “arbitrary and capricious.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.