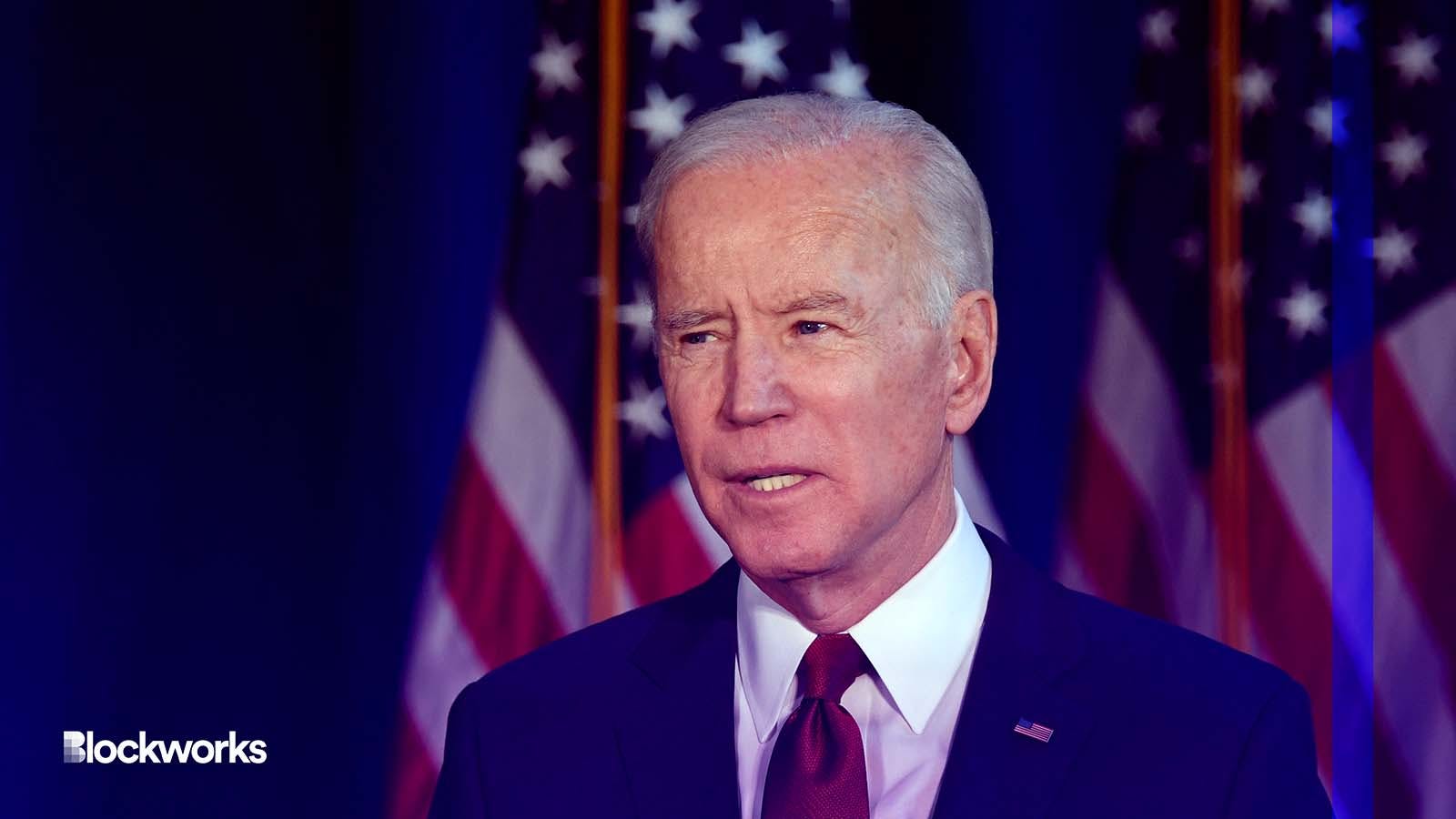

Biden: SVB, Signature Executives Will Be Fired

In a short speech, Biden told Americans their money is safe and executives will be held accountable

Ron Adar/Shutterstock.com modified by Blockworks

Banks need more regulatory oversight, President Biden said during an address Monday morning about the recent closure of Silicon Valley Bank and Signature Bank.

The government has taken control over these institutions and no losses will be put on taxpayers, Biden said during the roughly four-minute speech.

“Every American should feel confident that their deposits will be there, if and when they need,” Biden said. “Second, the management of these banks will be fired.”

Investors and banks will not be protected, according to Biden.

“They knowingly took a risk,” he said. “When the risk didn’t pay off, investors lose the money. That’s how capitalism works.”

There are “important questions” about how SVB and Signature found themselves in this position, the president said — problems his administration has signaled they’re working on addressing.

Biden did not take questions, leaving the podium as one press member asked for more clarity about why this crisis happened. The live feed was then cut.

The speech comes a day after US Treasury Secretary Janet Yellen, Federal Reserve Board Chair Jerome Powell, and FDIC Chair Martin Gruenberg said Sunday they are taking action to protect the US economy by strengthening public confidence in the banking system.

The failure of Silicon Valley Bank, located in Santa Clara, California, is to be resolved in a way that will fully protect all depositors, who will be granted access to their money starting from March 13, the regulators said in a statement Sunday evening.

“After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors,” the statement said.

The closure of the banks prompted widespread fear across the crypto industry. Stablecoin USDC dropped to its lowest price ever over the weekend, more than 10 cents below its dollar peg. Circle said Sunday its “$3.3B USDC reserve deposit held at Silicon Valley Bank, about 8% of the USDC total reserve, will be fully available when U.S. banks open Monday morning.”

“Trust, safety and 1:1 redeemability of all USDC in circulation is of paramount importance to Circle, even in the face of bank contagion affecting crypto markets,” co-founder and CEO of Circle Jeremy Allaire said in the statement.

“We are heartened to see the U.S. government and financial regulators take crucial steps to mitigate risks extending from the banking system.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.