Bitcoin Steady Before Options Expiry: Markets Wrap

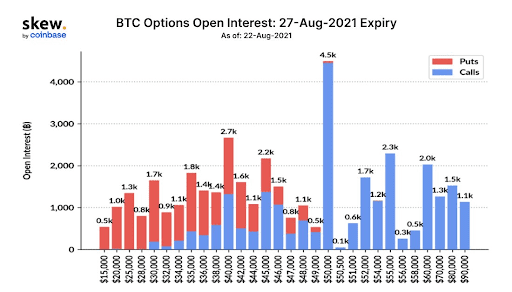

At the $50,000 strike price, there is a huge open interest in bitcoin options expiry on Friday.

Source: Shutterstock

- Osprey Funds registered a Solana (SOL) fund with the SEC, potentially making it the first private Solana investment offering in the US

- Citigroup may give clients crypto exposure, potentially allowing them to trade bitcoin futures contracts on the CME

Bitcoin is steady with little gains ahead of Friday when roughly 25% of the asset’s options open interest is set to expire.

Bitcoin is trading at $48,766.67, up 0.9% on-day. This comes two days after BTC benchmarked a three-month high, touching above $50,000 on Monday.

Investment manager Osprey Funds registered a Solana (SOL) fund with the Security Exchange Commission on Tuesday, making it the first private Solana investment offering in the US, Blockworks reported. Currently, Osprey offers clients three trusts: Osprey Bitcoin, along with investment offerings to access Polkadot and Algorand networks. Solana’s native token was little changed on the news, trading at $70.94 as of press time. Solana is the tenth largest crypto by market capitalization at $20.57 billion, according to Messari.

Alternative cryptos like Cardano’s ADA token shed 1.71% in losses after making its trading debut on Japanese exchange Bitpoint early Wednesday morning. This was the first time ADA traded in the country. ADA, the third largest crypto by market cap, traded at $2.73, as of press time.

Finally, Facebook is “definitely looking” into ways of adding non-fungible tokens (NFTs) in their digital wallet Novi, according to the company’s Financial Head David Marcus. Marcus said the financial product could be used to store NFTs, Blockworks reported.

DeFi

- Uniswap is trading at $26.96 with a total value locked of $4,776,030,042 declining -0.4% in 24 hours at 4:00 pm ET.

- Terra (LUNA) is trading at $29.71, shedding -5.7% with trading volume at $1,202,060,061 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 33.2% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $48,766.67, up 0.9% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,223.96, advancing 0.07% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.066, down -0.7% at 4:00 pm ET.

- VIX is down -3.77% to 17.16 at 4:00 pm ET.

Insight

“This cycle is very similar to the in 2017. A month ago this enabled a prediction that Bitcoin would cross $50k soon, which it has now done,” Cryptohopper CEO Ruud Feltkamp said in a note. “If this pattern continues, I think the price will go sideways in the next month or so before the fun will start and it’ll be up all the way.”

Equities

- The Dow was up 0.11% to 35,405.

- S&P 500 advanced 0.22% to 4,496.

- Nasdaq was up 0.15% to 15,041.

Currencies

- The US dollar fell -0.07%, according to the Bloomberg Dollar Spot Index.

Commodities

- Brent crude jumped to $72.15 per barrel, up 1.58%.

- Gold declined -0.9% to $1,792.30.

Fixed Income

- US 10-year treasury yields 1.342% as of 4:00 pm ET.

We are looking out for

- The now-virtual Jackson Hole Economic Policy Symposium begins on Thursday.

- US personal income and spending data will be released on Friday.

In other news…

Citigroup may give institutional clients access to cryptocurrency exposure, Blockworks reported. The global bank is considering trading bitcoin futures contracts on the Chicago Mercantile Exchange after other financial institutions like JPMorgan reportedly became the first bank to allow its financial advisors to give their wealthiest clients access to crypto funds.

Insight

“I expect that traditional Wall Street will try to get creative on how to benefit from crypto without diving in head-first,” David Tawil, president of ProChain Capital, previously told Blockworks. “It’s more likely that they will be forced [rather] than take the initiative.”

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.