The biggest Ethereum upgrade ever goes live

The Dencun hard fork hits Ethereum mainnet, the most significant upgrade since the Merge

Maurice NORBERT/Shutterstock modified by Blockworks

The long-awaited Dencun upgrade activated on Ethereum mainnet Wednesday at approximately 9:55 am ET — or the start of epoch 269568 if you’re following on-chain.

A scalability-focused upgrade, Dencun features EIP-4844 or Proto-Danksharding which carves out a dedicated data channel on Ethereum for layer-2 data, dramatically reducing the transaction fees on rollups.

But that’s not all. Dencun ships a total of 9 Ethereum Improvement Proposals (EIPs) in all, making it tied for the largest single hard fork in terms of improvements shipped, according to Tim Beiko, who coordinates the Ethereum core developer calls, on the Ethereum Foundation livestream commemorating the event.

Read more: Ethereum Improvement Proposals to watch in 2024

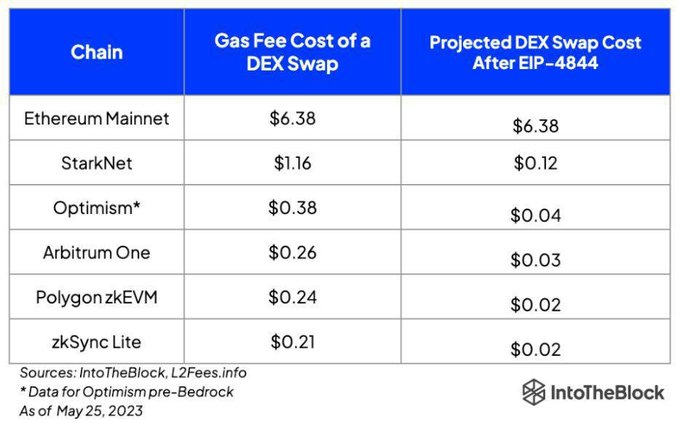

Post-Dencun, most rollups and their users will see benefits within hours to days, as the availability of data blobs on Ethereum — introduced by EIP-4844 — should slash transaction fees by 5-10x.

This real-world benefit to users is primarily driving anticipation for the upgrade, according to Hannes Graah, a builder of crypto wallet Zeal.

“The Dencun upgrade brings us closer to a future where fees are an afterthought, not a dealbreaker,” Graah told Blockworks. “Just as we generally don’t worry about the cost of traditional domestic bank transfers, Web3 users should be able to transact without worrying about fees.”

Aki Balogh, co-founder and CEO of DLC.Link, likens EIP-4844 to the “NoSQL movement of the 2010s,” which removed constraints of structured SQL data, through developments like MongoDB.

“Giving developers large blobs of temporary data (deleted after 30 days) provides them the opportunity to innovate while not increasing load on the network,” Balogh told Blockworks, removing a major Ethereum bottleneck. “Similar to Mongo’s effect, this proposal will help innovation as dApps and chains find new ways to use the temp storage space,” he said.

In contrast to scaling in Web2, this new data storage channel for Ethereum doesn’t sacrifice decentralization, notes Philippe Schommers, head of infrastructure at Gnosis, which implemented Dencun already on Monday.

Read more: Gnosis Chain premieres Ethereum’s Dencun hard fork

“When working towards scalability solutions on the blockchain, there are choices that developers have to make to prioritize decentralization,” Schommers told Blockworks. “When you look at Web2 infrastructure, it’s easy to see how centralized scalability can be done, but that’s not the path we’re trying to follow.”

While “less glamorous” Schommers said, it was part of Ethereum’s “big ambition,” calling Dencun “one piece of the puzzle that gets us a little bit closer to building a larger scale, fully decentralized network.”

Others are more effusive.

Lucas Henning, chief technology officer of Suku, says it’s still early days and the upgrade “will guide the Ethereum ecosystem towards a more sustainable future.”

“It’s an exciting time for Ethereum, and I am keen to see the effects of these changes on the decentralized world landscape,” Henning said.

“It’s the moment we’ve been waiting for,” said Eli Ben-Sasson, president of StarkWare. “Today will go down as the date of birth for a dapp-for-everything culture.”

Updated March 13, 2024 at 11:30 am ET, clarifying Dencun is equal to one earlier fork for the most number of EIPs included.

Correction March 13, 2024 at 1:40 pm ET: Misattribution of one quote.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.