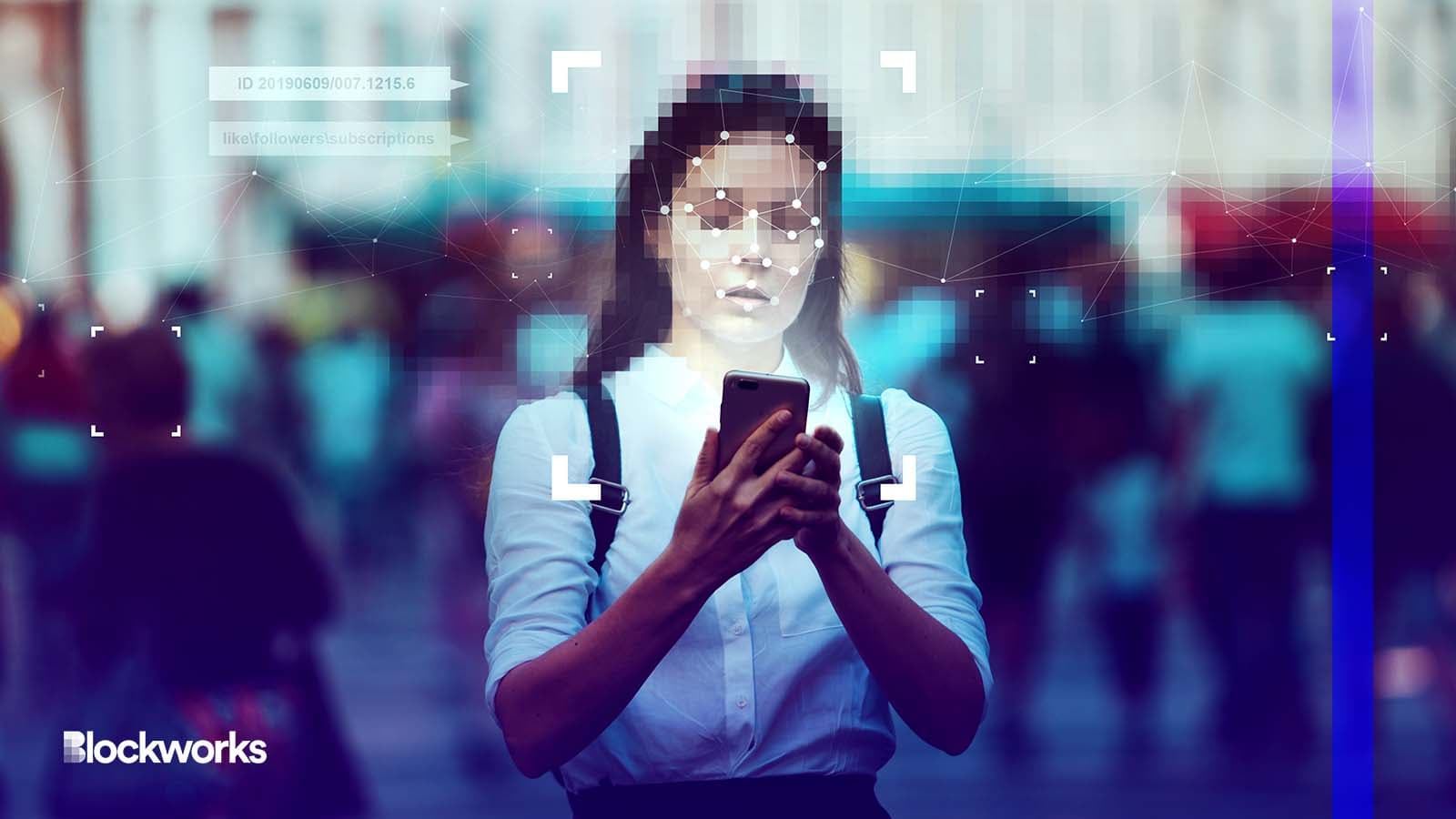

For the Internet of Things, It’s Either Web3 or 1984

IoT machines are not the enemy, but our legacy methods of running them will be

Trismegist san/Shutterstock modified by Blockworks

Let’s set the scene: The year is 2030, and the Internet of Things has become ubiquitous. Sensors are everywhere, everything’s outfitted with a chip, and you’ve already interacted with twenty IoT service providers before you brushed your teeth this morning without even knowing.

After your morning cup of coffee, dutifully prepared for you by the smart machine that knows your taste better than you do (it also knows your daily routines and may or may not be selling this info), you head for the hairdressers. Via an app, you find and unlock the nearest shared electric vehicle and hit the road as it happily sells off more of your data to Big Tech.

An hour later, as stylish as ever, you head back for the vehicle — only to find that it rejects all of your attempts to get in. You try to hop on the bus, using your phone to pay, but the transaction doesn’t go through. Even a nearby vending machine refuses to sell you your now much-needed emotional support chocolate bar.

The pieces moving today

All of the things that you tried to do during your hypothetical day in 2030 relied on transactions involving devices. These devices were leveraging central bank digital currencies (CBDCs), controlled by that self-same central bank. And your friendly central bank was only happy to help when the local authorities, upset by your involvement in some recent protests, wanted to teach you a lesson. The rest is history.

The above scenario may feel far-fetched, but my humorous hyperbole reflects the worst possible future scenario imagined by CBDC critics. The number of connected devices is growing fast, both in business inventories and on the consumer market. The rise of artificial intelligence — yes, that includes ChatGPT, which Twitter can’t get enough of these days — and the way the technology enables connected devices to be more efficient means that more processes will be automated. And this doesn’t just go for things like smart factories: Amazon’s autonomous shop and the fully-automated McDonald’s in Texas are both harbingers of just how much automation we will be dealing with daily. And it’s worth noting that my scare tactic of a morning routine is already more or less approaching the status quo in China.

The fact of the matter is, we are relying on connected devices in more daily activities. It’s not the problem, really; the real problem is the digital infrastructure that the apps — and thereby the increasingly intelligent vehicles, machines, and robots — run on. That’s why the paradigm of machine and human economic relations we are fast heading into needs to run on Web3 rails, with everyone in charge of their own data and assets. The machines are not the enemy, but our legacy methods of running them are.

The interactions between all of these internet-connected devices and the wide world out there include a transactional component. Sometimes it’s about selling your data, and sometimes, it’s more direct, like when you’re using your phone to pay at the grocery store (which is becoming ubiquitous). In today’s world, most of these transactions involve a traditional banking account at a certain point, either the user’s own or an omnibus held by a specific platform for its business needs. In the future, though, these accounts could instead be virtual wallets with CBDCs, digital tokens issued and managed by central banks.

And as wonderful as that might sound, CBDCs and their inherently centralized design enable the issuer to directly control your spending behavior. Digital currencies are programmable, malleable, which makes any sort of control possible. You can set limits on how much a person can keep in their account in order to stimulate economic activity by forcing purchases and investment. You can limit their ability to purchase non-eco-friendly goods, or build carbon offsets into transactions. Oh, and only one plane flight per year. For some, all of this may still sound appealing, but this slope is oh so slippery. Why not just ban everyone you don’t like from buying food?

Recent years already saw cases where governments sought to hamper citizens’ ability to transact as a punitive measure, like China’s social credit system, for example, or Canada’s action against trucker protests. You may feel differently about the people involved, but the mechanisms at play are similar in their logic. We enact our financial freedom by choosing what we purchase and from whom. If this freedom depends on the goodwill of a third party, it’s no freedom at all, and being excluded from the real-world economy is a direct threat to one’s livelihood.

Take these trends, put them together, let them simmer for a bit, and there we are — that doomsday scenario is looking way more realistic. You may have heard about the Social Dilemma, where tech experts from Silicon Valley sounded the alarm in an hour-and-a-half long informative yet dystopian documentary about the dangerous impact of social networking’s manipulative underbelly, “brought to you by Big Tech.” We’re next heading towards what you may call “the connected dilemma,” where we either leverage the Internet of Things at the cost of giving away even more intimate data about even more aspects of our lives, or keep some slither of privacy but remain in the Stone Age, comparatively speaking.

But IoT apps don’t have to be built on centralized Big Tech — they can be built on Web3 instead. IoT-specific decentralized applications (dapps) enable any user, whether human or machine, to securely interact and transact with others in a peer-to-peer manner. They can do so with full sovereignty and ownership over their identities and their data, meaning user surveillance becomes a thing of the past. On an even better note, if the currencies we choose to use are built on decentralized tech, the potential for monetary censorship then stays in the past too.

And so, this leaves us with a choice, not a dilemma. It’s no longer a case of ‘choose privacy, but live in the Stone Age, or ‘choose the latest tech but give up your most intimate data.’ It’s a case of choosing to build and use apps which run on decentralized foundations. On Web3, not Big Tech. If we get that right, we can have our cake and eat it too.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.