BTC and ETH Trade Sideways After Yesterday’s Sell-off: Markets Wrap

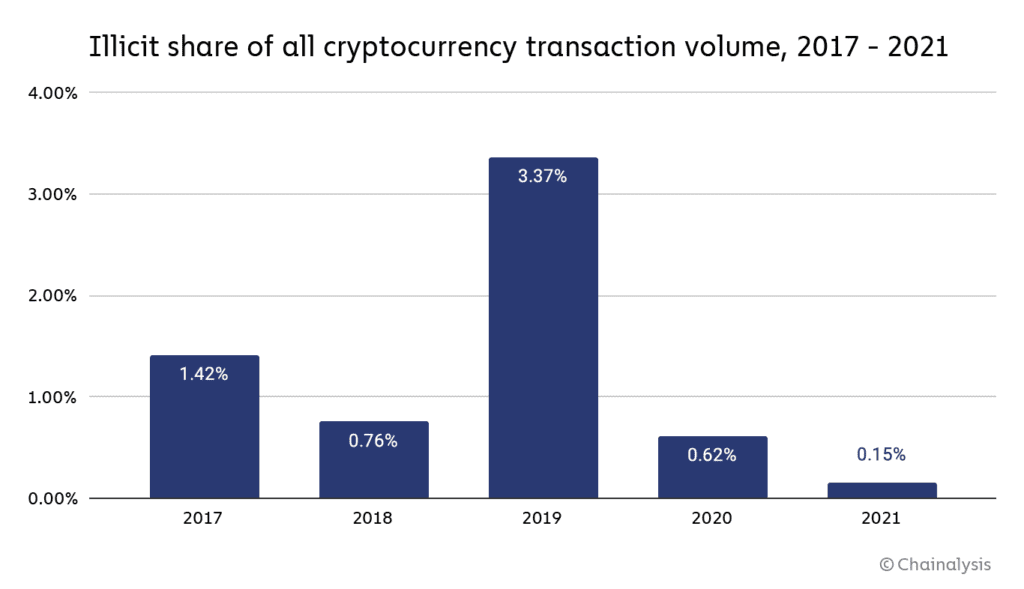

Illicit activity makes up 0.15% of crypto transaction volume

Blockworks exclusive art by Axel Rangel

- Digital assets trade sideways after yesterday’s sell-off

- Illicit activity makes up .15% of crypto transaction volume

Risk assets sell-off as bond yields rally.

BTC and ETH trade sideways after yesterday’s sell-off.

Illicit activity makes up .15% of crypto transaction volume.

Latest in Macro:

- S&P 500: 4,696, -0.10%

- NASDAQ: 15,080, -0.13%

- Gold: $1,788, -1.19%

- WTI Crude Oil: $79.47, +2.08%

- 10-Year Treasury: 1.73%, +0.027%

Latest in Crypto:

- BTC: $43,221, -0.10%

- ETH: $3,436, -2.50%

- ETH/BTC: 0.0793, -2.51%

- BTC.D: 39.60%, -0.31%

Bond yields rally

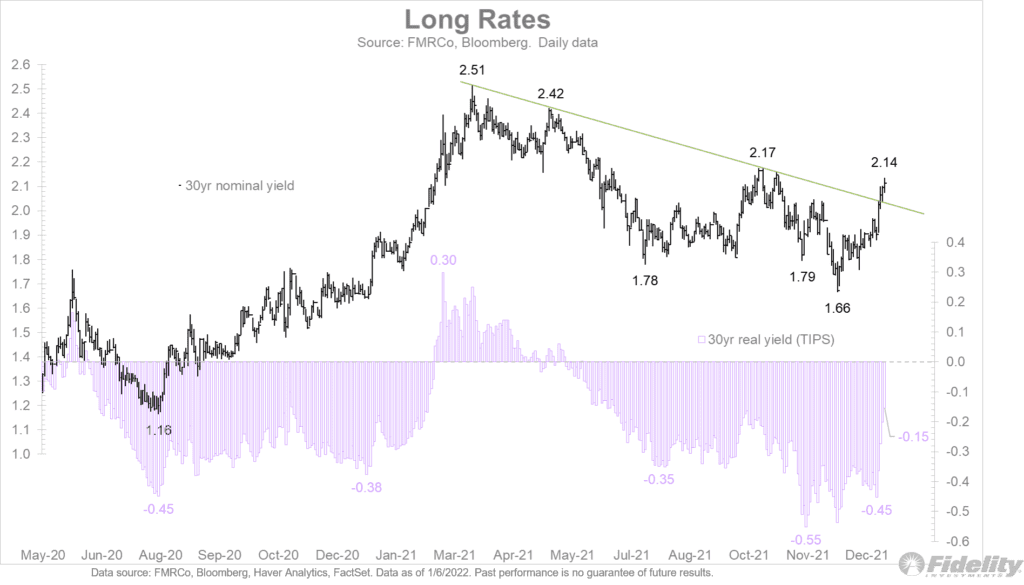

Jurrien Timmer, director of global macro at Fidelity, wrote, “The 30y TIPS real yield has jumped 30 bps in the last 4 days. Less-negative real rates could become part of the landscape during this Fed cycle, with implications for the liquidity highfliers and SoV (Store of Value) plays.”

Source: Fidelity

Source: Fidelity

The rise in rates likely comes as a result of the FOMC minutes released yesterday. “We are phasing out our purchases more rapidly because with elevated inflation pressures and a rapidly strengthening labor market, the economy no longer needs increasing amounts of policy support,” Powell said during a press conference in December following the conclusion of the two-day FOMC meeting.

The Wall Street Journal wrote: “They noted that current conditions included a stronger economic outlook, higher inflation, and a larger balance sheet and thus could warrant a potentially faster pace of policy rate normalization”.

BTC & ETH

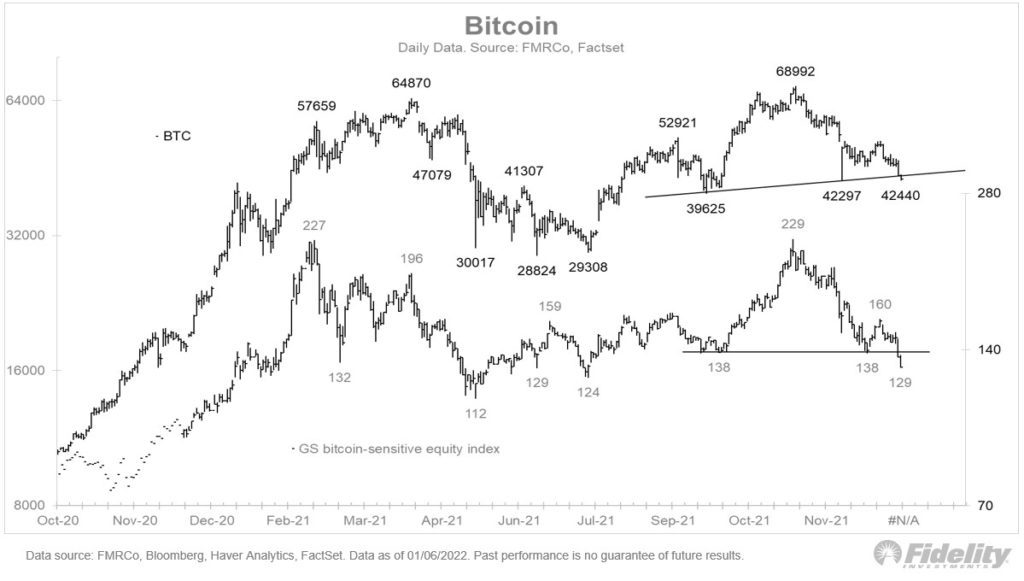

The rise in rates and news of tightening sent digital asset markets tumbling yesterday.

Timmer continued by adding, “I remain constructive on BTC & ETH over the long-term (and still see $100k as fair value for BTC in a few years based on my supply/demand models). But there is no denying that the short-term charts don’t look great”.

Bitcoin Fidelity

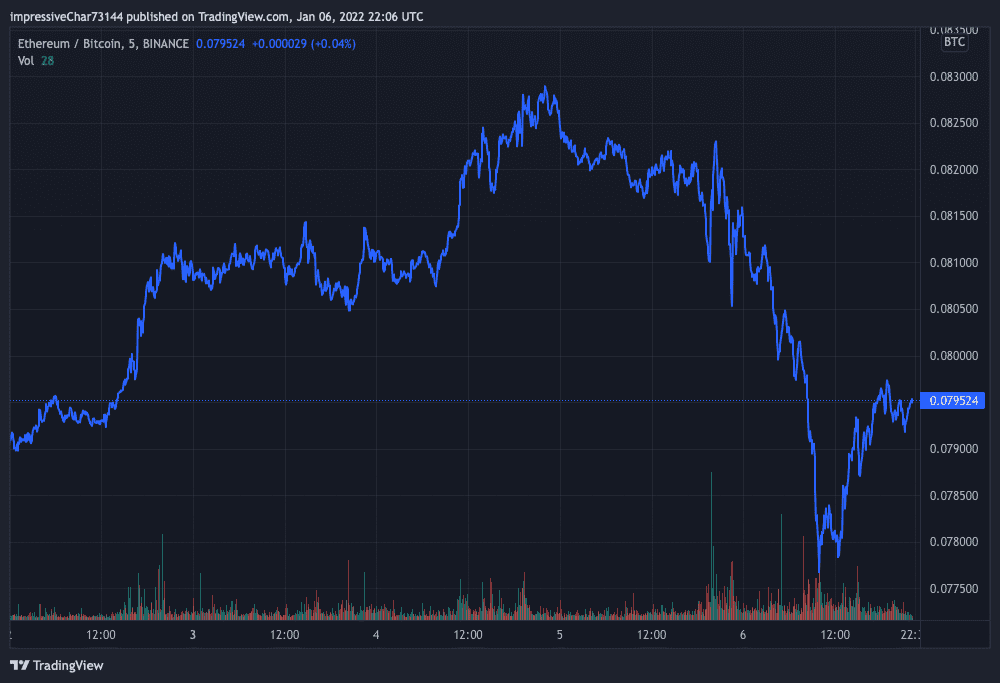

Bitcoin FidelityETH has begun to bounce back versus BTC after trading as low as $3,331 earlier today, according to data from CoinGecko. The ETH/BTC ratio was last hovering near .0795, according to Trading View, as it tries to reclaim its longer-term uptrend.

Crime in crypto on the decline

Illicit activity as a percentage of transaction volume has fallen drastically over the past five years, according to a Chainalysis report released today.

Source: Chainalysis

Source: Chainalysis“Across all cryptocurrencies tracked by Chainalysis, total transaction volume grew to $15.8 trillion in 2021, up 567% from 2020’s totals,” said Chainalysis. “Given that roaring adoption, it’s no surprise that more cybercriminals are using cryptocurrency. But the fact that the increase was just 79% — nearly an order of magnitude lower than overall adoption — might be the biggest surprise of all. In fact, with the growth of legitimate cryptocurrency usage far outpacing the growth of criminal usage, illicit activity’s share of cryptocurrency transaction volume has never been lower.”

NFTs

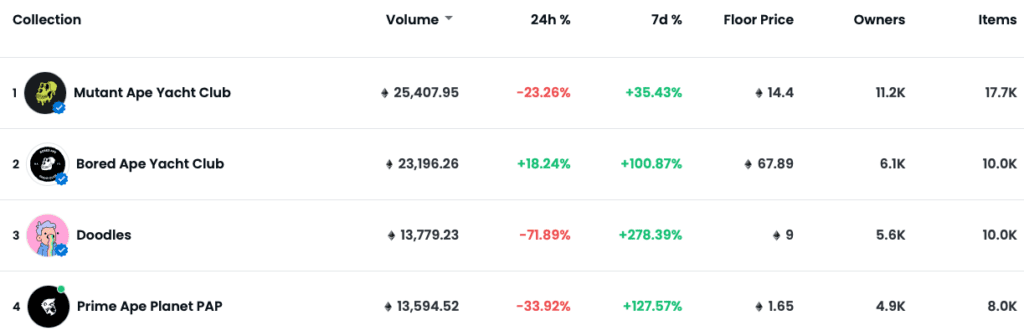

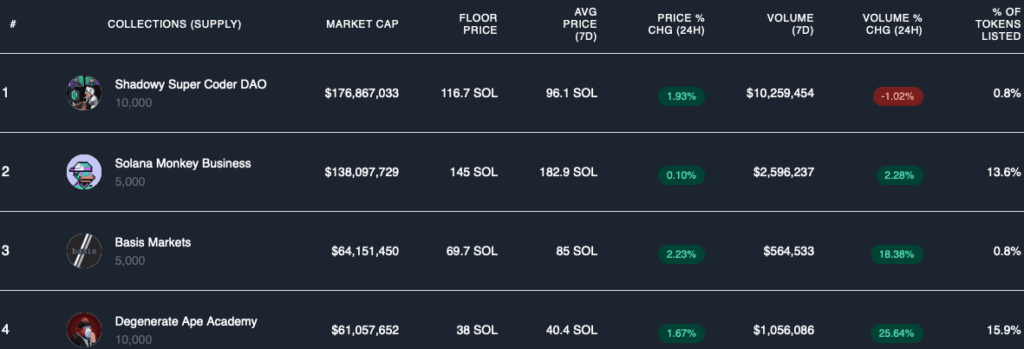

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.