CZ is now crypto’s number one influencer

The successes of BNB and Aster have something in common

Binance co-founder Changpeng Zhao | Web Summit (CC BY 2.0), reaction vectos by Ka Han/Shutterstock, Saint Stanislaus by Jan Długosz (1530s), modified by Blockworks,

Whether CZ is “officially” back at Binance is besides the point. Tokens in his orbit have rallied hard — and the common denominator is CZ’s $10-billion family office, YZi Labs, formerly Binance Labs.

BNB continued its rally to set a new all-time high at the start of this week, reaching close to $1,100 for the first time ever to bounce off a $150-billion market cap.

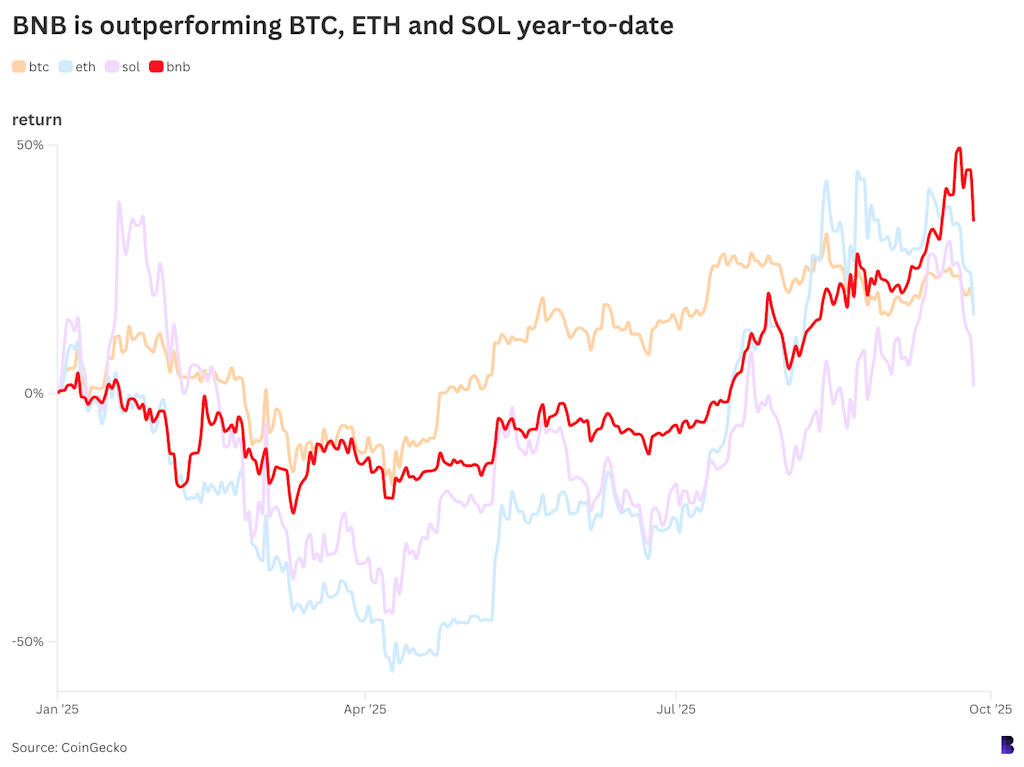

And if you compare its chart to BTC, ETH and SOL, it’s clear that at least until recently, BNB had kept up momentum where others have stalled.

BNB was trending up while BTC and ETH went sideways — before the recent correction.

BNB was trending up while BTC and ETH went sideways — before the recent correction.

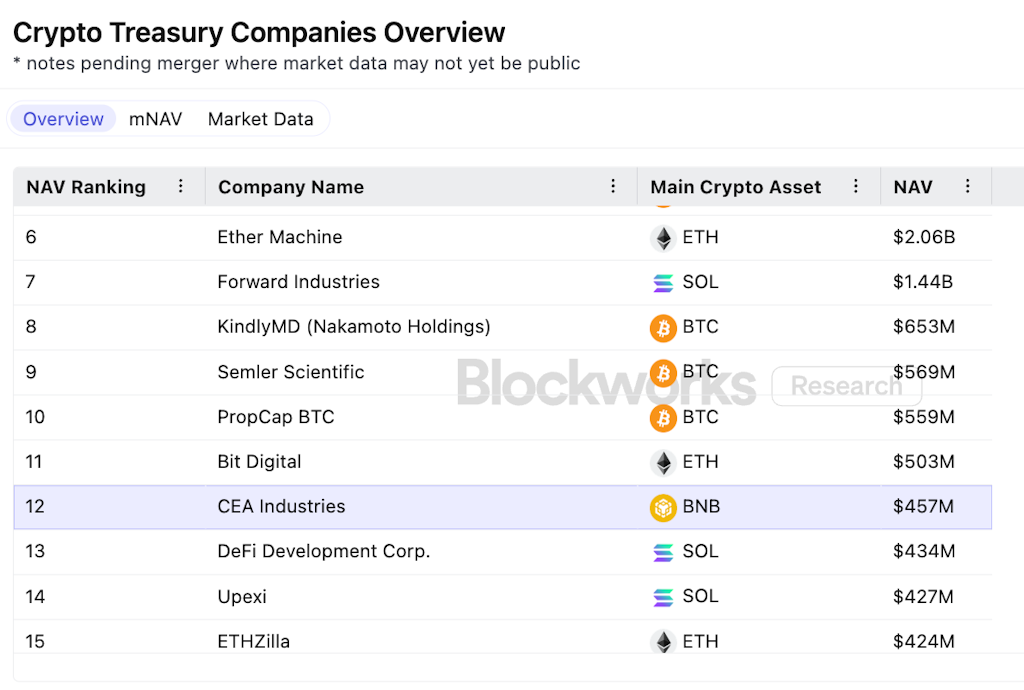

For sure, two well-timed announcements for BNB treasury companies had something to do with that. But only CEA Industries via its asset management arm BNB Network Company is active right now, and it’s accumulated BNB worth a little over $420 million per Blockworks Research data so far.

CEA Industries is currently 12th by NAV ranking, per Blockworks Research data, behind Bit Digital, which accumulates ETH.

CEA Industries is currently 12th by NAV ranking, per Blockworks Research data, behind Bit Digital, which accumulates ETH.

No doubt that’s a solid stack, but it’s only a fraction of a percent of BNB’s circulating supply.

Is that really why BNB is up?

A real Aster-oid

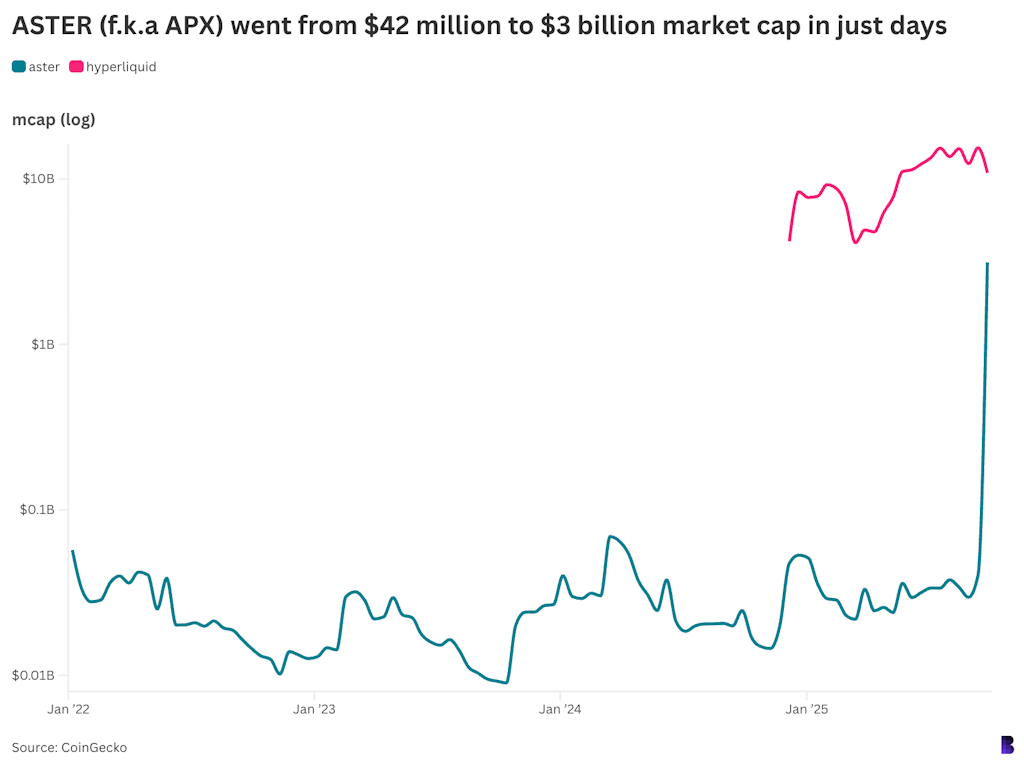

Meanwhile, ASTER, the token tied to the newish perps DEX of the same name and backed by CZ’s YZi Labs, rocketed to its own price record almost simultaneously with BNB.

ASTER then followed through with an even higher one a few days later when it skirted a $3.9 billion market cap.

Aster has been deployed across multiple chains but the majority of its activity is so far concentrated on BNB Chain. It offers up to 1001x leverage and looks like the number one perps DEX by volume over the past seven days, according to DeFiLlama, posting $101.7 billion compared to Hyperliquid’s $64.6 billion as of earlier today.

Hyperliquid only supports up to 40x leverage, but the real differentiator is likely Aster’s humongous points campaign that promises to distribute 50% of ASTER’s entire supply via airdrops to users.

“Traders accumulate points through metrics such as trading volume, position holding time, referral activities, team boosts, using Aster’s asBNB and USDF as margin, and on every profit or loss realized during the event. Stage 2 kicks off immediately, setting the stage for token distribution in Q4 2025,” per a promo from earlier this month.

The straight line up coincided with the ASTER TGE and a string of bullish tweets from CZ.

The straight line up coincided with the ASTER TGE and a string of bullish tweets from CZ.

Aster is the result of a March 2025 merger between liquidity hub Astherus and decentralized exchange APX Finance, which launched in early 2022. The APX token was recently rebranded as ASTER, and existing APX holders could redeem their tokens for ASTER at a 1:1 ratio as of last week, when the new token was created.

The chart above stitches the APX token’s original trading history with the new ASTER token, and plots it against Hyperliquid’s HYPE, in log view.

Still, there are real concerns about the concentration of ASTER’s supply and the impact that influencer whales have had on its price action. CZ has cheered on more attention-grabbing interactions — like MrBeast’s apparent ASTER trades.

CZ beyond BNB

Impressive for CZ, who in only February had never before used a decentralized exchange, automated market maker or liquidity pool.

“Dex is so much harder to use… 😂 … 27 minutes to do a test buy… Still haven’t figured out how to add to the liquidity pool. And you have to do this while they are all watching on the blockchain. 😆,” he tweeted.

Of course, CZ can be forgiven for not trading on the BNB Chain before this year. He builds teams and ships products — that’s his thing.

Aster’s sudden rush to prevalence only goes to show that for the first time outside of the BNB context, CZ has demonstrated his raw power to move markets as a Key Opinion Leader (KOL).

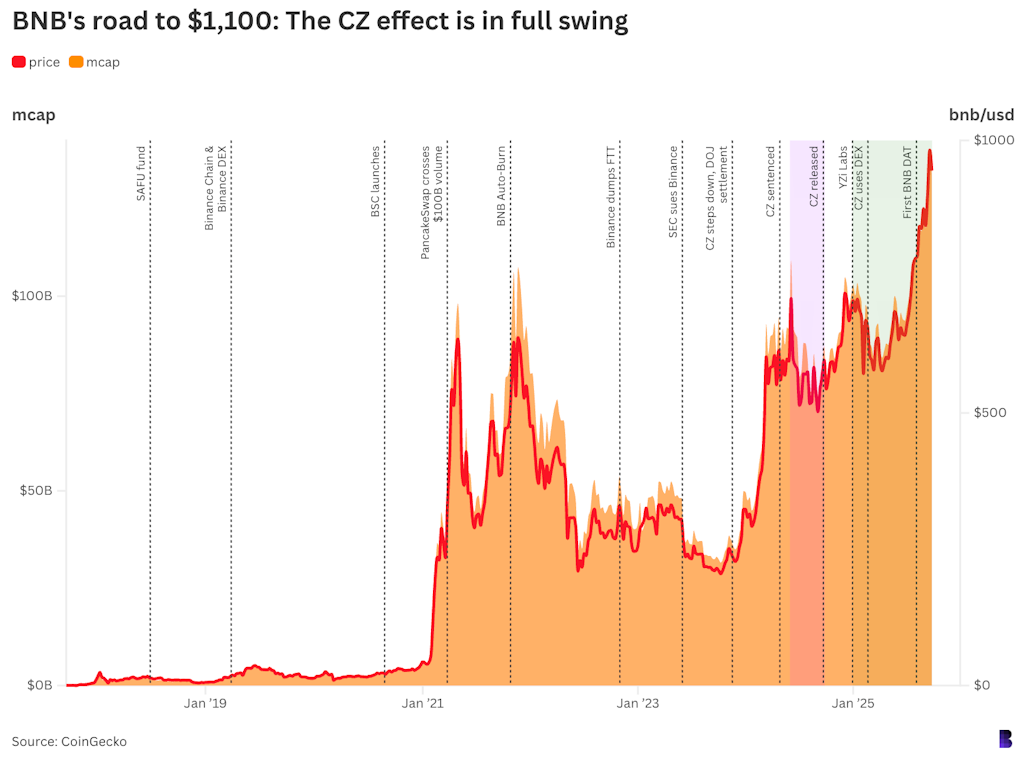

There were signs: The chart below pinpoints milestones across BNB’s entire trading history. Notice that prices went down while CZ served his brief prison sentence over Binance’s lax KYC/AML practices, as shown by the shaded purple area on the right hand side of the chart.

The green area shows where CZ officially became active again via his family office.

The green area shows where CZ officially became active again via his family office.

But BNB went up significantly on his release, and following a brief correction around the time that Binance Labs transformed into CZ’s family office, the major uptrend continued along with YZi Labs’ funding of the first BNB DAT.

Meanwhile, a second DAT, B Strategy, which is also funded by YZi Labs, is currently pushing to raise $1 billion to fund its own BNB buys — double the capital already earmarked for BNB Network Company.

All this adds up to one uncomfortable point: ASTER’s miraculous debut suggests that crypto has not seen such a powerful influencer as CZ since Do Kwon, with Terra, or Sam Bankman-Fried with FTT and SOL. At least, that’s outside of Michael Saylor and his impact on Bitcoin.

Please, let this be the time that history does not repeat itself. Or rhyme.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.