ETH’s run vs. BTC: Finished, or early days?

Any indication the FOMC is less dovish than anticipated could weigh on crypto, industry watcher says

TY Lim/Shutterstock modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

We focused on bitcoin’s trajectory yesterday. But I didn’t want to leave out ether and how institutional interest in the asset has driven recent momentum.

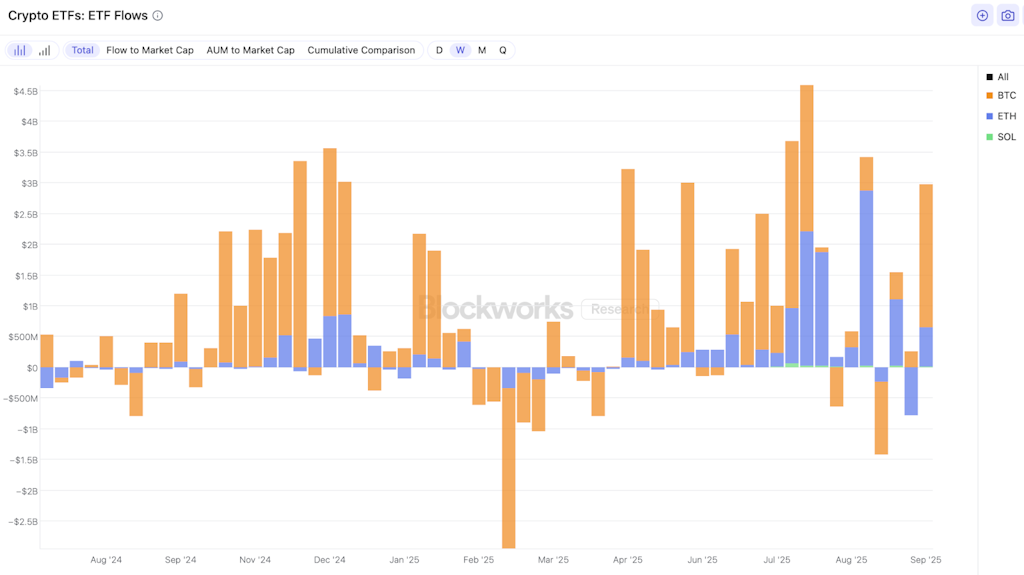

Just look at the pace at which companies are buying ETH and the simultaneous influx of capital into ETFs holding the asset, particularly compared to BTC.

US bitcoin ETFs last week restored order, so to speak — tallying about $2.3 billion of net inflows, compared to ~$640 million for ether ETFs. This is a turnaround from several recent weeks, during which ETH ETFs rather surprisingly welcomed the lion’s share of new money into crypto investment products.

Blockworks Research data shows how ETH ETF inflows surged in July and August — with those products seeing more inflows (or less outflows) than bitcoin ETFs for six straight weeks:

The ETH ETF inflows have come as several crypto treasury companies have been buying ether at scale.

Within roughly the same period as the ETH ETF inflow momentum, companies have bought more ETH than BTC in nine of the last 10 full weeks (we’re still early in the most recent week displayed):

Touting the largest ETH treasury is BitMine Immersion Technologies, which said Monday it now holds more than 2.1 million ETH (worth nearly $10 billion). It’s not hard to find BitMine Chair Tom Lee on television talking about ETH’s potential. For those who don’t know what television is, you can catch his CNBC interviews on the internet, too.

Of course, companies like BitMine and SharpLink Gaming are buying ETH itself, not the ETFs. So why exactly are we seeing the ETF inflows and corporate ETH buying coinciding?

It’s perhaps as simple as there being a clearer narrative for Ethereum now, Bloomberg Intelligence’s James Seyffart told me. He noted Tom Lee’s interviews as likely contributing to the demand.

“Combined with the fact that ETH bottomed and took off like a rocket ship and people are piling on,” Seyffart said. “Throw in the [digital asset treasury companies’] narrative and it’s all contributing to the price and flows for ETH and ETH ETFs.”

ETH holds the YTD return edge over BTC, 35% to 25%. Here’s what ETH price has done in the last month, as of 2 pm ET:

But bitcoin ETFs are likely to remain dominant in the flow category in the long term given their simpler proposition as a digital store of value, Seyffart added. Even with the recent ETH ETF momentum, global BTC products have the net inflow edge in 2025: ~$24 billion to ~$12 billion.

“That said, if [ETH] gets to a point where its market value surpasses bitcoin, it’s likely the ETF side of things would follow suit,” he noted.

Currently at $2.3 trillion for BTC and $540 billion for ETH, that would take a lot.

Near- and long-term ETH expectations

I’ve written how industry watchers expect a 25bps rate cut from the Fed tomorrow, given soft labor market data. Lower rates generally support risk assets like BTC and ETH.

That said, the bar for a positive surprise is now high, said LMAX Group’s Joel Kruger.

“With aggressive Fed easing already priced in, any indication that the committee is less dovish than anticipated could disappoint markets, lifting yields and weighing on equities and crypto alike,” he told me.

Longer-term, Hashdex CIO Samir Kerbage wrote that ETH’s role as “global plumbing” strengthens as infrastructure scales and tokenization explodes. He expects ETH to surpass $10,000 “once we start to see stablecoin solutions being implemented for US payments.”

As per usual, time will tell.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.