Blur NFT Volume Beats OpenSea Again, With 30% of the Traders

An airdrop scheme and impending token launch are likely fueling NFT activity on Blur, putting OpenSea in second place once more

Shutterstock.com/ilikeyellow, modified by Blockworks

Upstart NFT marketplace Blur continues to outstrip incumbent OpenSea as anticipation grows for its token launch next week.

The Ethereum-based protocol, geared towards seasoned traders, was only launched in October but it already boasts a 46% slice of the total weekly market share against OpenSea’s 36%.

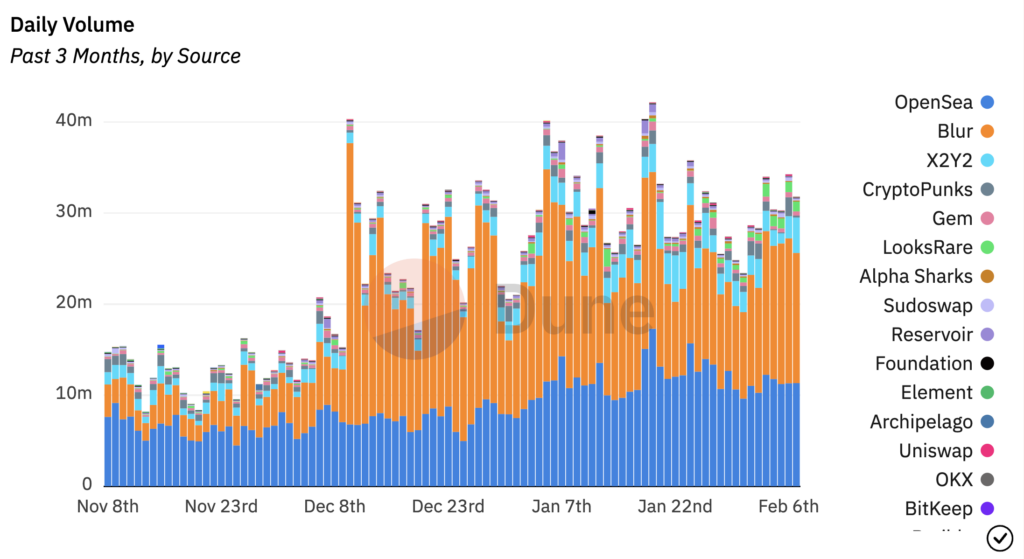

Blur has topped daily trade volume across the NFT sector every day throughout February so far, averaging roughly $14.3 million compared to OpenSea’s $11.3 million, per a Dune Analytics dashboard.

Blur’s trade volumes also eclipsed OpenSea throughout early January and for most of December.

OpenSea, launched in December 2017, has historically dominated the NFT segment. Blur still lags behind OpenSea based on number of trades, rather than by monetary value of trade volumes.

Data indicates that Blur boasts a smaller group of highly dedicated traders processing large amounts; the same dashboard shows 33,540 Blur traders over the past week compared to OpenSea’s 116,278.

Trade volumes on both OpenSea and Blur have grown, but Blur’s has grown faster (source Dune user @hildobby)

Trade volumes on both OpenSea and Blur have grown, but Blur’s has grown faster (source Dune user @hildobby)

Unlike OpenSea, which is a straightforward NFT marketplace, Blur also acts as a marketplace aggregator, allowing its users to trade NFTs on a variety of platforms via a single portal, including its own.

Blockworks previously reported that Blur’s boom is likely inspired by the upcoming launch of BLUR, set for Feb. 14, alongside its third and final airdrop for points which can eventually be redeemed for the token.

BLUR will serve as the platform’s native cryptocurrency. The specific functions of the token remain largely unknown though indications suggest it will play a role in governance.

Blur airdrops to be swapped for crypto

Blur is powered by a team of engineers from the likes of Square, MIT, Brex, Five Rings and YCombinator. It raised $11 million in early-stage funding last March.

The team has been busy preparing its token launch, with its supply to be initially distributed through airdrops marketed as “care packages” for users who’ve actively traded NFTs.

In order to claim the drops, traders were incentivized to list NFTs for sale on Blur.

A similar approach was implemented for the second airdrop. Blur’s final airdrop, which has run from early December, is pegged to distribute more than twice the number of care packages.

Users are instead earning reward points based on their NFT bidding activities.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.