Bitcoin ETFs in conservative portfolios is good for crypto — and Wall Street

Fidelity Canada’s bold move to include a BTC ETF in their conservative portfolio marks a significant shift in how Wall street can approach digital assets

Artwork by Crystal Le

The financial landscape is evolving, and Fidelity Canada is leading the charge by adding a bitcoin ETF to its “conservative all in one” portfolio.

Fidelity Canada’s asset allocation shift is a gamechanger for conservative portfolios. Traditionally, conservative portfolios have leaned heavily on low-risk investments like Treasury bonds, known for their stability and predictability. The inclusion of a bitcoin ETF by Fidelity Canada represents a stark contrast, introducing a dynamic asset class known for its volatility into the realm of conservative investment strategies.

This bold integration underscores the evolving perception of cryptocurrencies as a legitimate component of diversified portfolios, challenging conventional investment wisdom.

By including bitcoin in their investment strategy, Fidelity Canada has acknowledged the asset’s potential to improve portfolio diversification without materially increasing risk. This approach aligns with the evolving narrative of cryptocurrencies as a new asset class and paves the way for other institutional investors to follow suit.

Fidelity Canada’s bold move marks a significant shift in how institutional investors can approach digital assets — putting forward a new conservative strategy that balances potential returns with a focus on diversification.

But there are many implications behind allocating a 1-3% position in cryptocurrencies to achieve enhanced risk-adjusted returns.

Institutional investors have often grappled with the question of whether or not to include crypto in their portfolios, conservative or otherwise — the return/risk profile is so unique that it adds diversification benefits to a lot of portfolios. The new consensus, supported by back-testing data, suggests that a modest allocation to cryptocurrencies — between 1% and 3% — can enhance returns without jeopardizing overall portfolio stability. This allocation strategy mitigates the risk of market volatility while allowing investors to participate in the growth potential of digital assets.

The conventional methodologies for evaluating investment performance are often mismatched with crypto assets’ unique nature, characterized by their significant volatility and distinct market cycles.

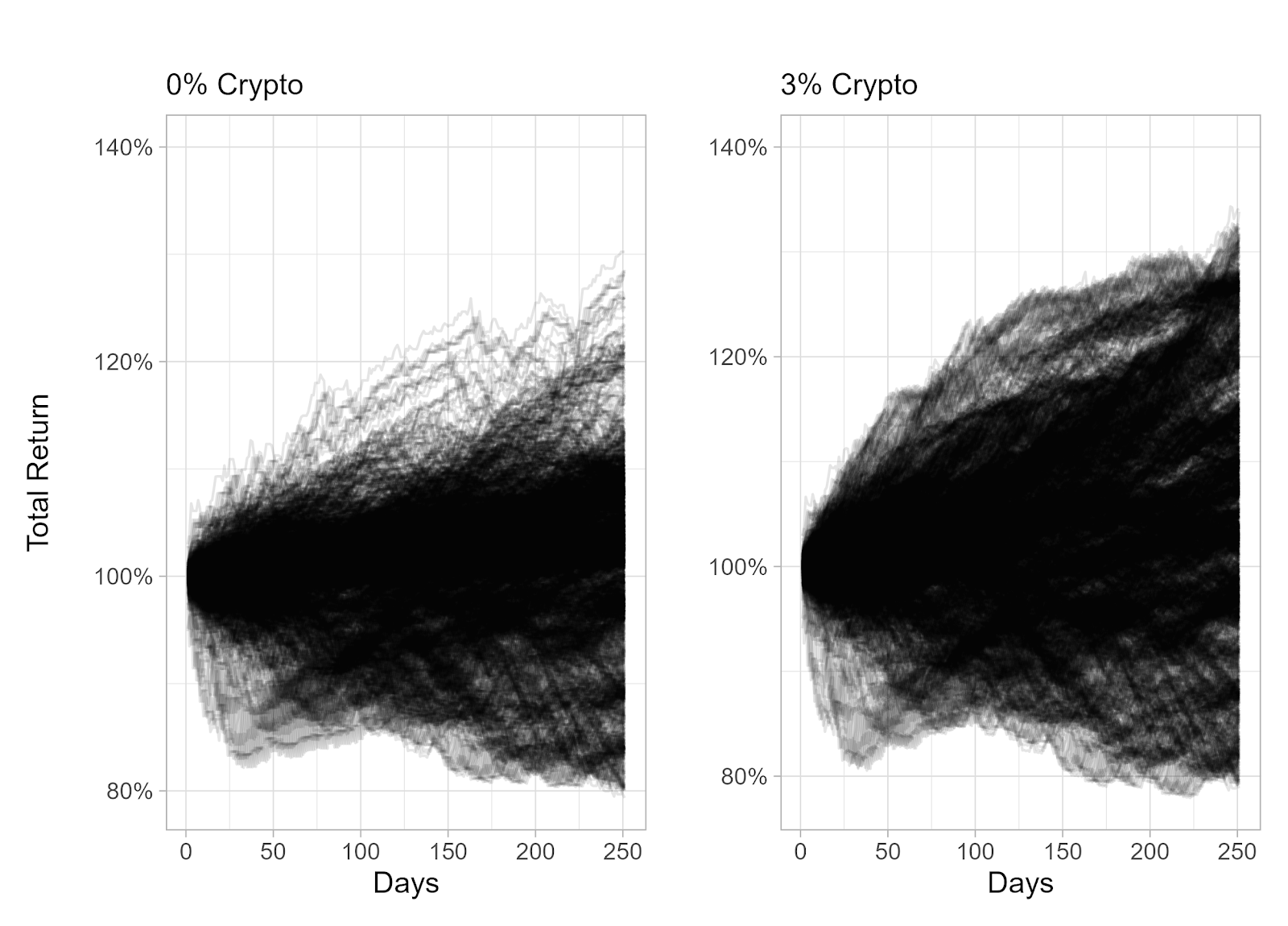

However, an advanced analytical technique (scrutinizing portfolios with a certain crypto allocation over a 250-day period from 2015 to now) yields a more accurate depiction of investment performance. This approach embraces the full spectrum of market dynamics and eliminates the fallacy of optimal investment timing.

With this type of analysis, you will find that incorporating crypto assets in a portfolio broadens the range of possible performance outcomes, yet does not inherently amplify risk in a meaningful way — particularly when adhering to a prudent allocation of 3%.

The “3% Crypto” graph exhibits a significantly broader dispersion of return path, suggesting higher volatility. However, the paths spread more extensively upwards, suggesting that the inclusion of cryptocurrency has the potential to generate higher returns with the same level of risk.

Source: “Mastering Crypto Assets. Investing in Bitcoin, Ethereum and Beyond” (Wiley 2024). The image displays two side-by-side graphs comparing the total return paths of two portfolios over a period of approximately 250 days since the start of 2015.

Source: “Mastering Crypto Assets. Investing in Bitcoin, Ethereum and Beyond” (Wiley 2024). The image displays two side-by-side graphs comparing the total return paths of two portfolios over a period of approximately 250 days since the start of 2015.

The success of a crypto-inclusive portfolio lies in understanding the correlation between assets.

Cryptocurrencies can contribute positively to a portfolio, especially when they exhibit a low correlation with other investments. And high volatility is not necessarily a detriment; rather, it can be advantageous for diversification purposes. This understanding is crucial for employing active trading strategies and robust money management techniques.

Fidelity Canada’s inclusion of a bitcoin ETF in their conservative portfolio signals a move beyond the initial hype surrounding cryptocurrencies. Instead, it suggests a considered, strategic approach to asset allocation, where digital assets are evaluated on their merits and integrated thoughtfully into investment portfolios.

Institutional investors seeking to understand and incorporate crypto assets into their portfolios can take a cue from Fidelity Canada’s inclusion of a bitcoin ETF. By focusing on a conservative allocation strategy that emphasizes the connection between return paths and risk sizing, investors can achieve a well-diversified portfolio that is resilient to market shifts.

The evolution of crypto assets as a viable asset class for conservative portfolios is not just imminent — it’s already here.

Disclaimer: This article was updated on March 7, 8:00AM EST to note that Fidelity Canada, not Fidelity Investments, added bitcoin to its “conservative all in one” portfolio.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.