BlackRock’s bitcoin ETF team has met 5 times with the SEC

Pooling BlackRock’s meetings with the rest of the ETF hopefuls, the agency has met 24 times with applicants

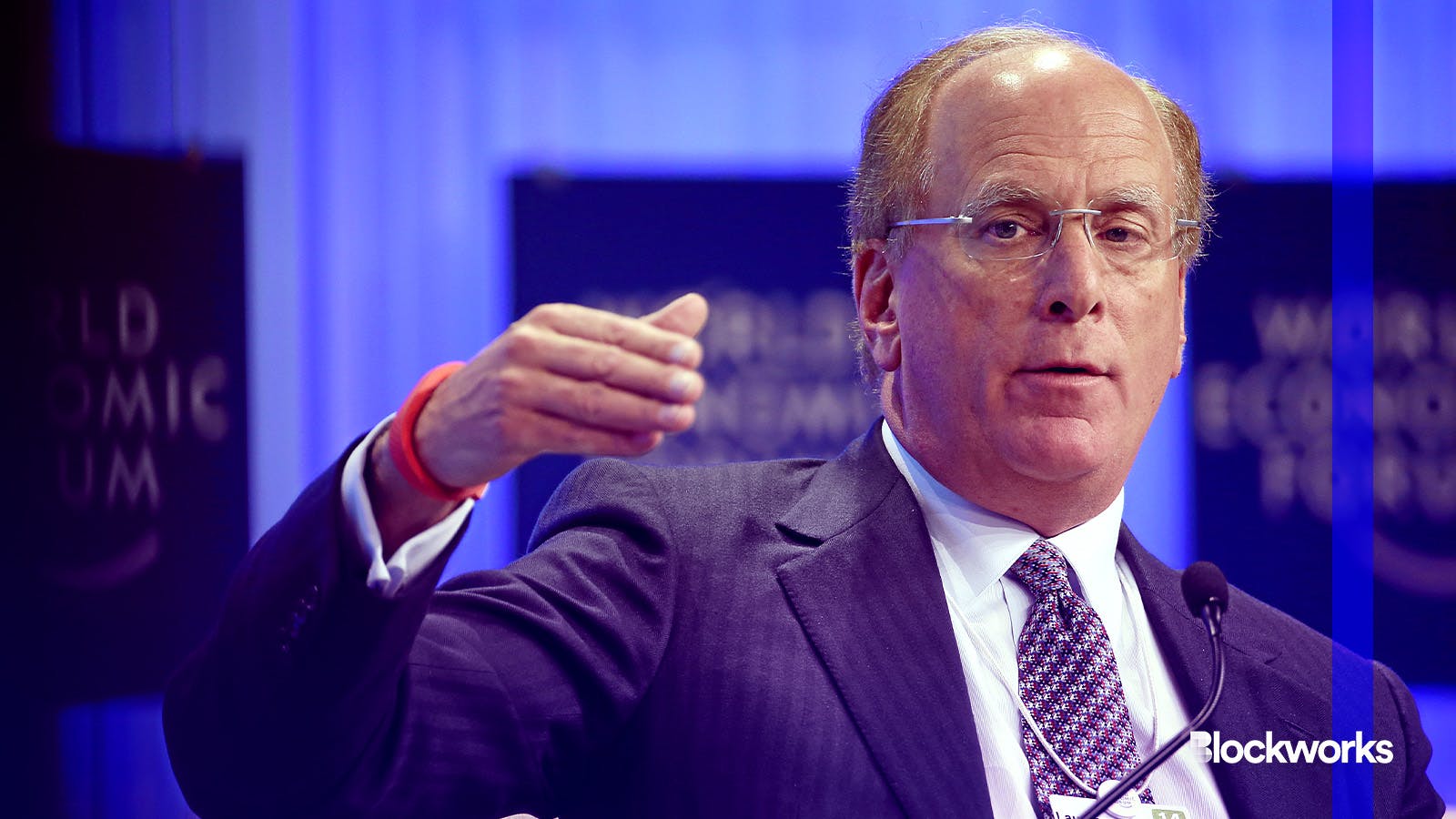

BlackRock CEO Larry Fink | Jolanda Flubacher/"Global Economic Outlook 2014: Laurence Fink" (CC license)

BlackRock has been busy this holiday season.

The asset management giant is one of more than a dozen fund groups vying to launch a spot bitcoin ETF. The applicants for such funds have so far met 24 times with officials at the US Securities and Exchange Commission, according to data from Bloomberg Intelligence analyst James Seyffart.

The SEC, BlackRock and Nasdaq most recently discussed the company’s planned spot bitcoin ETF on Dec. 19.

BlackRock is one of a few issuers planning to list shares of its bitcoin ETF on Nasdaq. The iShares Bitcoin Trust, if approved, would trade under the ticker IBIT.

Read more: Lucky 13? Where spot bitcoin ETF proposals stand ahead of judgment day

Ahead of the Tuesday meeting, BlackRock updated its S-1 for the proposed ETF. CryptoSlate first reported that the amendment included six changes — far less than the 21 changes it made in its prior filing.

Various fund issuers have discussed with the SEC in-kind and cash creation and redemption models for their planned bitcoin ETFs, meeting memorandums in recent weeks show.

With in-kind transactions, authorized participants exchange ETF shares for a corresponding basket of securities that reflects the ETF’s holdings. The other method is participants creating and redeeming shares in exchange for cash.

Read more: The SEC continues meeting with bitcoin ETF hopefuls. Here’s what they’re discussing

BlackRock’s potential ETF, like many others, would feature cash creations and redemptions, a change the SEC seems to have pushed for, based on other proposal amendments. A spokesperson for the regulator has declined to comment.

But BlackRock, according to its S-1, seems to be keeping the option open for in-kind transactions down the line.

“These transactions will take place in exchange for cash. Subject to The Nasdaq Stock Market receiving the necessary regulatory approval to permit the Trust to create and redeem Shares in-kind for bitcoin, these transactions may also take place in exchange for bitcoin,” the firm’s amended filing states.

Bloomberg Intelligence analyst Eric Balchunas said in a November X post the agency was “advising” the potential bitcoin ETF issuers that they want to do cash creates.

Balchunas also said that the SEC wants the cash transaction model because “this means only the ETF issuer handles [bitcoin] and not the intermediaries (registered broker dealers can’t).”

The latest meeting marks the third such meeting in seven business days, though the two have held a total of five meetings since November.

All eyes are on the world’s largest asset manager, which manages roughly $2.5 trillion in its US ETFs and has only ever had one proposal declined by the SEC. While this is BlackRock’s first try at a spot bitcoin ETF, others — including Ark Invest — have failed in previous attempts.

Read more: Bitcoin ETF saga reaches ‘pattern break’ as amendments pile up

An approval could come as soon as early January, with Bloomberg Intelligence analysts expecting a decision from Jan. 5 to Jan. 10. The latter date is the SEC’s deadline to rule on the proposal by Ark Invest and 21Shares.

Industry watchers have said they expect the regulator could decide to approve or deny multiple bitcoin ETF applications by Jan. 10.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.