Crypto Exchange Injective Pro Rolls Out BAYC Perpetuals Amid Heated NFT Market

Injective’s NFT floor price perpetuals will allow investors to speculate on the direction of the frothy Bored Ape project

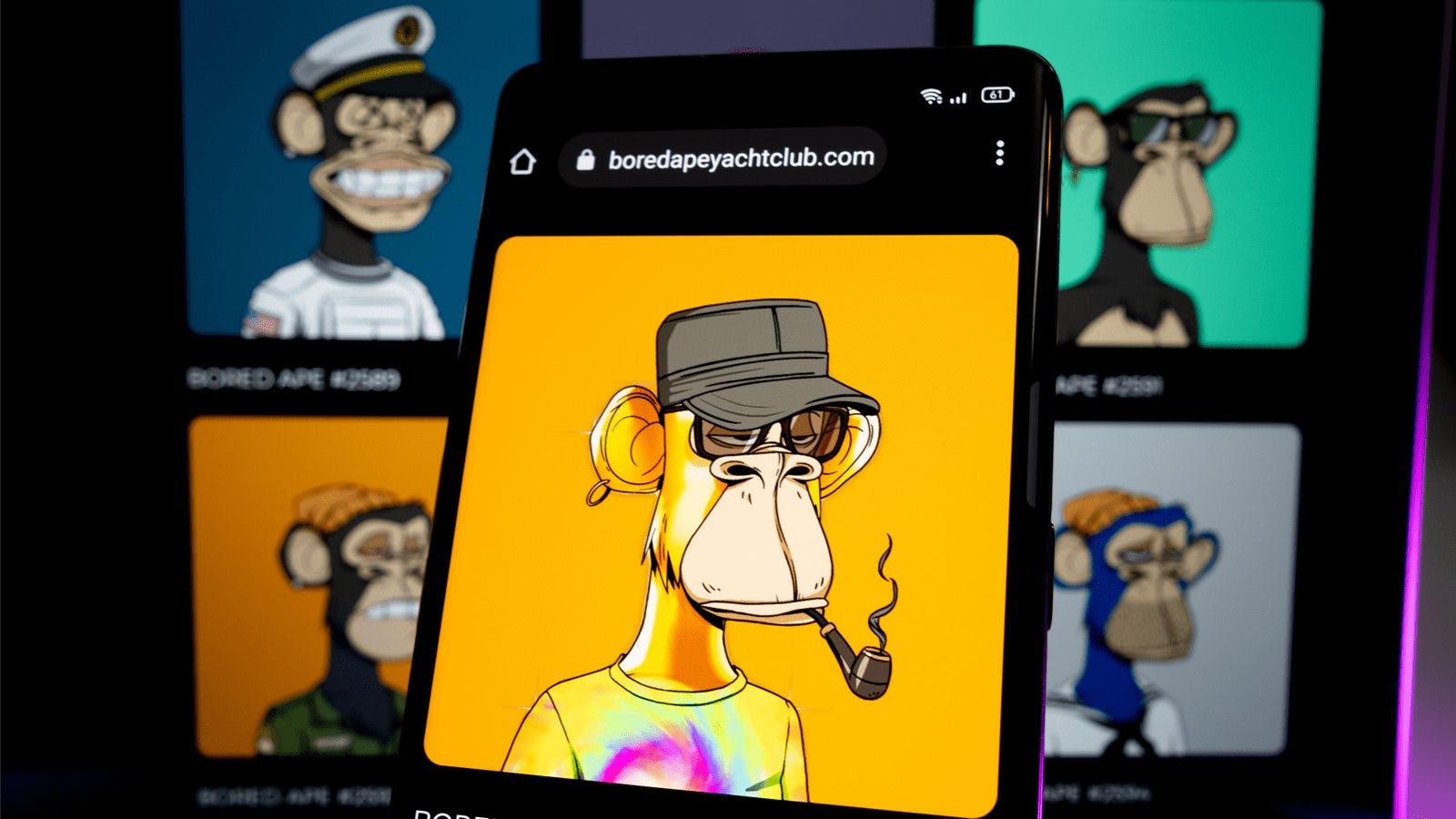

Bored Ape Yacht Club | Source: Shutterstock

- The exchange said it wants to lower the barrier to entry for investing in high-value NFTs through crypto perpetuals

- The contracts will allow investors to bet on the direction of NFT projects, starting at $1

Crypto derivatives exchange Injective Pro said Thursday it has listed perpetual contracts based on Bored Ape Yacht Club NFTs in a bid to make them more accessible to the average investor.

The exchange also said it was the “first-ever” to bring an NFT (non-fungible token) floor price perpetual to market via its BAYC listing, according to a statement.

Crypto perpetuals are a form of derivative agreement allowing investors to purchase or sell a digital asset for a specified amount at an unspecified point in the future. They differ from futures contracts in that they allow an individual to hold onto the contract indefinitely.

Demand for NFTs has soared in recent years. Minted on the Ethereum blockchain, Bored Ape NFTs — founded by parent company Yuga Labs last year — have continued to ride the fervor of speculation, pushing prices beyond the reach of many investors.

The minimum price for a single Bored Ape NFT for immediate purchase stands at 127.7 ETH, or roughly $378,000, according to the project’s floor price listed on marketplace OpenSea.

Injective Pro’s latest perpetuals will attempt to lower the barrier to entry by providing retail investors a means to speculate on the floor price of NFT collections without the need to custody the underlying asset.

“Just like NFTs, we believe that with an intuitive product and education on the true value of an NFT floor perpetual market, users will be able to benefit from this innovative technology, without needing to know all the intricacies of how perps work,” Injective Labs CEO Eric Chen told Blockworks.

Users will be able to execute long or short positions of a particular NFT project starting at $1. This would allow more users to gain exposure to high-value assets or hedge against NFT market volatility, Injective said.

“NFTs are still in a stage in which price points are stopping many people from joining these communities,” Chen said. “That is why we chose BAYC as the first project to list in an NFT floor perpetual market on Injective Pro. We wanted to lower the barrier to entry to join projects that people do understand the value of, yet at the same time, are blocked to enter because of price.”

Injective Pro, which is the first major decentralized application built on the Injective blockchain, offers cross-chain margin trading, derivatives and forex futures trading, including perpetuals.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.