Ex-Coinbase Employee Accused of Insider Trading Pleads Not Guilty

A former Coinbase employee at the heart of an insider trading case has pleaded not guilty. His lawyer claims the assets aren’t securities

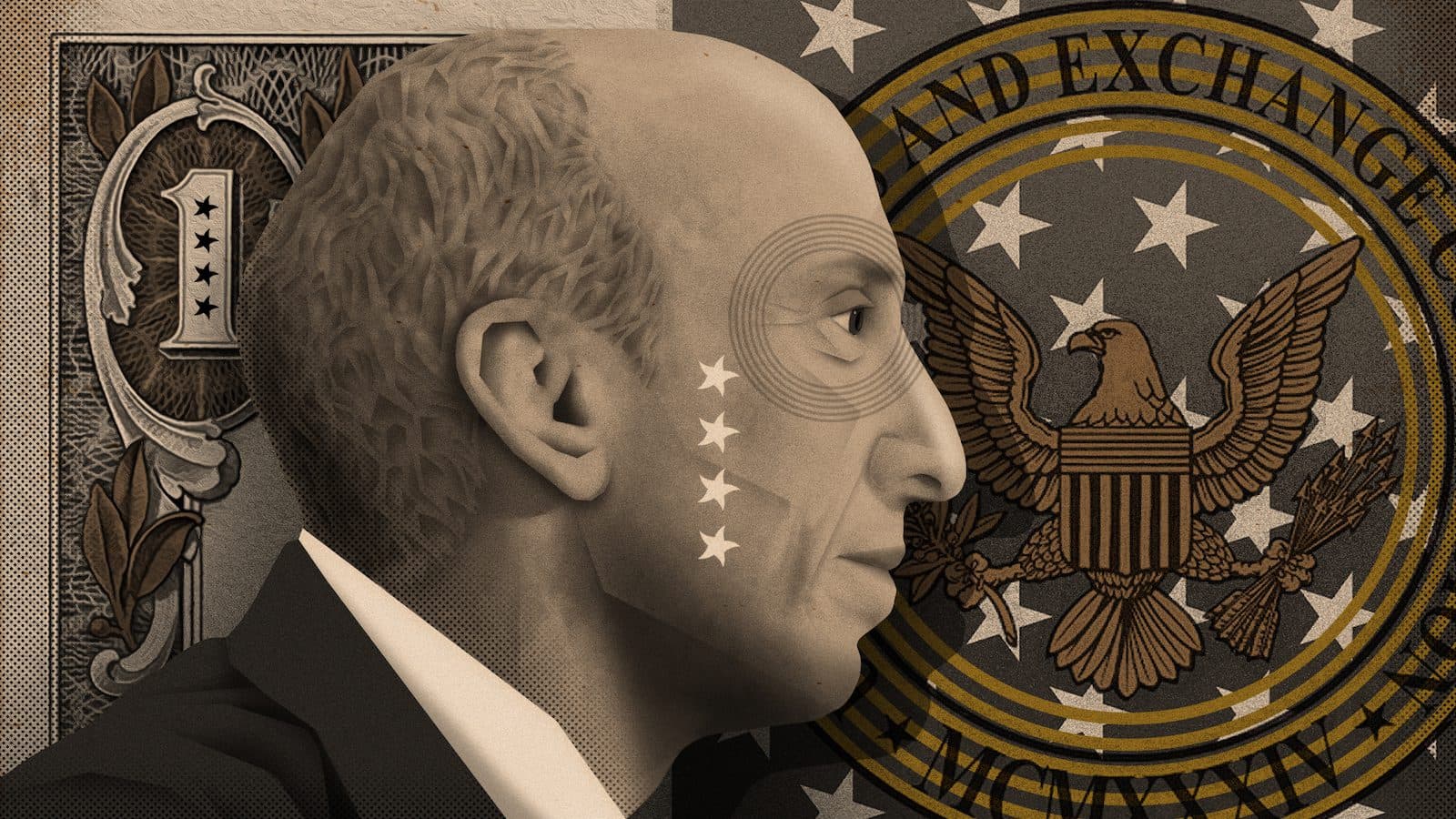

Gary Gensler, Chair, US Securities and Exchange Commission | Blockworks exclusive art by Axel Rangel

- The accused, along with two others, allegedly profited $1.1 million with inside knowledge of Coinbase token listings

- His lawyer has reportedly argued the charges should be dropped, as insider trading cases only relate to securities or commodities

An insider trading case could confirm whether some cryptocurrencies listed by Coinbase are in fact securities.

Ishan Wahi, the former Coinbase product manager accused of insider trading, has pleaded not guilty to the Securities and Exchange Commission’s (SEC) charges of wire fraud.

Reuters reported on Wednesday that both he and his brother, Nikhil Wahi, made their “not guilty” pleas at an arraignment in a Manhattan court before District Judge Loretta Preska.

They were both arrested in Seattle last month after the SEC accused Ishan of trading cryptoassets based on confidential information between June 2021 and April 2022.

The regulator alleged he tipped his brother and friend Sameer Ramani about upcoming announcements of new Coinbase listings, which have been found to often coincide with big rallies.

All three have been charged with netting $1.1 million in profits from the sale of at least 25 tokens in an insider trading scheme.

Ishan is said to have bought a one-way plane ticket to India after a Coinbase security director called him for a meeting at the crypto exchange’s Seattle office. Ramani reportedly remains at large.

Ishan’s lawyer, David Miller, has disputed the wire fraud charges. He reportedly believes they should be dropped as insider trading cases relate to securities or commodities — saying those laws wouldn’t be relevant in this case.

However the SEC, in its statement, labeled at least nine of the cryptoassets traded by the charged individuals as securities, which Coinbase has denied.

Miller also suggested that the information shared by his client wasn’t confidential, saying Coinbase tested new tokens before publicly listing them.

Judge Preska has ordered both the brothers to be released on a $1 million personal recognizance bond, according to Law360.

Blockworks didn’t receive replies to requests for comment from Coinbase or lawyers for Ishan and Nikhil by press time. It’s unclear whether Ramani has an attorney.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.