Gone Crypto: Olympic Gold Medalist to Digital Asset Research

When Sean Rooney moved back to the US in 2015, he had to fly from Los Angeles to Milan just to close his accounts and transfer money to his American bank. It was his frustration with how incompatible different financial systems were that motivated him to look into digital assets.

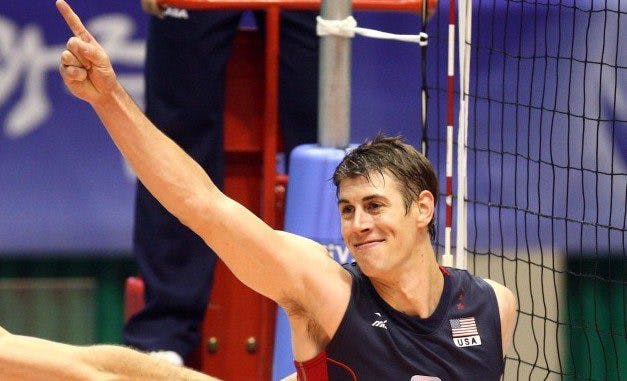

- Sean Rooney played volleyball for Pepperdine University, where he studied business, before becoming a professional athlete

- Rooney joined Valkyrie as Head of Research earlier this year

Olympic gold medalist Sean Rooney has lived in a lot of places and met a lot of different people thanks to his chosen professional sport: volleyball. While it may seem a stretch that volleyball led Rooney to crypto, his experience living overseas, and difficulties opening and closing many bank accounts, make digital assets a natural fit.

“I would play professionally overseas for nine months of the year. Those teams were comprised of players from all over the world,” said Rooney. “Everybody was from a different socio-economic background, everybody thought about money and investments and just culture differently.”

Rooney played volleyball for Pepperdine University, where he studied business, before becoming a professional athlete.

He played on teams based in Russia, South Korea and Italy between 2005 and 2014. He was a member of Team USA during the 2008 and 2012 Olympic Games. Moving between countries so often was difficult, though.

International banking challenges

“Living abroad, you have to open up bank accounts in different countries,” said Rooney. “There are challenges with international banking, just opening up accounts and transferring money is difficult.”

Once Rooney moved back to the US in 2015, he had to fly from Los Angeles to Milan just to close his accounts and transfer money to his American bank. It was his frustration with how incompatible different financial systems were that motivated him to look into digital assets.

“Because of those experiences, it was kind of a natural progression for me to get into bitcoin and crypto,” said Rooney. “Once I started doing that research, it just consumed me. I was able to connect with other teammates and other people and have these discussions. I sort of have never looked back.”

Rooney started investing in digital currencies in 2015. He was coaching volleyball at Pepperdine at the time, but he kept learning everything he could about crypto. Like so many other crypto fans, he was enamored with the seamlessness and lack of intermediaries.

“One of my favorite things about Bitcoin is that it’s available for pretty much everybody and it’s borderless and, and it has unique characteristics of transparency,” said Rooney.

Building bridges

Rooney continued investing and researching for about five years before he was introduced to members of the Valkyrie team in 2020. Steven McClurg, CIO, and Leah Wald, CEO of the alternative asset management firm, shared their vision with Rooney and he was eager to get involved.

“I was able to connect with Leah and Steven, and hearing about the products and what they were trying to do, what we’re trying to do now, with the company was very compelling,” Rooney said.

Rooney joined Valkyrie as Head of Research earlier this year. The mission of the firm remains the same.

“Building a sort of bridge and connecting the two worlds of traditional finance and crypto is just special, because it hasn’t really been done yet,” said Rooney And that’s why I’m so excited to be a part of it.”

Correcting misconceptions

When he made the career switch, the reaction from his peers was mixed.

“My family was completely baffled,” said Rooney. “They were used to me being an athlete, where I’d perform in front of everybody with my teammates and be judged on the spot, and now I’m trying to explain this thing that you can’t see.”

Much like the broader perception of cryptocurrencies, Rooney’s friends and family have since come around to digital assets.

“It’s been really fun to see people that were really skeptical at first have grown, as the industry as the ecosystem has grown as well,” said Rooney. “I mean, my wife has a Kraken account now. Five years ago she was like ‘stop talking about this stuff. I don’t want to hear about it.’”

While digital assets are certainly making their way into the mainstream, there are still misconceptions that remain, especially when it comes to security, Rooney said.

“I still hear a ton of remarks about how bitcoin is anonymous and so secretive. And I think that actually, the ability to see where things are moving on the ledger is one of the most unique and powerful things, to be able to confirm transactions and transact in a free manner,” said Rooney. “That’s what I think is so cool about it.”

Have your own traditional-finance-gone-crypto story to tell? Email us [email protected].