Empire Newsletter: ETH could debut on Wall Street this month

Plus, German and American government are dumping hundreds of millions of dollars in bitcoin

WindAwake/Shutterstock modified by Blockworks

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Are we there yet?

Ether ETFs are on the way. They could even launch later this month.

Obviously, the bitcoin ETFs were a success at launch, and since then we’ve seen a big appetite for the funds.

Last quarter, we discussed the adoption of bitcoin ETFs by asset managers (as disclosed in their 13Fs). We’ll do a check-in later on when the next round of SEC filings drops, but it’s reasonable to expect more disclosures from firms buying up the ETFs.

But the question on my mind is: How successful will the ETH ETFs be?

There’s no defined answer, and success may be a moving target, since it’s unclear if we can expect the same welcome received by the bitcoin ETFs.

Matt Hougan, Bitwise’s chief investment officer, thinks they could “surprise to the upside.”

Take tech stocks for example. There’s clearly demand for them. And, if investors understand ETH, then Hougan says it’s reasonable for some to lighten their tech holdings and diversify into an ether ETF.

Hougan says he expects the ether ETFs to have roughly $15 billion in assets around 18 months from launch.

Keep in mind, though, that Grayscale’s following a similar path to its ether ETF and plans to convert its closed-ended Trust into a redeemable spot fund. There could be outflows like we saw with its Bitcoin Trust, but perhaps not on the same level.

The fee war has also yet to play out, which will also set the scene for what funds seem the most competitive. Franklin Templeton’s planned fee of 0.19% for its proposed fund is the lowest one so far.

A few months ago, when the SEC suddenly engaged with issuers and all of the language around staking disappeared from their filings, there were some questions about the success of these products without staking.

“You could argue that Ethereum ETPs will underperform my estimate because they will not stake assets, which will lower demand. I don’t think this is true — staking income is a rounding error on ETH’s average annual return, and I think ETP investors will be happy simply having exposure. But it is a valid critique,” Hougan wrote in a memo last week around staking.

While Hougan’s sticking to $15 billion in the next 18 months, he also thinks the products could even outperform his expectations.

Numbers-wise, they’ll still underperform bitcoin ETFs but they are two different products. An optimist may even note that bitcoin could be carving the path for the ETH ETFs.

“Bitcoin ETPs have already pulled in $14 billion in net flows after less than six months on the market. I expect that number to swell to north of $50 billion by the end of 2025, as bitcoin ETPs are approved on large platforms like Morgan Stanley and Merrill Lynch,” Hougan wrote.

But Hougan brings up a valid point: Investors — outside of crypto — are pretty familiar with bitcoin and its use cases. How familiar are they with ETH? If we stick to the tech comparison, then the appetite could grow so long as investors do their due diligence and focus on the differences between ether and bitcoin.

As it stands, the next six or so months are going to be fascinating.

— Katherine Ross

Data Center

- The Ethereum validator queue is at its emptiest since the end of May, with 327 currently waiting. One month ago, there were 6,500 validators waiting to join the chain.

- ETH supply is at its highest point since mid-December after reversing months of deflation.

- Solana users paid $52.9 million to use the network last month, up from $46.8 million in May.

- The entire top-end of crypto is down today, with ENS, TAO and LDO all falling more than 12.5%. ENS is still up 12% over the past week.

- BTC and ETH have both slipped 4% to $60,300 and $3,300 each.

Uncle Paperhands

A riddle for you: Is it a top or bottom signal when world governments dump hundreds of millions of dollars in bitcoin?

As it turns out, Germany and the US are seemingly competing for who can spook bitcoin markets more.

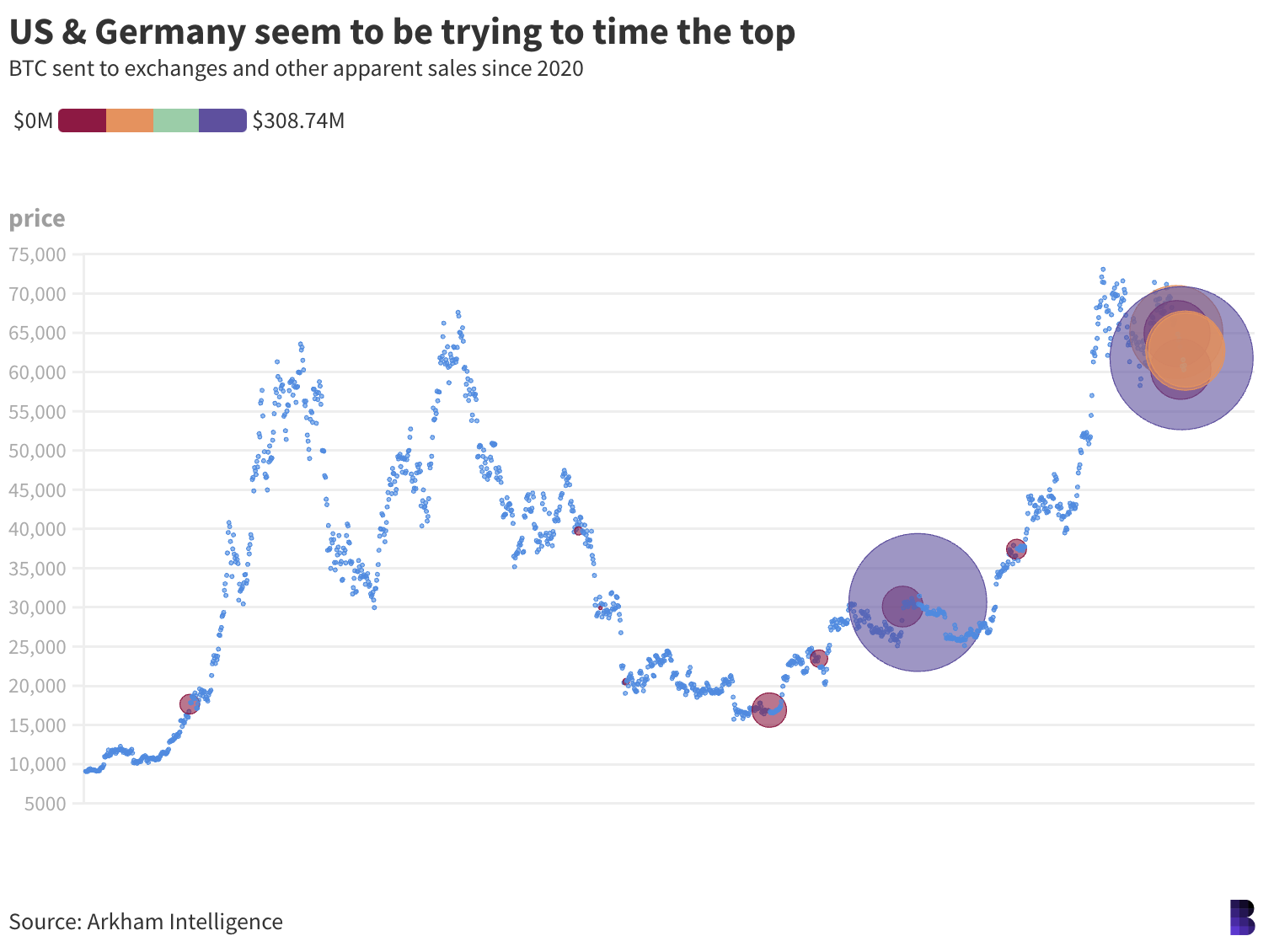

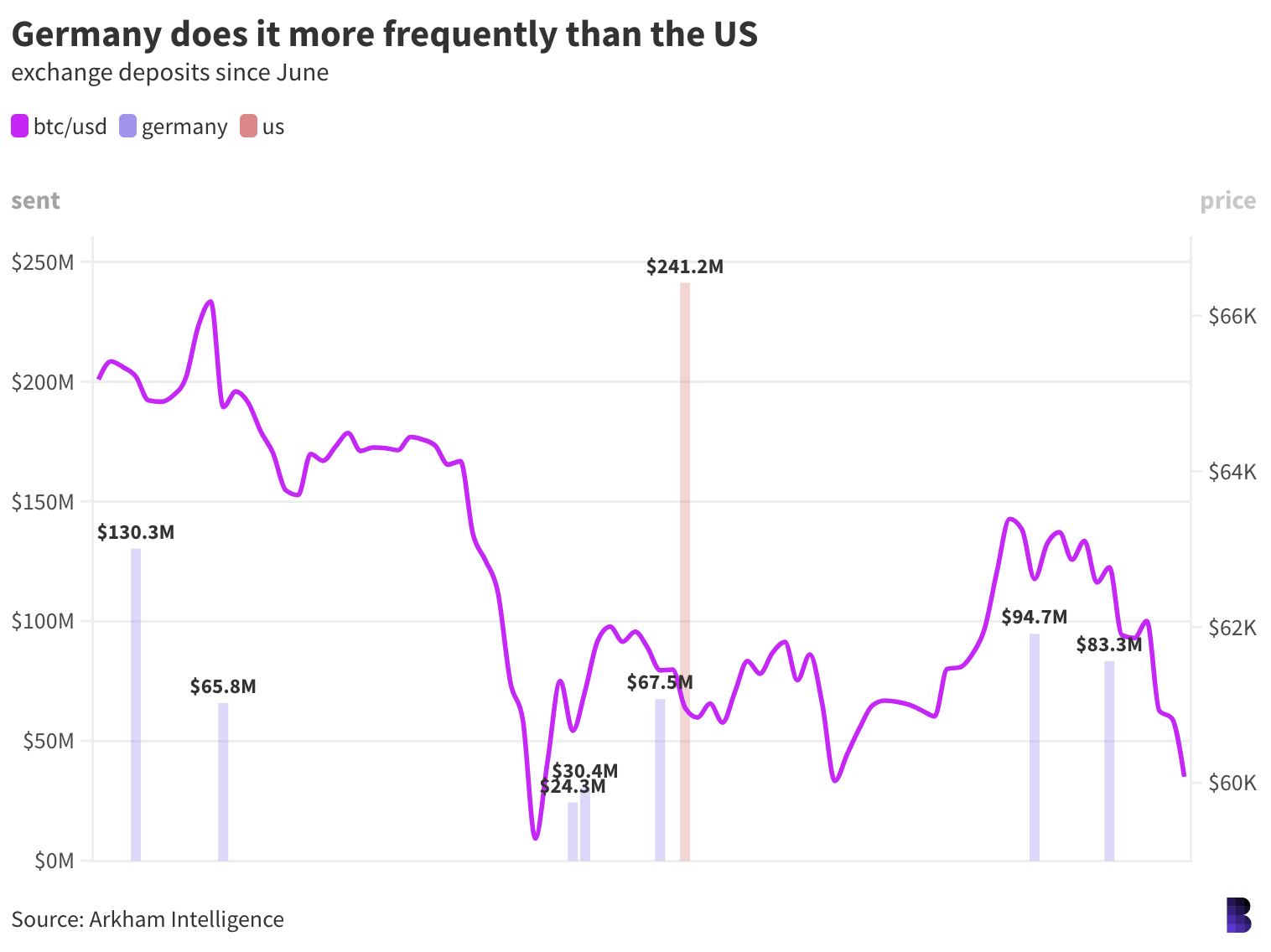

Since June, addresses linked to German and US governments have sent $737.6 million in bitcoin to exchanges including Coinbase, Bitstamp and Kraken, as well as some to OTC desk operator-slash-market maker Flow Traders.

Germany makes up about three-quarters of that total, with its deposits spread across 30 different transactions — usually in the morning around 9 am local time.

Bitcoin transfers to exchanges from governments have ramped up significantly.

Bitcoin transfers to exchanges from governments have ramped up significantly.

While it’s unclear whether all the bitcoin was actually sold (a small portion has since been returned to the original address), Germany’s transfers to exchanges are believed to be the first ever, at least going by Arkham Intelligence data.

Local authorities had previously seized bitcoin via various criminal cases, including pirate portal Movie2k.

As for the US, the Feds used to sell bitcoin at auction. Now, it sells on Coinbase.

The US sent a single 3,940 BTC deposit to Coinbase Prime at 11 am ET on June 26. The bitcoin, which once belonged to drug dealer Banmeet Singh, was worth $241.22 million at the time, while the same haul would fetch $237.35 million right now.

It’s hard to say whether these transfers have moved markets — but bitcoin definitely hasn’t gone up.

It’s hard to say whether these transfers have moved markets — but bitcoin definitely hasn’t gone up.

Aside from the bitcoin sold at auction in years prior, putting an exact value on how much the US government has offloaded over the years is difficult.

Some transactions are obvious, like the Coinbase deposits. Others only end up on exchanges after being sent through multiple single-use addresses.

But after combing through the onchain data for exchange deposits, and other transfers that have all the hallmarks of sales, it looks like the US government may have now either liquidated or moved to liquidate almost $590 million in bitcoin since November 2020. Which is about 20% more than Germany’s recent moves.

The US is still sitting on about $13.3 billion in crypto, mostly bitcoin, as well as a combined $300 million in ether and tether.

Germany otherwise continues to hold 43,549 BTC ($2.6 billion).

— David Canellis

The Works

- Kraken is mulling the use of nuclear energy as a source of power, CoinDesk reported.

- Fidelity International and Sygnum partnered with Chainlink to provide NAV data onchain.

- Crypto futures may be coming to Robinhood following its Bitstamp acquisition, Bloomberg reported.

- CoinDCX, an Indian crypto exchange, bought BitOasis.

- Genesis Digital Assets is weighing a US IPO, Bloomberg reported.

The Riff

Q: Is major marketing spend cringe in crypto?

I think it is…at least in this cycle. The marketing push we saw pre-FTX collapse is decently fresh in people’s minds. I still get questions from family and friends about crypto companies when they pop up at sports arenas or on jerseys.

I’m not saying marketing isn’t important, or that this kind of spending shouldn’t happen in a healthy environment. Just that it’s an uphill battle to get folks to forget the former FTX Arena down in Miami.

Crypto’s recovered, and it’s different than it was, but we don’t need back-to-back ads during prime sportsball games to convince the non-crypto folks that this time is different. Let them come to us.

— Katherine Ross

It’s not so much the major marketing spend. It’s the undisclosed paid partnerships and hidden payments to influencers.

Big flashy promos, crossover branding deals and silly Superbowl ads can mostly be forgiven. You gotta spend cash on something.

But there’s something so tacky about encouraging crypto to celebrate major partnerships with household brand names, and other cultural moments that appear organic, only to find out it was all bought and paid for.

There’s fake it until you make it, and then there’s just faking it. Better to avoid the latter.

— David Canellis

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.