JPMorgan: 2022 Could Be ‘Year of the Blockchain Bridge’

Growth in crypto space could hinge on Ethereum’s upcoming upgrade, more regulatory clarity, company analysts say

Source: Shutterstock

- Ethereum’s use cases are far more significant than bitcoin’s, JPMorgan research analysts Kenneth Worthington and Reginald Smith wrote in a report published Friday

- The analysts see potential for tokenization within financial services as transactions speeds in crypto become more competitive with traditional finance networks

While many in the crypto community summarized 2021 as the year during which NFTs saw massive growth, JPMorgan analysts predicted that greater interoperability of various blockchains and financial tokenization could be this year’s hallmarks.

If 2021 was the year of the NFT, we see 2022 as possibly the year of the blockchain bridge…or the year of financial tokenization,” JPMorgan research analysts Kenneth Worthington and Reginald Smith wrote in a report published Friday.

“As such, we see the cryptocurrency markets as increasingly relevant to financial services.”

Worthington and Smith said that they expect the evolution of crypto markets to accelerate this year, particularly for financial services, if greater capacity and transaction speeds are achieved by upgrades to the Ethereum blockchain or new layer-2 initiatives.

Ethereum versus bitcoin

“If bitcoin is digital value, Ethereum is a digital canvas or software platform that allows developers to create new crypto and traditional applications,” the JPMorgan analysts wrote.

“[Ethereum’s] use cases are far more significant than what we see for bitcoin.”

Currently, network congestion on Ethereum has driven the prices up to around $50 per transaction, the JPMorgan report states, noting that Ethereum also “doesn’t communicate well with other blockchains,” although they don’t elaborate on what they mean by this.

Ethereum’s layer-1 network favors security and decentralization over scalability, and processes roughly 15 transactions per second. That’s compared to Mastercard’s network, which can process about 5,000 transactions per second. But layer-2 networks will address transaction throughput while inheriting Ethereum’s security.

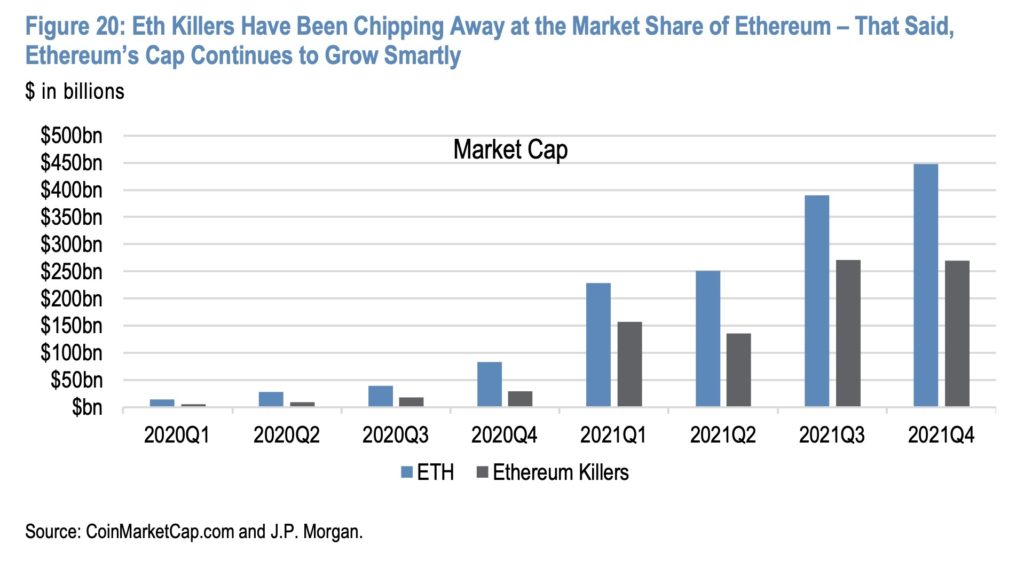

“Solana is much faster than Ethereum. Cardano is more scalable. Polkadot is more interoperable,” the analysts noted. “These advantages could allow these other chains to chip away at Ethereum’s dominance and market value as they facilitate the development of new projects levering Ethereum limitations.”

An Ethereum upgrade is expected in mid-2022 and will convert the blockchain from proof-of-work to proof-of-stake. It will ultimately alleviate some of the concerns around speed, costs and scalability, they suggest.

While the technology backing bitcoin is significant, the use cases for Bitcoin are “rather one-dimensional” when compared to Ethereum, Worthington and Smith said.

“Relative to gold, we see Bitcoin is at least or more durable, portable, fungible, visible, scarce, verifiable and free from censorship,” the analysts explained. “However, Bitcoin falls short of gold in its history as a store of value.”

Worthington and Smith pointed to bitcoin’s limited history compared to gold, adding that bitcoin’s price volatility levels are materially higher than other asset classes including gold, the US dollar, equities and commodities.

The price of bitcoin was roughly $41,700, as of 1:30 pm ET on Friday, according to CoinGecko. The asset, which carried a market capitalization of about $800 million at the time, had hit an all-time-high of more than $68,000 in November.

Ethereum’s price and market cap was at about $3,200 and $380 million, respectively.

Tokenization and DeFi in financial services

Transaction volumes on NFT marketplace OpenSea grew exponentially in 2022.

But the JPMorgan analysts said the segment is in its early stages, as tokenization could hold the greatest potential within financial services — particular for illiquid assets that could benefit from price discovery, liquidity, asset servicing and asset composition.

“In our future we see the tokenization (and fractionalization) of credit, equities, parts of real estate (commercial to residential to hotel rooms), and non-traded investments including private equity,” they wrote.

Though the JPMorgan analysts argued that decentralized finance (DeFi) was “a bit of a flop” in 2021, it has strong potential, as they said the traditional financial system today “has more intermediaries than it probably needs.”

Traditional Financial Services firms are embracing the crypto ecosystem to make traditional financial offerings better.

“Here, we see traditional financial services on the front-end, but DeFi powering the back-end,” Worthington and Smith noted. “However, we see the current regulatory environment (really the lack of Federal Crypto Rules and Regulation) limiting the presence that traditional finance can have in crypto.”

Coinbase is a buy

The JPMorgan analysts also noted the potential of Coinbase’s stock, calling the exchange “a leading direct beneficiary of cryptomarket growth.”

Coinbase, which had 73 million verified users as of the end of the third quarter, became a public company in April.

Bill Miller made similar comments about Coinbase in October, when he said during an interview with author William Green that it could be “the default position for growth investors” that want exposure to the crypto market without investing directly in crypto assets. He added at the time that Coinbase could reach a $1 trillion market capitalization.

Bank of America analyst Jason Kupferberg upgraded his rating of Coinbase from neutral to buy this week. He wrote in a research note published Thursday that the company’s increasing signs of revenue diversification beyond retail crypto trading could spur increased interest in the stock among institutional investors.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.