Coinbase Insider Traders Profit $1.5M Since 2018: Academic Study

University of Technology Sydney academics say they’ve proven multiple cases of insider trading around Coinbase listings yet to be prosecuted

Coinbase CEO Brian Armstrong | blockworks exclusive art by axel rangel

- Numerous tokens saw prices begin rising 250 hours before Coinbase listings, academics found

- “Our findings identify cases that are yet to be prosecuted,” academics at the University of Technology Sydney wrote

US federal regulators last month charged a former Coinbase employee with insider trading. Now, academics have found more staff at the leading crypto exchange could be up to no good.

Insider trading allegedly took place ahead of 10-25% of Coinbase listings between September 2018 and May 2022, according to a study published by the University of Technology Sydney on August 12, spotted by Decrypt.

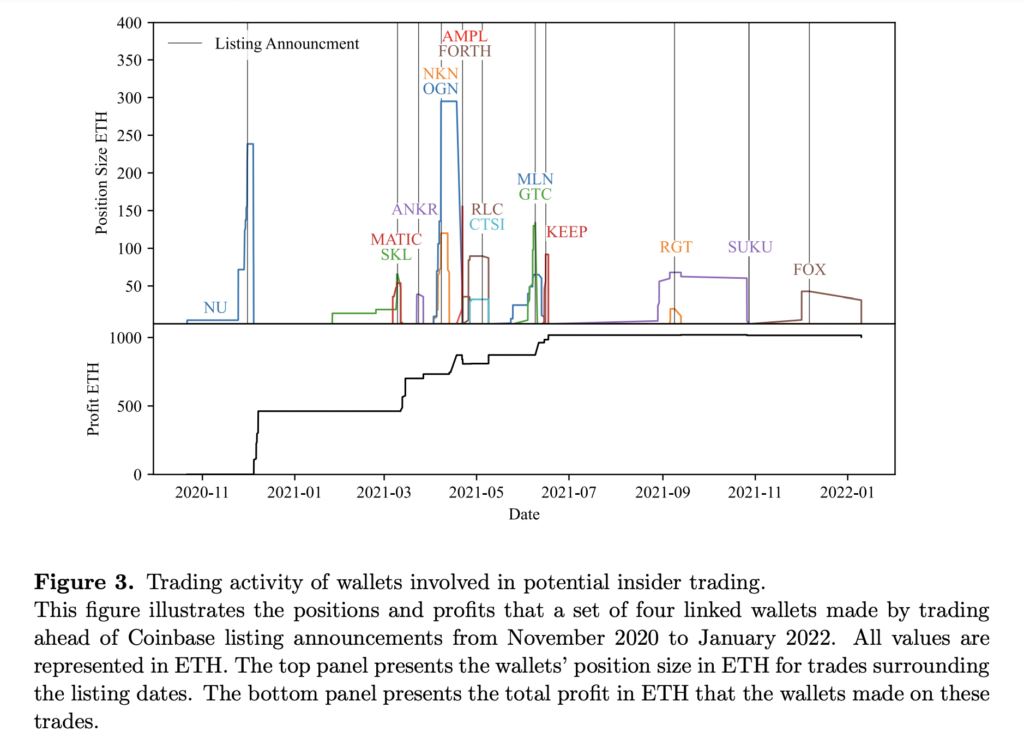

They reckon insiders made profits of $1.5 million by trading before announcements. “Our findings identify cases that are yet to be prosecuted,” finance lecturers Ester Felez Vinas and Talis Putnins, and PhD candidate Luke Johnson wrote.

The study is limited in its scope, as samples have been extracted only from Coinbase.

Trading ahead of public listing, based on unfair informational advantage, is a violation of securities law. Coinbase is the largest publicly-traded crypto exchange, and new token listings on the platform regularly inspire price surges rendering early purchases profitable.

Insider trading could be worse on decentralized exchanges

The academics based their research, which isn’t yet peer-reviewed, on Coinbase listings. They used an archive site to validate the date and hour of original announcement posts.

Their final sample size included 146 token listings, of which 6 made their crypto exchange debut on Coinbase. They tracked the price movements of the tokens between 300 hours before Coinbase listing announcements, and 100 hours after.

“From visual inspection, we note that there is an evident [price] run-up pattern prior to the listing announcement starting at -250 hours,” the researchers wrote.

“The run-up continues until the listing announcement event, where we see a jump in price because of new information entering the market and traders reacting to the news. The run-up pattern we observe is consistent with the run-ups in prosecuted cases of insider trading in stock markets.”

Academics highlighted red flags surrounding listings of several cryptocurrencies including Polygon native token MATIC and algo-powered AMPL.

Academics highlighted red flags surrounding listings of several cryptocurrencies including Polygon native token MATIC and algo-powered AMPL.

The academics deduced insider trading was more likely to occur on decentralized exchanges (DEXs), which typically don’t have strict identity checks and allow pseudonymous trade.

In response to the study, Coinbase said the exchange “takes allegations of frontrunning incredibly seriously and we work hard to ensure all market participants have access to the same information.”

“We have zero tolerance for illicit behavior and monitor for it, conducting investigations where appropriate,” a company spokesperson told Blockworks in an emailed response.

In a May blog, chief legal officer Paul Grewal wrote the exchange has a team dedicated to preventing and identifying instances of financial crime.

“If an investigation finds that a Coinbase employee was involved in misuse of company information related to asset listings, we will not hesitate to terminate them,” he wrote.

Former Coinbase product manager pleads not guilty to insider trading

In July, the US Securities and Exchange Commission (SEC) charged former Coinbase product manager Ishan Wahi for allegedly trading ahead of multiple cryptoasset listings based on confidential information.

Wahi entered a not guilty plea, with his lawyer David Miller arguing the charges should be dropped as insider trading only relates to securities or commodities.

According to him, the cryptoassets Wahi traded weren’t securities, which means they don’t fall under the SEC’s purview.

Miller is confident Wahi will be exonerated. “There are significant legal issues in this case and we have strong grounds for motions to dismiss and suppress,” he told Blockworks in an email.

This article was updated at 8:54 am ET to include comments from Coinbase.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.