Cheatsheet: MicroStrategy has now outperformed Nvidia this year

DeFi users seem to suffer from itchy palms ahead of an anticipated run for ether to record highs

Sundry Photography/Shutterstock modified by Blockworks

This is Cheatsheet, a primer on what’s happening in crypto today.

Bitcoin just set another all-time high above $73,000, but It’s looking a lot like altcoin season.

That’s not to be confused with memecoin season: Multiple cryptocurrencies for various layer-1 networks have finally outperformed the dog tokens across multiple days.

Toncoin (TON) has extended its rally for a third day, again the star performer of the top 100 after gaining nearly 21% — now up by nearly two-thirds over the past week.

TON is now the 13th largest cryptocurrency by market cap, ahead of polygon (MATIC), chainlink (LINK) and tron (TRX). TON-powered trading bot BananaGun continues to burn more ETH than layer-2 Arbitrum and MetaMask, which signals higher on-chain activity.

THORChain (RUNE) has the rest beaten for weekly gains, however, after a 16.4% rally in the past day and has now more than doubled in seven days.

The network is built as a liquidity network for powering cross-chain token swaps. THORChain daily volume hit an all-time high yesterday of $639.6 million.

Bitcoin (BTC) is meanwhile up 1.5% and ether (ETH) is about flat and still 17% below its own price record, changing hands for $4,050 as of 7:45 am ET.

On-chain mail

Rising prices have DeFi’s total value locked (TVL) metric posturing to reclaim levels not seen since the Great Terra Implosion of 2022, now more than $104 billion. But dollar bias beware.

- Ethereum’s apps have felt slight net ETH outflows over the past month, losing about 80,000 ETH ($324.3 million).

- Layer-2s Arbitrum and Optimism have lost almost 15% of their ETH over the same period (nearly 205,000 ETH worth $830.5 million).

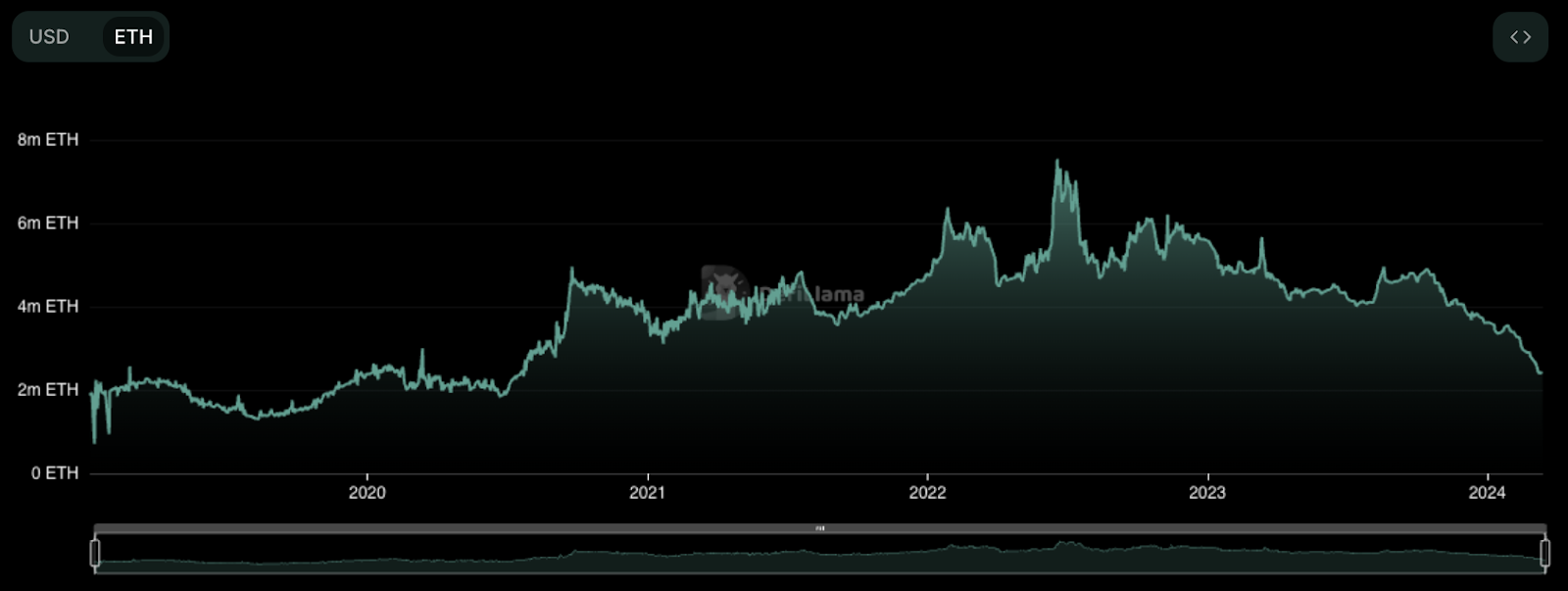

- Maker, the collateralized debt protocol behind DAI, has 25% less ether after losing about 770,000 ETH ($3.11 billion). Its dollar-denominated TVL is still up 15%.

The Maker situation, perhaps the result of rising popularity for liquid staking and restaking, has led to rate hikes and an “accelerated proposal” to prepare the protocol to meet anticipated demand for DAI with fewer deposits. Tron, Binance Smart Chain, Polygon and Avalanche apps have also seen net outflows denominated in native tokens, per DeFiLlama.

But not all networks are seeing the same trend. Solana apps now have more than 27% more SOL than this time last month — the equivalent of 4.81 million SOL ($731.6 million) — even as the price of SOL swelled 45%.

Solana derivatives DEX Jupiter and Parcl, a platform to gain leveraged exposure to real estate assets, have pulled in much of that SOL. Tron and Sui apps have also attracted more native tokens over the past 30 days.

Read more: Jito Labs ends mempool functionality citing impact on Solana users

- Ethereum’s degen-optimized layer-2 Blast is jostling to flip Optimism for TVL, both about $1.06 billion.

- That would make Blast the second-biggest Ethereum layer-2 after Arbitrum, which has more than three times the TVL.

- Blast lending app Orbit is the fastest growing DeFi app with more than $100 million TVL over the past week, popping from $88 million to $430.9 million.

MakerDAO’s ETH deposits have trended downward all year (source)

MakerDAO’s ETH deposits have trended downward all year (source)

Crypto business

A rarity in recent weeks: MicroStrategy wasn’t the best performing crypto-related stock over the past day, even with its 12.65% rally spread before and after the bell as of 7 am ET.

- Las Vegas-based bitcoin mining stock Gryphon Digital led with almost 16% gains (13.4% in the day session and 2.25% pre-market).

- Markets barely reacted to Coinbase’s $1 billion convertible note offering, with COIN set to open 0.5% higher.

- Ohio-based miner Griid lost almost 7%, followed by Core Scientific, which altogether shed 5.7% between the day and pre-market sessions, dragged by lackluster earnings.

Coinbase’s move to raise cash with convertible notes (a hybrid of debt and equity) may also raise eyebrows. The firm, by far the largest crypto stock on the market, already had more than $200 billion in liabilities as of the end of last year — up from $15 billion in 2021.

(For scale, Apple, valued at more than 40 times Coinbase, has $279.4 billion liabilities, while Intel has $81 billion.)

COIN’s long-term debt has meanwhile declined 12% year on year, now around $3 billion with $5.7 billion cash on hand.

Read more: Coinbase announces offering of $1B in convertible notes

- If CleanSpark loses more ground, Coinbase and MicroStrategy will be the only crypto stocks to beat the S&P 500 over the past month.

- MicroStrategy has now outperformed the buzzy Nvidia over the year to date — 133% to 91%.

- Tesla and Block are now up more than 100% on their bitcoin buys to date, joining MicroStrategy.

On the ground

Macauley Peterson contributed reporting.

Updated Mar. 13, 2024 at 8:45 am ET: Corrected year referenced for Coinbase liabilities.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.