Coinbase: Crypto Market Cap Up 86% YTD, Ethereum Passes Bitcoin on YoY Growth

In general, ethereum outperformed benchmark assets, including bitcoin in H1 with the crypto-asset appreciating 895% in the 12 month period compared to bitcoin’s appreciation of 280%

Blockworks exclusive art by Axel Rangel

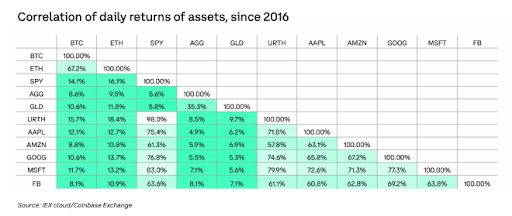

- Bitcoin continued to show low correlation to other benchmarks during the time frame. Its 12-month correlation was closest to ethereum’s daily returns at 67.2%, followed by the S&P 500 asset at a much lower 14.1% correlation, the data showed.

- Coinbase noted that many major ETF issuers believe the US SEC could give the “go-ahead” to the crypto ETFS in 2021 or 2022.

The first half of 2021 was one of the most active periods on record for crypto, said Brian Foster, a member of Coinbase’s Institutional Sales, Trading, and Prime Services team and Coinbase Ventures, in the company’s H1 2021 Review report.

The first six months brought in new all-time highs in asset prices, user adoption and trader activity, Foster said.

“Crypto saw continued price volatility — total market capitalization began the year at $769 billion, peaked at $2.4 trillion in May, and ended the period at $1.4 trillion, registering a net gain of 86% year to date,” he added.

At the end of the first half, bitcoin stored $657 billion in global wealth as institutional investors, such as traditional hedge funds, endowments and corporates increased their exposure over the period. Compared to other asset classes, bitcoin increased 280% in the last 12 months, even after declining from mid-April highs of about $64,000, according to the report.

As other assets also increased at lower percentages, bitcoin continued to show low correlation to other benchmarks during the time frame. Its 12-month correlation was closest to ethereum’s daily returns at 67.2%, followed by the S&P 500 asset at a much lower 14.1% correlation, the data showed.

Ethereum outperforms

In general, ethereum outperformed benchmark assets, including bitcoin in H1 with the crypto-asset appreciating 895% in the 12-month period compared to bitcoin’s appreciation of 280%. Ethereum rose about 210% over the 6-month period ending June 30, the data showed.

A handful of factors contributed to ethereum’s outperformance, mainly increased usage of decentralized finance protocols built on Ethereum, which validated the network’s value as a global financial utility and platform for developers alike, the report wrote.

Additionally, investor optimism grew as Ethereum’s transitions to ETH 2.0, which will introduce a new proof-of-stake consensus to turn ethereum into a yielding asset, and the launch of EIP-1559, which is expected to decrease the supply of ethereum by burning its gas fees as the network is used.

Overall, the first half of 2021 brought ethereum’s five-year performance total return to 17.962% for the period. Many of Coinbase’s large institutional clients — including hedge funds, endowments and corporations — increased or added first-time exposure to ethereum during that time period as they believe the asset has long-term power equivalent to bitcoins, just in a differentiated way in their portfolios, it said.

ETF outlook

Many new applications for ETFs have been filed with the US Securities and Exchange Commission in recent months from firms like Global X, Ark Investment Management, VanEck and investment banking company Goldman Sachs.

Over a dozen applications to list a bitcoin ETF have been knocked down by the US SEC in the past on the basis of exchange rules “designed to prevent fraudulent and manipulative acts and practices, to protect investors and the public interest,” said the report.

But, Coinbase’s institutional practice monitored developments in the crypto exchange-traded fund market and said it expects an eventual US crypto ETF approval, but did not clarify when. It also noted that many major ETF issuers believe the SEC could give the “go-ahead” to the crypto ETFS in 2021 or 2022.

“There are a number of factors driving this optimism,” the report said.

The new chairman of the SEC, Gary Gensler, is seen as a knowledgeable person in the crypto space and more likely than previous chairmen to allow a crypto ETF to list. Additionally, desire for cryptocurrencies have boomed recently among both institutional investors and retail investors, with growing demand for exposure without the need to directly buy, hold or sell underlying assets.

While the market is continuously changing, Coinbase’s report said a growing base of well-known institutions have begun to engage with crypto and the regulated bitcoin futures market has grown substantially over time, giving the industry more credibility. In regards to growth, the CME’s monthly notional trading volumes increased from $6 billion in June 2020 to over $34 billion in June 2021, up over 466% year on year.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.