Cheatsheet: Bitcoin open interest at all-time high amid price rally

Crypto is fast and it’s only getting faster as bitcoin threatens to retest its own highs set more than two years ago

Art by Crystal Le

This is Cheatsheet, a primer on what you should know about crypto today.

Bitcoin is back to prices last seen during the heat of the last bull market in 2021 — rising to $56,500 after rallying 10% in the past 24 hours.

Now a $1.1 trillion asset, bitcoin (BTC) has more than doubled in price since October. It makes up about half of the total crypto market.

Mainstream media outlets around the world are running stories about bitcoin’s current surge, which has put it only 18% shy of its $69,000 record high.

Dogecoin (DOGE) and Bitcoin Cash (BCH) have gained nearly 13% over the day, while bitcoin layer-2 Stacks (STX) shot up by 25%.

Ether (ETH) is otherwise up 6%, slightly less than solana (SOL) and avalanche (AVAX).

What’s happening on-chain

Uniswap is still the number-one gas guzzler on Ethereum, responsible for nearly 13% of all gas spent over the past 24 hours (as of about 5:00 am ET).

- Uniswap spent 628.17 ETH ($2 million), up more than 50% from Sunday’s 400 ETH ($1.3 million).

- Stablecoin Tether is second today with nearly $1 million in fees.

- Layer-2s zkSync Era, Arbitrum, Scroll and Optimism came next, altogether 457 ETH ($1.49 million).

Activity on Ethereum layer-2s is generally DeFi related: automatic market maker Maverick, perpetual futures DEX GMX, liquidity protocol iZUMi Finance and Uniswap are the most-used apps right now.

Solana users, on the other hand, are favoring DEX aggregator Jupiter and automated market maker Raydium. There were a similar number of NFT-related transactions through NFT standard Metaplex over the past week, according to Nansen.

Read more: Token extensions on Solana: Q&A with Solana’s head of strategy Austin Federa

Tron and Binance Smart Chain are, currently, mostly stablecoin networks. 90% of all TRX fees paid and burned came from Tether users, which has been the trend over the past year or so. Two-thirds of BSC activity is coming from its native USDT wrapper.

- Polygon PoS just passed 1 million daily active addresses for the first time in weeks, double from the start of the year (per Artemis).

- DEX volumes hit $5.44 billion yesterday, up 45% on Sunday and its highest since Jan. 12.

- Total value locked is now $87 billion, up 4% over the past 24 hours, although most can be attributed to surging token prices. Ethereum makes up $5 billion of that total.

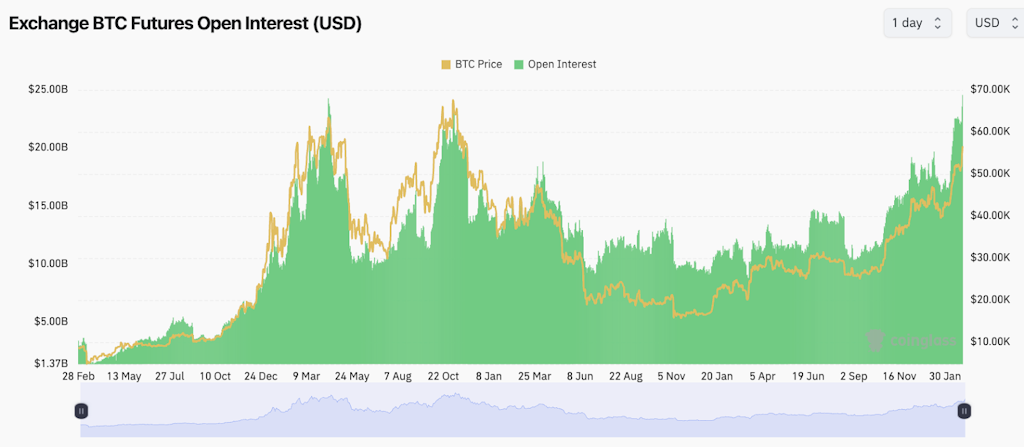

Meanwhile, bitcoin open interest is at all-time high with $24.55 billion (previous record: $24.27 billion in April 2021). Source: CoinGlass

Meanwhile, bitcoin open interest is at all-time high with $24.55 billion (previous record: $24.27 billion in April 2021). Source: CoinGlass

Crypto business

Bitcoin took crypto stocks along for the ride on Monday — some more than others. The S&P 500 and Nasdaq 100 fell slightly.

- Miners ClearSpark, BitDeer and Marathon Digital all pumped more than 20% yesterday.

- Coinbase and bitcoin accumulator MicroStrategy were middle of the road with 16%.

- No-longer bankrupt Core Scientific gained only 6.3%.

Bitcoin mining stocks are altogether now worth more than $25 billion, up from $8.6 billion in November, when bitcoin traded under $40,000.

Miner netflows (the difference between bitcoin flowing into miner treasuries and onto crypto exchanges) hit nearly 4,683 BTC ($265 million) in favor of the treasuries yesterday — the most since Jan. 31.

But already this morning, those flows have skewed towards exchanges: 4,418 BTC ($250 million) for the day so far, per CryptoQuant.

Netflows to exchanges indicate potential profit taking from miners (and who can blame them?).

Read more: The next bitcoin halving is coming. Here’s what you need to know

The total number of bitcoins held by miners has dropped by less than 1% over the year to date, although the shrinkage accelerated somewhat after prices started going up in October.

Still, miners hold more than 1.82 million BTC ($103 billion) — about 10% of the circulating supply. US-listed spot bitcoin ETFs are sitting on bitcoin equal to about 40% of miners’ treasuries.

- MicroStrategy is 79% up on its bitcoin, turning $6 billion into nearly $11 billion (and it just bought more).

- Tesla is up 63%, assuming it still holds the 9,720 BTC ($550 million) in its latest disclosure.

- Similarly, El Salvador is presumably up 33%, or $40 million, on bitcoin bought by president Nayib Bukele, after holding through a sustained period in the red.

On the ground

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.