Crypto’s ‘Revolving Door’ Hires Are Raising Eyebrows Among US Lawmakers

Five US lawmakers have signed a letter demanding information on ethics and transparency related to revolving door hires

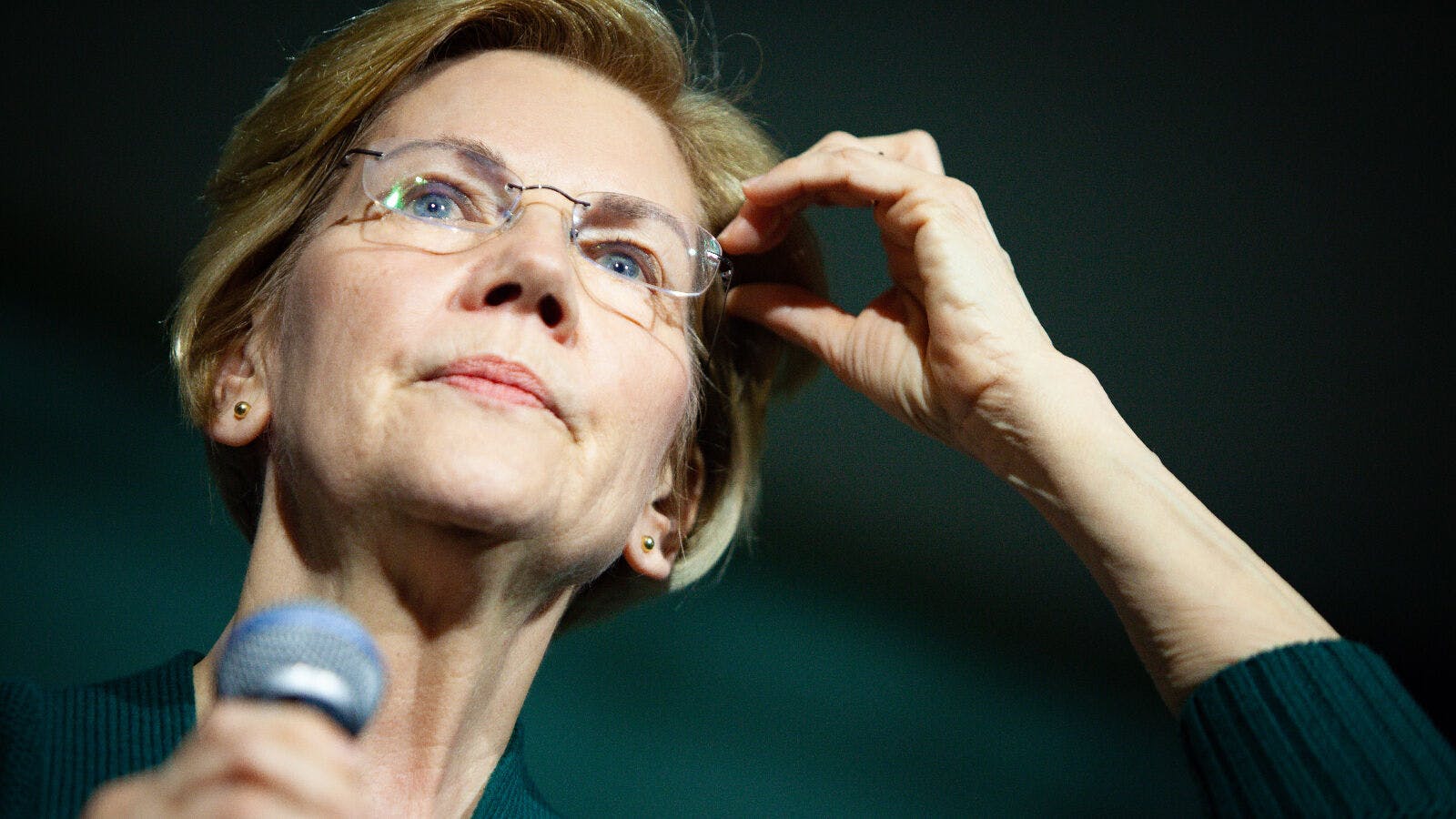

Sen. Elizabeth Warren | Source: Shutterstock

- Over 200 government officials have left their public service posts to move into senior positions at crypto startups, the lawmakers say

- Many of these individuals later serve as “advisers, board members, investors, lobbyists, legal counsel, or in-house executives,” in the the crypto industry

A number of prominent US lawmakers say they’re increasingly concerned about the growing number of financial regulators taking crypto jobs.

Sen. Elizabeth Warren, D-Mass., and Rep. Alexandria Ocasio-Cortez, D-N.Y., were among those who penned a slew of letters Oct. 24 to a number of US financial watchdogs.

“We write seeking information about the steps your agency is taking to stop the revolving door between our financial regulatory agencies and the cryptocurrency (crypto) industry,” they wrote.

More than 200 government officials, per the lawmakers, have left public service jobs in favor of digital asset firms, where they’ve taken up senior positions including “advisers, board members, investors, lobbyists, legal counsel, or in-house executives.”

Added the letter: “Just as powerful Wall Street interests have long exercised their influence over financial regulation by hiring former officials with knowledge of government’s inner workings, crypto firms appear to be pursuing the same strategy in order to secure ‘a regulatory system to the industry’s exact specifications.’”

Other politicians who signed on include Sheldon Whitehouse, Jesús García and Rashida Tlaib.

The lawmakers asked for information related to ethics and transparency on revolving door hires under a Nov. 7 deadline.

“Our financial regulators are tasked with ensuring the safety and fairness of our financial markets,” the letter said. “The rapid rise of the crypto market has presented regulators with new questions about how these assets will be regulated.”

Warren has long been a critic of the cryptocurrency industry. Earlier in September, the senator, alongside other lawmakers, wrote a letter expressing their concern that Facebook was becoming a “breeding ground” for crypto fraud.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.