More Capital Flowed into Stablecoins than Muni Bonds in 2021

Stablecoins have gained more capital than US municipal bond funds so far this year, catching regulators’ attention

Source: Shutterstock

- USDT, USDC and Binance USD have almost quadrupled assets in 2021

- Collectively, the three largest stablecoins represent almost three times the amount of cash sitting at PayPal

Year-to-date, more capital has flowed into stablecoins, dollar-backed digital currencies, than into United States municipal bond funds.

The top three stablecoins, Tether (USDT), USD Coin and Binance USD, now have more than $100 billion in assets collectively. This is almost three times the cash reserves sitting at PayPal.

USDT, USDC and Binance USD have almost quadrupled in 2021 from $21 billion to $102 billion in assets. This $75 billion increase is greater than the $73 billion investors have added to municipal bond mutual funds and exchange-traded funds year-to-date.

In July, bitcoin traded into USDT totaled 4.3 million, making up 61.6% of all bitcoin traded into either fiat or stablecoins, according to data from research group CryptoCompare. This is the highest level since December 2020, when 63.1% of traded bitcoin was put into USDT.

Stablecoins are intended to trade at $1 per token, protecting them from volatility associated with other digital assets. They are backed dollar-for-dollar by real US cash, in theory.

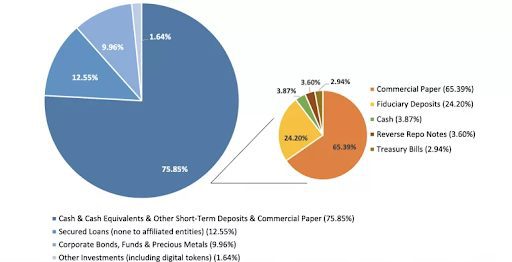

Tether revealed in May that in reality, only 2.6% of its reserves are in cash. The remainder is a combination of secured loans, corporate bonds, crypto holdings and more. Circle has reported that 61% of USDC reserves are in cash. Binance has said that its stable coin is backed one-to-one with US dollars, but the company has not reported cash reserves recently.

Tether reserves breakdown; source: Tether

Tether reserves breakdown; source: TetherLow interest rates mean stablecoin issues have a hard time making money. Exchanges have started to take on a more traditional banking role in order to increase profits. Coinbase now offers 4% yield on lended USDC. There appears to be high demand for these types of products, but they are not FDIC-insured.

Stablecoins on the regulatory radar

The general lack of transparency and reporting requirements for stablecoin issuers has caught the attention of regulators.

US Securities and Exchange Commission Chairman Gary Gensler said earlier this week that stablecoin regulation is essential to curbing crypto crimes. Stablecoins mean transactions are cryptocurrency-to-cryptocurrency without intermediaries, allowing bad actors to fly under the radar easily.

“USD-linked stablecoins are a global phenomenon, which is as much a reason to regulate them as concerns over shadow banking,” wrote Nicholas Colas, co-founder of DataTrek Research in a recent note. “The Federal Reserve may be undecided about a central bank digital currency, but as often happens with disruptive technologies the incumbent is always late to the party. In the meantime, dollar-linked stablecoins are happy to fill the void.”

Federal Reserve Chairman Jerome Powell has been hesitant to take a stance on establishing a US central bank digital currency, but he admitted that there is value in terms of undermining existing digital assets.

““You wouldn’t need stablecoins, you wouldn’t need cryptocurrencies if you had a digital US currency,” Powell said in July during his testimony before the House financial services committee. “I think that’s one of the strong arguments in its favor.”

Stablecoins have the potential to disrupt commercial and central banks, making their regulation a top concern for lawmakers.

“Stablecoins themselves are not especially disruptive,” said Colas. “Rather, it is their utility in enabling other financial transactions that is disruptive to traditional finance. In this respect, stablecoins are analogous to Amazon starting with books in the 1990s. The analogy between department stores then and traditional banks now is obvious.”

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.