Americans Say There’s Still One Brand Worse Than FTX

Criminal behavior will get you to the bottom of this list

denysganbap/Shutterstock modified by Blockworks

Several months after the collapse of FTX, and following relentless media coverage of alleged criminal mastermind Sam Bankman-Fried, Axios and Harris Polling asked Americans how they felt about 100 highly-visible brands.

And shockingly, despite evaporating billions of dollars of investor value, crashing the crypto industry, and wiping out countless average crypto enthusiasts through a mixture of incompetence and alleged criminality, FTX did not come out absolute bottom of that survey — which may give some hope to those behind a plan to reboot the exchange.

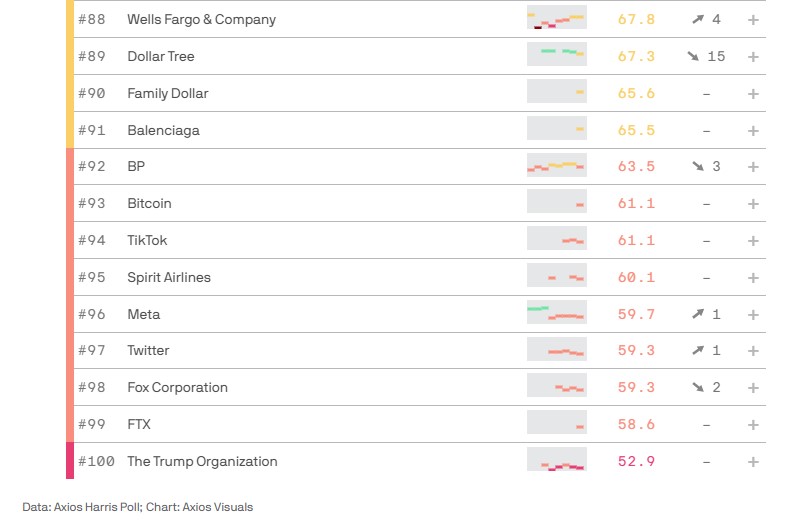

In fact FTX wasn’t too far away from the companies in 97th and 98th on the list: Twitter and the Fox Corporation.

By the time Axios surveyed over 16,000 Americans in March 2023, Twitter had been decimated by Elon Musk and Fox Corporation was facing a Dominion lawsuit. Fox’s rating was captured in the face of widely-reported comments from Tucker Carlson on ex-President Trump, such as “I hate him passionately” that may have helped add a bipartisan flavor to the apparent disdain Americans have for the company.

FTX, in 99th place on the list of 100 companies, also trailed Spirit Airlines, TikTok, Balenciaga and even Meta. Another Elon Musk project, Tesla, dropped 50 places in the public’s estimation.

Axios measured attitudes to company reputations on character, trust, and ethics, among other metrics.

Bitcoin doesn’t do so well, either

FTX was not the only crypto brand represented on the list, however. Bitcoin was also top-of-mind among Americans last year, and was included in the survey.

Bitcoin’s scores were not quite as catastrophic as FTX’s — but the largest cryptocurrency was still in the bottom 10, just behind oil giant BP… and two places behind Family Dollar. Bitcoin has been the target of environmental groups concerned about its energy use, although a New York Times ‘hit piece’ on the subject did not emerge until after the survey was completed.

At the other end of the list, Patagonia and Costco headed the brands considered most reputable by Americans, with Amazon’s top 10 ranking proving that being a tech company does not automatically make you unpopular. Apple and Samsung also made the top 10.

Given that FTX is accused of stealing customer money and blowing it on lavish parties in the Bahamas while its principals lived it up in an orgiastic penthouse, it would have to be quite an achievement to rank below the crypto exchange in public trust.

And indeed, only one corporate entity was perceived as worse, a business already convicted of criminal behavior in the lead-up to the poll: The Trump Organization.

Bottom of the barrel: The wrong end of American perceptions – Source: Axios Harris Poll

Bottom of the barrel: The wrong end of American perceptions – Source: Axios Harris Poll

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.