Bitcoin’s mission to flip gold demands one last 10x

If silver and gold both trade flat, bitcoin would need to hit $96k to eclipse silver and $910k to surpass gold

Rost9/Shutterstock modified by Blockworks

This is a segment from the Empire newsletter. To read full editions, subscribe.

Bitcoin’s value can be boiled down to one specific quality: accountability.

We know precisely how many bitcoins have been mined at any point in time. We also understand which addresses have access to those coins, as well as how long they’ve been held without moving.

What we don’t know is how many coins are lost forever — BTC tied to private keys that have been destroyed, misplaced or otherwise not passed on after death and so on.

Some estimates suggest around 20% of all BTC won’t ever move again, the equivalent of 3.7 million BTC ($318 billion).

We’ll never uncover the private keys for all those coins, but we will always know exactly where they’re sitting onchain.

The same can’t be said for gold and silver. World Gold Council reckons 212,582 tonnes of gold had been mined across all of history as of the end of last year.

Of that, 45% of it has been made into jewelry, 22% in bars and coins, 17% held by central banks and the rest is scattered across the world in various other forms.

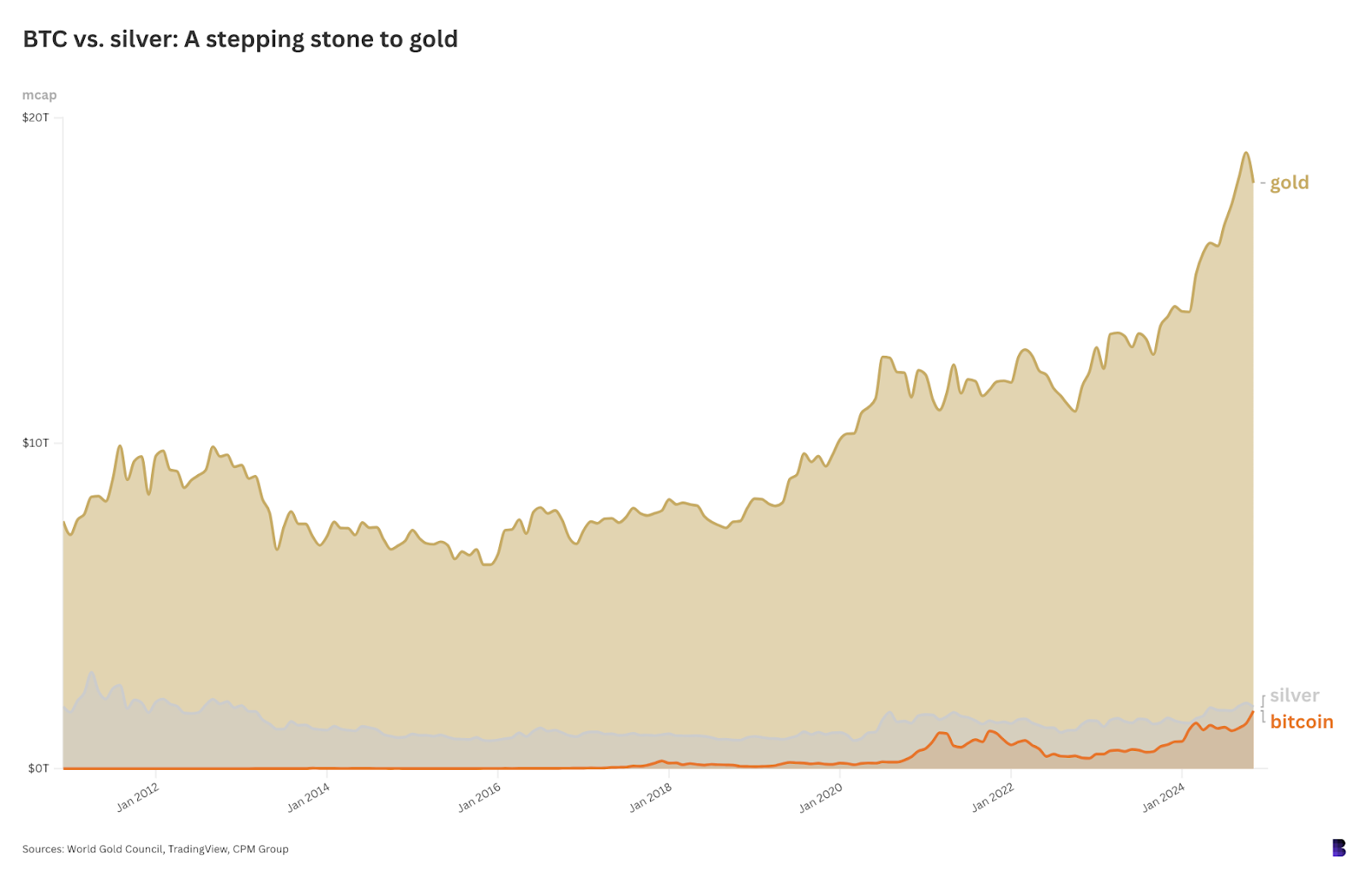

Based on those figures, the total value of mined gold (analogous to circulating supply) is about $18 trillion. But who knows how much of it is readily available to be brought to market.

Data for total above-ground supplies for silver is similarly vague. InfinteMarketCap, which tracks all assets against each other, goes by the 2019 CPM Group Silver Yearbook, which says that 1.751 million metric tonnes of silver have been mined to date.

Permanently flipping silver will be a milestone for bitcoin

Permanently flipping silver will be a milestone for bitcoin

At current prices, that would put silver’s market cap at nearly $1.9 trillion — almost $200 billion higher than what InfiniteMarketCap shows right now, putting it ahead of bitcoin.

But again, just how much silver is really out there is an unsolvable mystery. For what it’s worth, a gold blog (probably biased) in 2021 sized silver, within the context of the financial market, at only $108 billion, having removed all silver used for industrial purposes and jewelry from its estimates.

That would make silver much, much smaller than bitcoin, which is today at $1.8 trillion. But going by the same loose definitions that award gold an $18 trillion value, silver is still bigger than bitcoin — but only just.

So, what would it take for bitcoin to flip both silver and gold? The moon math says bitcoin would need to hit $96,000 to eclipse silver — if it trades flat from here — and $910,000 to surpass gold.

There you have it: a single 10x is the goal.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.