Japan to Tighten Crypto Anti-Money Laundering Rules Next Month

Japan has continued to ratchet up its standards on crypto regulation for roughly two years in response to criticisms levied against it

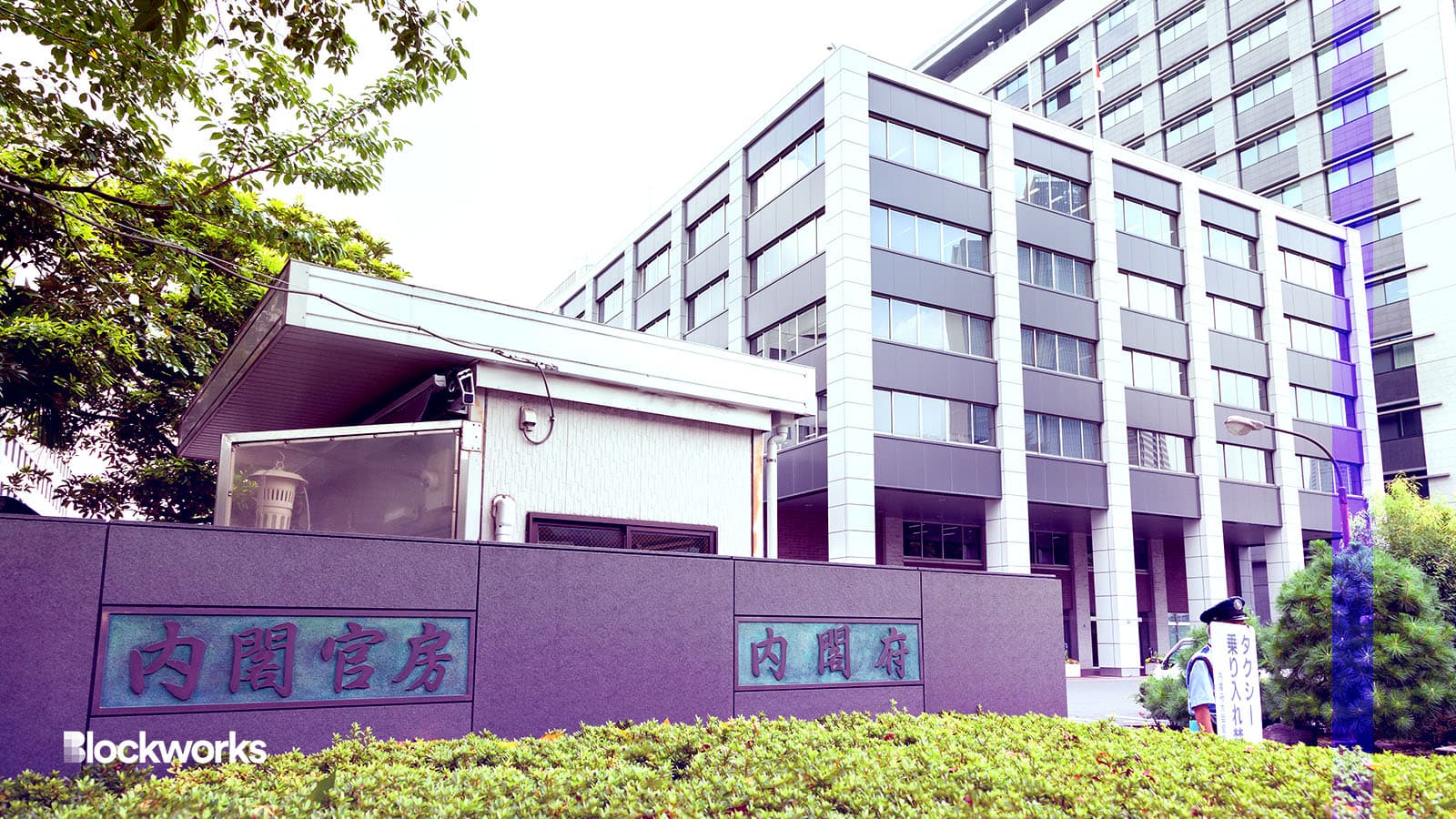

Osugi/Shutterstock, modified by Blockworks

Japan is expected to introduce new anti-money laundering measures designed to better track crypto transactions as it continues to move in lockstep with other nations across the region.

The country’s cabinet intends to implement the new measures come June 1, which would see the enforcement of what’s known as the travel rule, Japan Today reported on Tuesday.

It requires financial institutions to pass certain information between them, with the goal of transaction traceability — to prevent, detect and prosecute money laundering and other financial crimes.

It also requires the names, addresses and other financially identifiable data to be included in each step of a given transaction. The rule was later adapted for virtual asset service providers.

An intergovernmental organization, known as the Financial Action Task Force (FATF) — responsible for enforcing the rule — found Japan’s previous attempt at adoption in 2021 to be deficient.

Japan has continued to ratchet up its standards on crypto regulation for roughly two years in response to criticisms levied against it. Those criticisms also included the FATF’s public shaming of Japan’s “inadequate progress” on the issue when it came to digital assets.

As a result, a significant investor protection bill was approved by the Japanese legislature in June of last year, establishing a legal structure for stablecoins and defining them as digital currencies.

Under the law, the issuance of stablecoins is exclusively reserved for recognized financial entities, including registered banks, money transfer agencies, and trust companies.

Around the same time, the country also sought changes to its Foreign Exchange Act in a bid to clamp down on crypto transactions thought to be making their way into the hands of sanctioned Russian nationalists.

Coincidentally, as Japan strengthens its AML rules for crypto, Hong Kong is anticipated to ease restrictions on virtual asset providers previously barred from serving retail crypto investors.

Though, like Japan and much of the regions across Asia, Hong Kong and others continue to advance more aggressive policies in the wake of a brutal year for digital assets and the demise of FTX — a particular sore spot for Singapore.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.