Gap Releases First Line of NFTs on Tezos Blockchain

The company dropped a non-fungible token collection, joining a laundry list of fashion giants such as Adidas, Macy’s and Dolce & Gabbana

Source: Shutterstock

- One Gap NFT currently goes for 2 XTZ or roughly $8.41 worth of Tezos, as of press time

- The new collection features artwork by Brandon Sines

Gap Inc. (GPS.N) released a line of non-fungible tokens (NFTs) on Thursday, joining a laundry list of major retailers to step into the world of digital collectibles. The collection, dubbed “Gap Threads,” will be powered by Tezos, which touts itself as a more energy-efficient blockchain.

One NFT currently goes for roughly $8.41 worth of Tezos and can be purchased on the San Francisco-based company’s website.

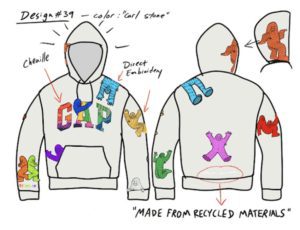

The NFTs were designed by artist Brandon Sines and will be released periodically throughout the month, according to a statement from the firm. Additionally, certain holders of the asset will receive a real-life Gap hoodie, along with their NFT.

Source: The Gap

Source: The GapBrian David-Marshall, president of InterPop which collaborated with Gap to create the collection, described NFTs as a way for companies to bridge the gap between physical and digital ownership.

“These NFTs will unlock an opportunity for fans to get their hands on an exclusive real world apparel drop from this collection. This is a great example of how NFTs are empowering creators and brands globally to connect with their fan bases on new levels,” David-Marshall said in a statement to Blockworks.

Other major brands such as Adidas, Macy’s and Dolce & Gabbana released NFT plans in the past few months.

Adidas dropped 30,000 NFTs, recording $23.5 million worth of ether in sales last year. The collection went down in history as the most widely-distributed NFT drops, despite reports of failed transactions, according to the company.

Garrette David, co-founder of Atomic Form, said it’s no surprise that large brands are venturing into NFTs, describing the partnerships as “a total no brainer.”

“Streetwear culture and clothing lines [have] historically leveraged their branding, [intellectual property] and their community to guide their sales and distribution,” David, who runs a Web3 startup, told Blockworks. “NFTs are a logical continuum. Aforementioned historical strategies translate well into the NFT space because it is a new medium for their IP and drives merchandising costs to be very low because the goods are code rather than physical goods.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.