Gensler On Board With CFTC Taking Over Bitcoin Oversight

Gensler, who served as the CFTC head for six years, said he is on board with helping Congress grant the commodities regulator more oversight

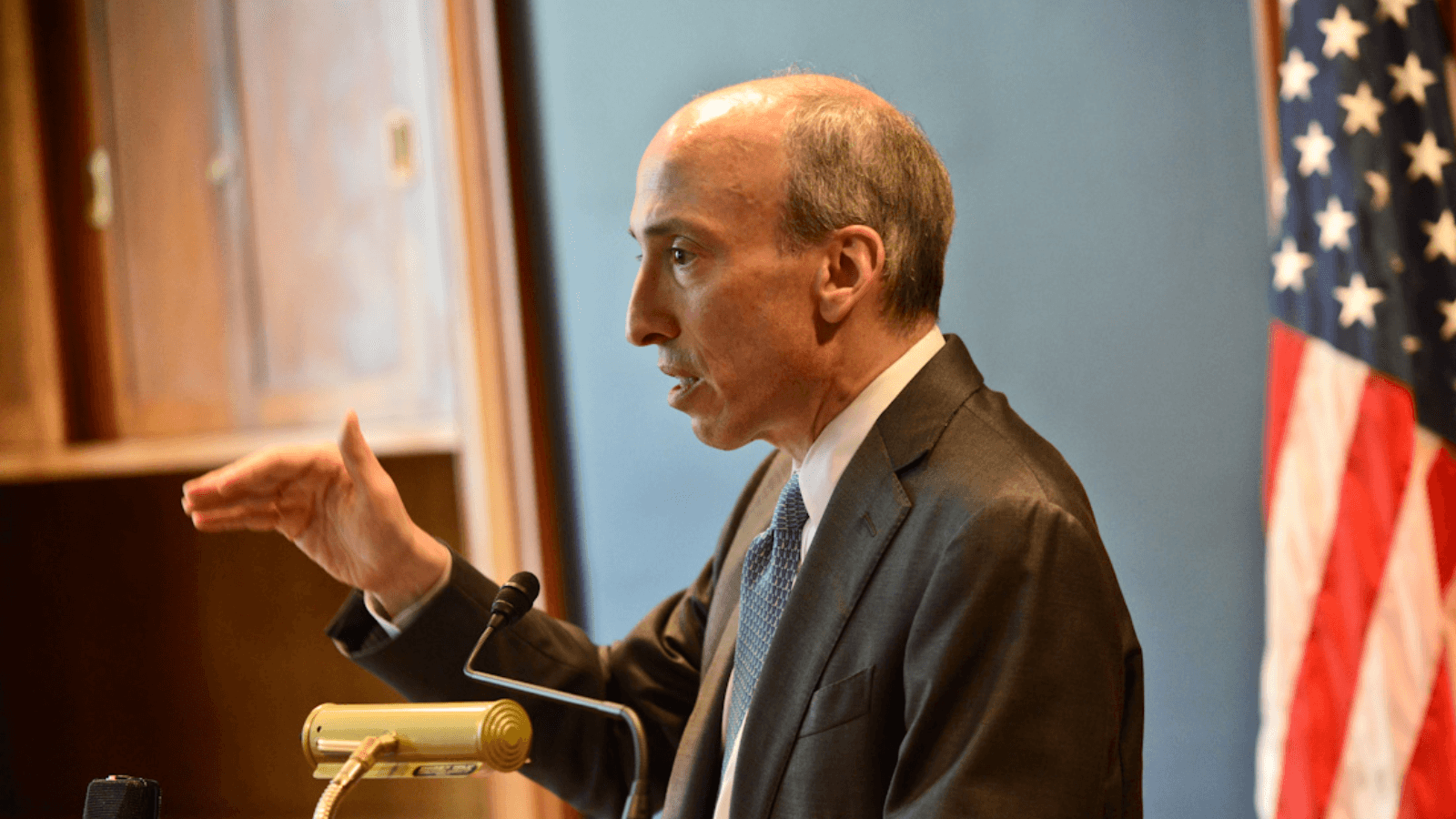

SEC Chair Gary Gensler | Third Way Think Tank/"Gary Gensler" (CC license)

- In August, senators proposed legislation that would have the CFTC oversee cryptoassets deemed commodities, such as bitcoin and ether

- The SEC has previously said that ether is a commodity

In a surprising move for the industry, Securities and Exchange Commission Chair Gary Gensler supports allowing the Commodity Futures Trading Commission to oversee bitcoin.

Regulating bodies need to collaborate to establish clear policies around cryptocurrency technology and investments in order to protect investors, Gensler said during his prepared remarks at the SEC Speaks event Thursday.

“To the extent the Commodity Futures Trading Commission (CFTC) needs greater authorities with which to oversee and regulate crypto non-security tokens and related intermediaries, I look forward to working with Congress to achieve that goal consistent with maintaining the regulation of crypto security tokens and related intermediaries at the SEC,” Gensler said.

In 2018, William Hinman, the former director of the SEC’s Division of Corporation Finance, called ether a commodity. Gensler has been less clear on his personal stance regarding ether, but said that the only token he would classify as a commodity would be bitcoin, during a June 2022 interview with CNBC.

The news comes after a group of bipartisan senators introduced legislation that would make the CFTC in charge of overseeing bitcoin and ether, two cryptocurrencies the senators classify as commodities. Sens. Debbie Stabenow, D-Mich., and John Boozman, R-Ark., authored the bill, dubbed the Digital Commodities Consumer Protection Act, and introduced it in early August.

Exchanges that enable investors to trade bitcoin and ether must also register with the CFTC, the bill notes. The SEC, which is roughly six times the size of the CFTC, will still control some aspects of governance over the crypto industry, but the bill does not detail exactly what this division of responsibilities will look like.

Gensler’s support of CFTC involvement in crypto regulation is not the first time the two agencies have seen eye to eye. In August, The SEC proposed an amendment to Form PF, the confidential form via which registered investment advisers are required to disclose specific information about their security holdings.

The CFTC is considering proposing the same amendments, which would require funds with at least $500 million in assets under management to disclose exposure to cryptoassets. The updates also would mandate large funds to report investment concentration, as well as leverage and related trading financing.

Bitcoin rallied following the remarks, rising 1.3% and recovering from its Wednesday slump below $19,000, alongside major market indexes, in Thursday afternoon trading in New York.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.